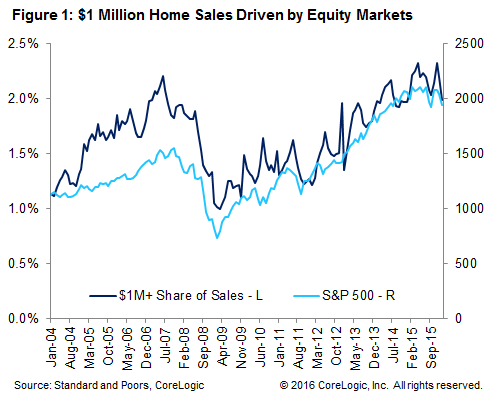

It's not exactly a startling concept but one that has been underlined by recent events; there is a strong correlation between the performance of the stock market and sales of high-end homes. Sam Khater, CoreLogic's deputy chief economist, says that as the stock market "swooned" in recent months, so did sales of million-dollar plus houses. This has been the case in the past and the trend is apparently continuing.

Writing in the company's Market Trends blog, Khater says that as the stock market rose rapidly between 2009 and 2015 it drove a large increase in the sales of high tier homes. Million-dollar plus homes have historically had an average share of 1.2 percent of the market. As more people became homeowners during the housing bubble the spread between stock market equities and expensive home sales shares widened but then those sales and the S&P began to move more in unison. By the time the equity markets had peaked in May 2015 the high-end market had nearly doubled its historic average, reaching a 2.2 percent share for the remainder of the year.

Since that peak the S&P has lost 10 percent of its value (Khater's numbers are from mid-February; the market has rallied substantially since then) and the Wall Street decline was matched for a 30 basis point or 15 percent drop in the share of expensive homes - from 2.3 percent in November to 2.0 percent in January.

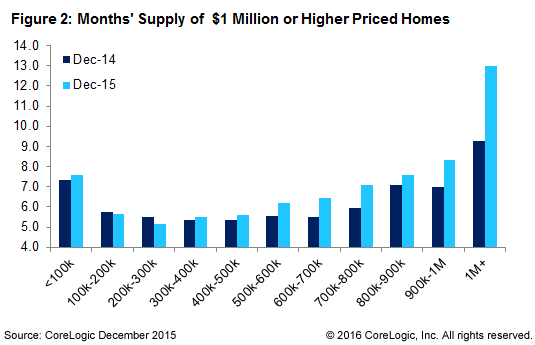

Khater says the future pattern of expensive home sales depends on the trajectory of the stock market but also on what happens with housing inventory. Homes priced below $500,000 remain in tight supply in many areas but the supply of higher priced homes is beginning to increase.

This is especially true for homes above $1 million. In December 2014 there was an estimated 9.3-month supply of properties in that price range but that situation began to change in early 2015 when inventory began to exceed sales growth. Since then the slowdown in sales crept down the price range, now reaching homes in the $700,000 and up range. That is consistent with a strong correlation between high-end sales and the stock market.

By December 2015 the inventory of million-dollar plus homes was up to 13.0 months, the highest since January 2012, shortly before the market bottomed out. Khater says with an inventory that large prices for the most part won't be increasing.

Going forward, equities remain key. If the markets continue to weaken, look for high-end sales to fall further, and inventories to climb. If the market stabilizes, as it has shown signs of doing most recently, the high-end market will stabilize as well.

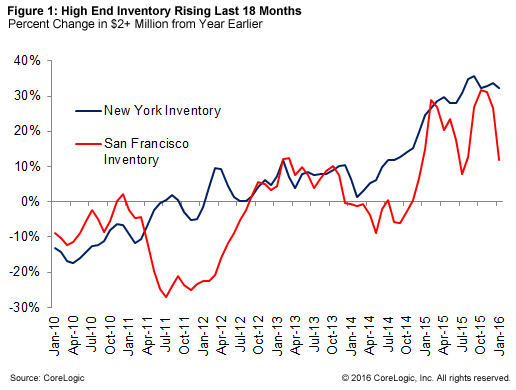

In a second related blog article Khater writes about a gloomy outlook for high tier homes in two of the nation's priciest markets. In both San Francisco and New York City 2015 was a record year for sales of homes priced above $2 million. There were 410 such sales in the Big Apple and 1,417 in San Francisco. In both cases however the growth rate began either to stall or decline as the year wore on.

In New York sales declined for four of the last five months of the year and in December sales were down 5 percent on an annual basis. In San Francisco, propelled by Silicon Valley wealth and Asian investment, sales are still growing but at a slower rate; down from a 31 percent year-over-year gain in July to 10 percent by December.

Khater calls the change in inventory the most forward-looking indicator for residential real estate and says the deterioration in inventory began much earlier than any noticeable slowdown in sales. Inventory began to rise in New York by double digits in June 2014 while in San Francisco the increase started in January 2015. By that December inventory in the high end market it was up 25 percent in the California metro.

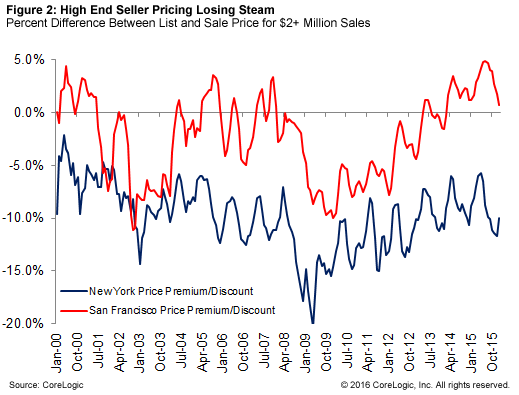

Rather than focus on average or median prices Khater looks at the ratio of the initial list price to final sales price and in New York during the first half of 2015 the list to price discount was smaller than 2014, but after July that reversed and 2015's price discount became several percentage points larger.

In July 2015, the list-to-price premium in San Francisco was at its highest point in the last 15 years, a clear indication of a very tight the market but this began to fade and by December 2015 was nearly back at 2014 levels. This indicates that while San Francisco's market is still very tight, the cycle is beginning to turn.

Khater again turns to the volatility of the stock market to explain these increases in inventory in the two cities, saying "Now it looks like even the uber rich aren't immune."