One of the sea changes that swept in with the housing crisis was the growth of single family houses as a share of rental properties. Frank Nothaft, Senior Economist at CoreLogic said last summer that single family houses at that point represented 40 percent of the rental stock. This is notable especially since apartment houses constituted only 42 percent. Nothaft estimated that about three million formerly owned-occupied single-family homes were purchased and turned into rental properties between 2006 and 2013. Many of those homes were distressed properties bought at foreclosures, from lender inventories of REO, or as short sales.

Even as that supply of properties shrinks Freddie Mac said last month that the appetite of large investors for single family housing appears to be increasing. In a blog article the company looked at the purchases of eight large companies that have bought a cumulative $16 billion in buy-to-rent properties over the last three years and found a decreasing share off these properties were distressed and that companies were more and more purchasing homes that were newer and required lower expenditures for repair and/or renovations.

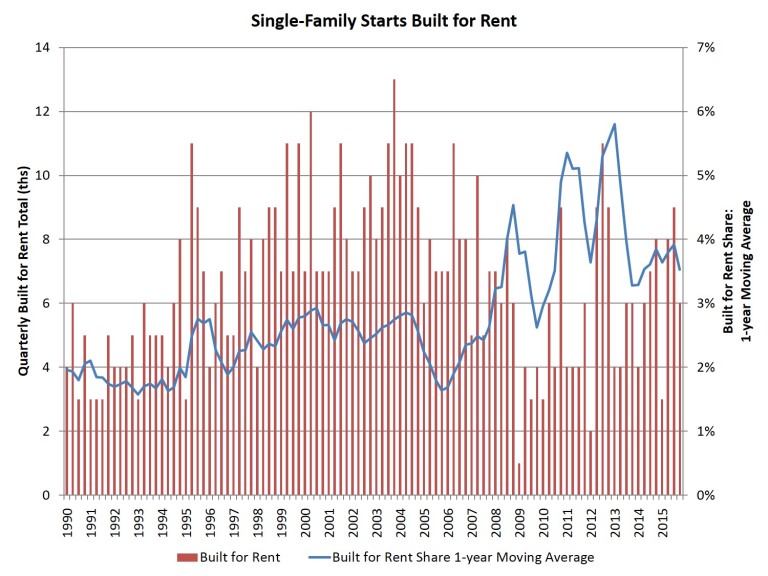

One area of single family houses that appears not to have benefitted from the popularity of single family rentals is new home construction. Robert Dietz, writing for the National Association of Home Builders (NAHB) said on Monday that the total number of single-family houses that were built specifically to rent was relatively unchanged in 2015. The market share of such construction, he said, is always very small so it is difficult to identify trends, but such construction, measured as a one-year moving average, was 3.5 percent of all single family starts in the fourth quarter.

For the year as a whole, single-family built-for-rent starts totaled 26,000 units in 2015 compared to 25,000 in 2014. The current market share remains higher than the historical average of 2.8% but is down from the 5.8% registered at the start of 2013. This class of single-family construction excludes homes that are sold to another party for rental purposes. It only includes homes built and held for rental purposes.

Dietz said the onset of the recession coincided with an increase in the share of built-for-rent homes. "Despite the current elevated market concentration, the total number of single-family starts built-for-rent remains fairly low in terms of the total building market." As homes age, he said, they often transition to the rental housing stock.