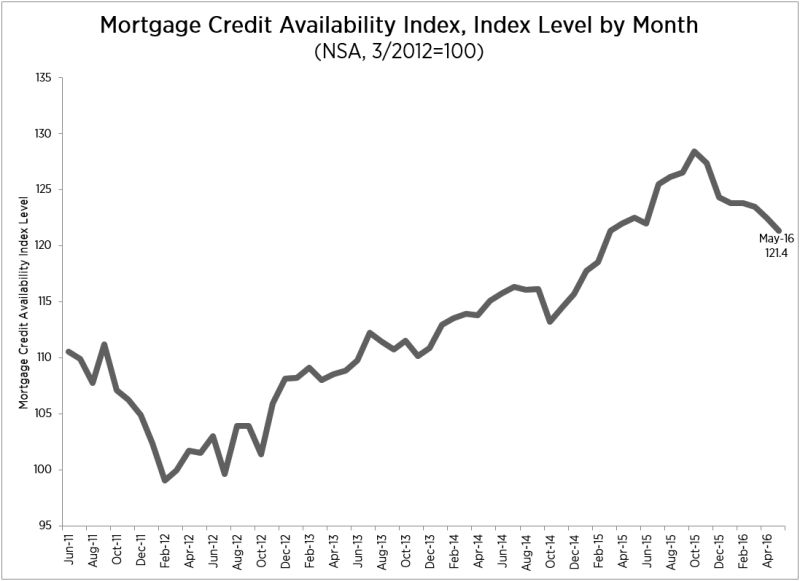

Mortgage credit access continued to inch down in May. The Mortgage Bankers Association said its Mortgage Credit Availability Index (MCAI) decreased to 121.4, down 0.8 percent from April. A decline in the MCAI indicates that lending standards are tightening, while increases in the index are indicative of loosening credit. The index hit a recent peak of 128.4 in October 2015 and has declined almost exclusively since then.

"Credit availability decreased for the third consecutive month in May," said Lynn Fisher, MBA's Vice President of Research and Economics. "Gains in credit availability caused by the continued roll-out of Fannie Mae and Freddie Mac low down payment programs were offset by modest tightening among government loan programs that serve borrowers in high cost areas."

Of the four component indices, the Jumbo MCAI saw the greatest tightening (down 1.3 percent) over the month followed by the Government MCAI (down 1.0 percent), the Conventional MCAI (down 0.8 percent), and the Conforming MCAI (down 0.3 percent).

The MCAI is calculated using several factors related to borrower eligibility (credit score, loan type, loan-to-value ratio, etc.). These metrics and underwriting criteria for over 95 lenders/investors are combined by MBA using data made available via the AllRegs® Market Clarity® product and a proprietary formula derived by MBA to calculate the MCAI The MCAI, Conforming, and Jumbo indices were benchmarked to 100 in March 2012. The Conventional and Government indices were benchmarked on that date to 69 and 222 respectively.