Lenders, especially mortgage banks and larger lending institutions, are increasingly pessimistic about their profits. Fannie Mae says that responses to its fourth quarter 2015 Mortgage Lender Sentiment Survey indicated a reversal from surveys in the first two quarters of the year; lenders were significantly more likely to say they expected their profit margins to decline.

Steve Solomon, Fannie Mae's Director of Strategic Customer Management, writing about the survey said that the mortgage industry has faced both challenges and opportunities over the last two years, with a significantly improved economy, strengthening labor markets, and historically low interest rates helping the housing market to recover. On the other hand household formation has been down and a number of new rules and regulatory changes have increased lenders' compliance costs. Consequently respondents have seen steadily increasing rates of declining profits since the first quarter of last year.

There were 194 respondents to the fourth quarter survey; 59 were described by Fannie Mae as larger institutions, lenders with a loan origination volume in the top 15 percent of the industry. An identical number were classified as mid-sized, with origination volumes that put them in the 16 to 35 percent range. Seventy six were smaller institutions, those with an origination volume in the bottom 65 percent. There were 39 credit unions represented, 75 depository institutions, and 71 mortgage banks.

Lenders were asked how their profit margin outlook has evolved over the past two years, what key factors drove their margin outlook either up or down, and what strategies they intend to use to address their expectations. They were also asked if either the drivers or the strategies had evolved over the last two years.

After peaking in the first quarter of 2015 the share of lenders expecting their profit margin to increase over the next three months fell steadily during 2015. When compared with the prior year (2014), more lenders reported expectations of declining profit margins in 2015 and into early 2016.

Lenders identified two primary factors accounting for the pessimistic outlook. The first is government regulatory compliance. In the third quarter it was cited as one of the two drivers by 61 percent of respondents, the highest rate in survey history. Fannie Mae said this indicates the impact of the new Truth-in-Lending Disclosure (TRID) rule which went into effect in October. Lenders say the workflow changes and technology updates necessary for compliance have been significant.

The second driver was increased competition from other lenders. With the refinance boom ending lenders are competing for a smaller origination market. The results also indicate that lenders are less likely than they were a year earlier to use new mortgage products or to expand marketing to increase their profit margins. Fannie Mae says that this can be partially explained by the maturing of the Housing Affordable Refinance Program (HARP) which many lenders have successfully leveraged. The program is set to expire at the end of 2016 and fewer HARP opportunities are still out there.

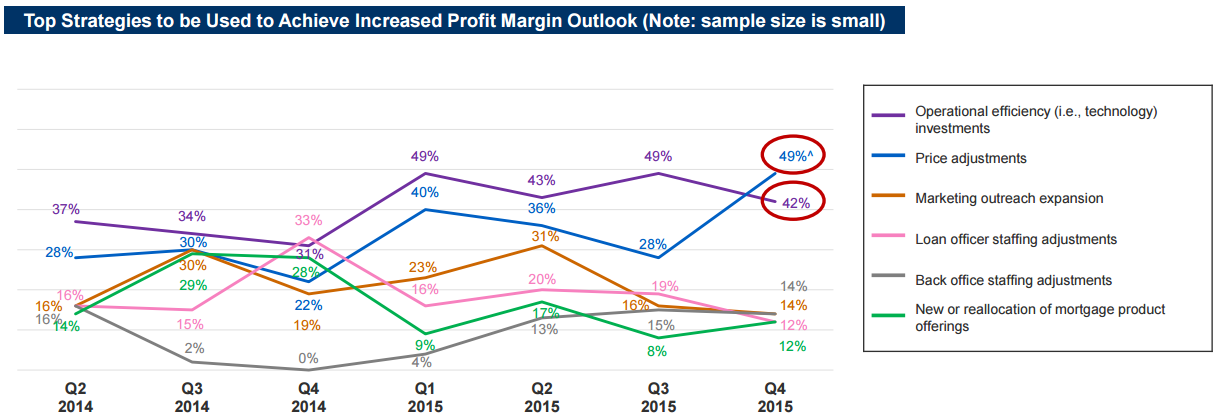

Those who anticipated increased profit margins most frequently cited operational efficiency as the likely driver. The influence of customer demand has decreased dramatically.

Operational efficiency has also cited as an important strategy for lenders to address profit margin outlooks. This held true for lenders anticipating both decreased and increased profit margins ahead although those with the more optimistic attitudes put their first emphasis on using pricing changes.