The CFPB's 2015 Annual Consumer Mortgage Experience report dealt with the major sources of dissatisfaction reported by homeowners with the origination, closing, and servicing processes of their mortgages. It found that escrow amount-related issues including inaccuracies of annual tax estimates and the settlement funds required at closing were among the more prevalent areas of complaint;

Almost 50 percent of all borrowers told CFPB they were only "somewhat familiar" with the amounts required at closing, a percentage that was even higher among first-time homebuyers. CoreLogic's Dominique Lalisse says this reinforces the need for homebuyers to have clear disclosure of housing costs in the loan estimate.

Lalisse says a lack of standardization in origination and underwriting drives this problem. "From the moment a home is put on the market until the time the new homeowner's mortgage is being serviced by the lender, up to six annual tax estimates are being completed with different levels of accuracy"

To start, the real estate agent includes property tax information on the home listing but a diligent homebuyer may also research that information for his or her own budgeting. The loan originator will probably also gather the data afresh to construct a loan estimate and it may be validated again by an underwriter while calculating the borrower's debt-to-income ratio and to estimate the amount required at closing. The closing agent may procure property tax information to prepare closing documents and finally the servicer will need both property tax amounts and due dates to set up escrow accounts.

In each case those amounts are based on past amounts and inaccurate estimates can mean that the borrower is actually unable to afford the loan or may require an escrow analysis in the first year of the mortgage. "If the amount is significantly underestimated, the homeowner might face financial hardship which could have been avoided with a more accurate estimate early in the process," Lalisse says.

One survey, of a major national lender, indicated that about 12 percent of loans will require a change - immediately after closing-in yearly escrow payments of $250 or more due to inaccurate tax estimates. This, the author says, not only increases servicing costs but also generates customer dissatisfaction.

The author does not explain how these estimates - all of which we would assume would come from a common source; the local taxing authority - become so flawed. Is it that lenders are failing to account for homestead exemptions or other owner-specific anomalies that may not pass to the buyer or because tax amounts can change from year-to-year?

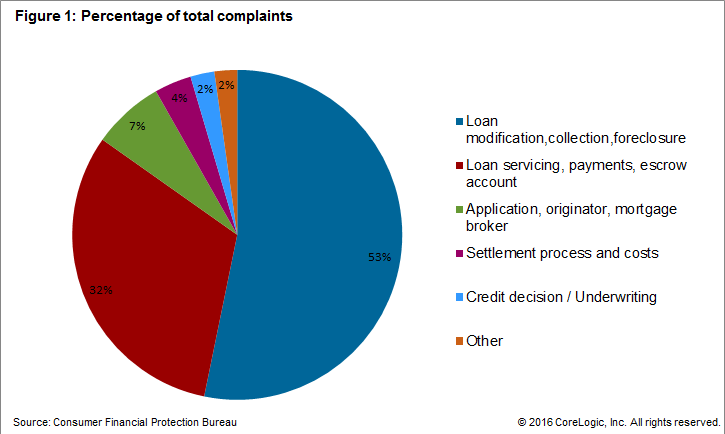

The CFPB report covers approximately 170,000 consumer complaints and many are too general to pinpoint specific root causes. However the Bureau says approximately 32 percent are about loan servicing, payments, and escrow accounts and about 4 percent relate to the settlement process and costs, both of which are directly affected by the accuracy of property tax information throughout the closing process.

Lalisse points out that the new TILA-RESPA Disclosure (TRID) focuses on increased quality and accuracy of information for settlement services, transparency, speed and accuracy of escrow estimations remain key areas of opportunity to improve homeowners' experience. By using more accurate annual tax estimates during the origination and underwriting processes, "lenders will not only satisfy regulatory requirements, but also provide more transparent information and thus a quality experience for the borrower throughout the entire loan lifecycle."