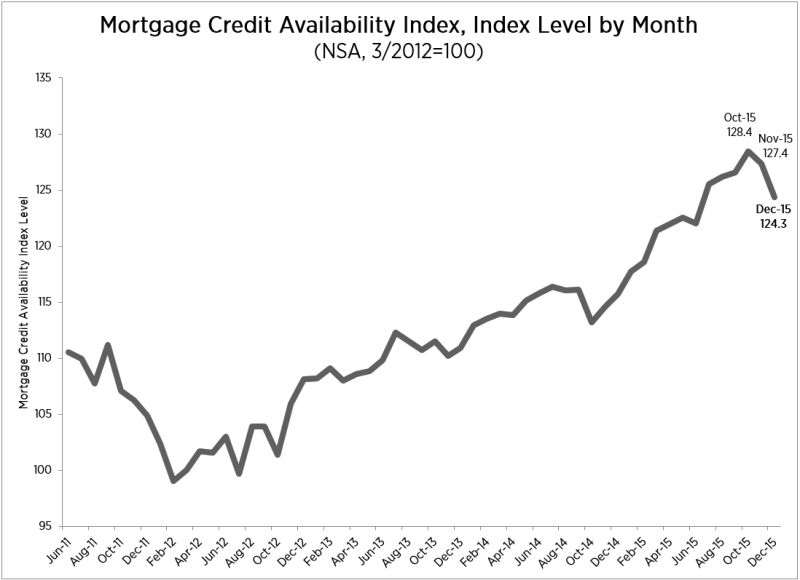

Credit available as measured by the Mortgage Bankers Association's (MBA's) Mortgage Credit Availability Index (MCAI) appeared to have declined in December. Except apparently it really didn't.

The MCAI, by the numbers, decreased 2.4 percent to 124.3 in December. A decline in the index should indicate that lending standards are tightening while the opposite would be reflected in rising number. The apparently varied last month.

As Lynn Fisher MBA's Vice President of Research and Economics explains. "A decline to the index is generally indicative of tightening lending standards. However, this month, a large part of the decline was driven by a technical issue related to implementation of affordable, low down payment, loan programs. Many investors discontinued existing low down payment loan programs only to replace them with new iterations of similar programs that were discontinued.

"This introduced volatility into the December index reading and magnified the decline we saw over the month. Conceptually the underwriting changes that caused these issues represent an expansion of the credit, and are targeted at low-to-moderate income borrowers and first time homebuyers. A similar issue also caused changes to jumbo loan programs and had a tightening effect on the index while changes to government lending programs (FHA and VA) had an upward/loosening impact," Fisher continued.

Whether the decline reflected actual tightening or not, it was the second month in a row that the numbers dropped. Since the index hit a post-recession high of 128.4 in October it has lost 4.1 points.

Of the four component indices, the Conventional MCAI saw the greatest tightening (down 4.8 percent) over the month followed by the Jumbo MCAI (down 4.2 percent), and the Government MCAI (down 0.6 percent). The Conforming MCAI increased 0.1 percent over the month.

The MCAI and its four component indices are all constructed using the same methodology and are designed to show relative credit risk/availability for their respective index with the primary difference being the population of loans each measures. The Conforming and Jumbo indices have the same "base levels" as the Total MCAI (March 2012=100), while the Conventional and Government indices have adjusted "base levels" in March 2012.