While we have all been sitting around waiting for millennials to take the homeowner plunge we have apparently overlooked that both they and their parents are poised (relative to prevailing sentiment) to make an impact on other aspects of the housing market.

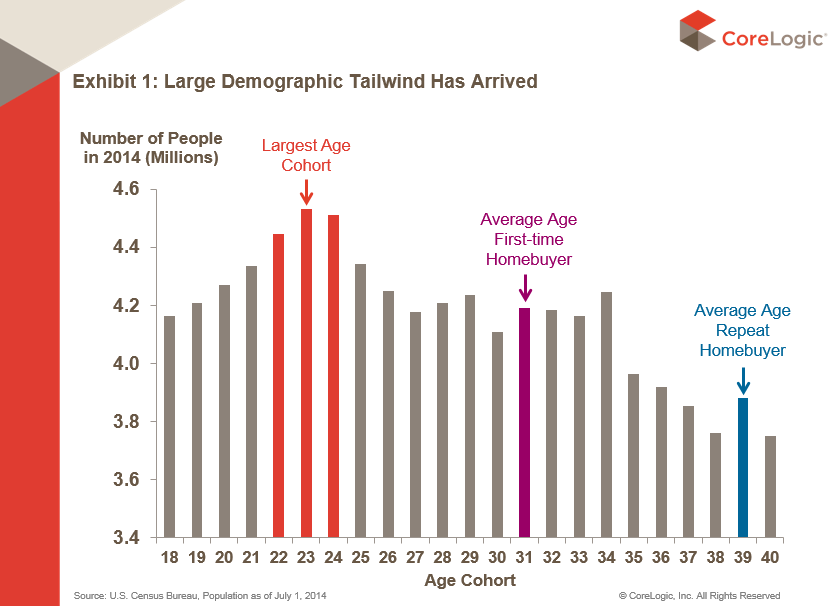

The 2014 Census data put the largest single age group of younger Americans at 23 followed by those 22 and 24, each group containing around 4.5 million people. As the prime age for buying a home is 31 we can expect that in six to eight years this demographic bulge will increase home sales and mortgage originations. Although it must be noted that the older members of this millennial generation have not flocked to homebuying in the numbers of their predecessors.

Frank Notaft, CoreLogic's Chief Economist, writing in the company's Insights blog says that the young 20-somethings are not going to be the only demographic driver. The average age of a move-up or repeat buyer is 39 and in eight years there will be about 4.2 million people who are potential repeat buyers of that age compared to 3.9 million at the present time.

He notes that aging baby boomers may present a third demographic wave as the largest single chunk of that generation, those born between 1956 and 1958, hit reitrement age and start looking for retirement homes, vacation homes, or to downsize.

Still it is millennials that everyone is watching and Nothaft says that their high student debt and antipathy to buying homes "is the stuff of legend." But he expects this will change as they advance in their working careers and start families. He references surveys of generation members which indicate they share their parents' desire for homeownership but plan to transition into it at a later age. "Six to eight years from now, it's a good bet they will look more like the home-buying cohorts of the past," he says.

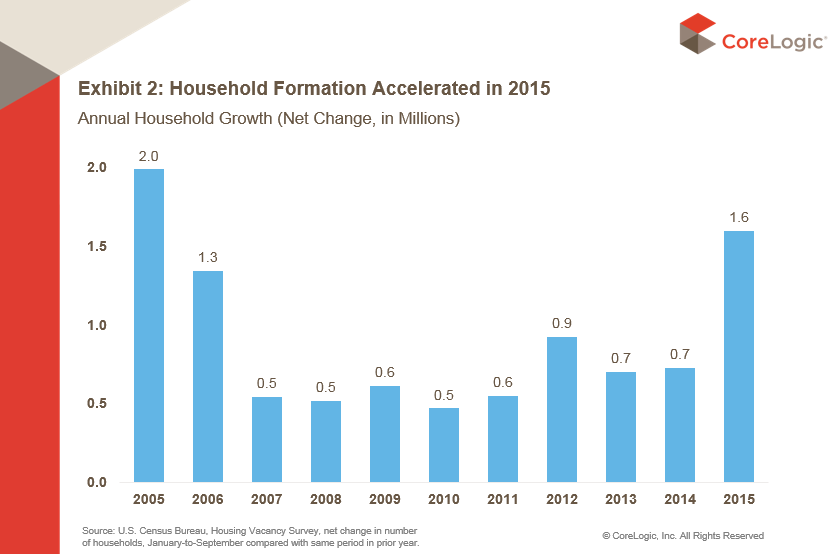

Millennials have started to leave home, however belatedly. Household formations doubled in 2015 over 2014 (from 700,000 to 1.6 million) in step with an improving economy and more jobs. For now, those household formations likely will be rentals, Nothaft says, but in a few years, these new households will likely be looking to buy homes.

Millennials have a greater racial and ethnic diversity than do the generations ahead of them. Forty-five percent are minorities compared to 28 percent of baby boomers. Minority-headed households are projected to make up approximately three-fourths of the net households formed over the next decade and these minority-headed households have historically had a lower homeownership rate than non-Hispanic whites. During the first three quarters of 2015, the homeownership rate for non-Hispanic whites was 72 percent, compared with 47 percent for minority-headed households. Whether the homeownership gap by race/ethnicity narrows or not over time depends on many factors outside of the housing industry, Nothaft says, such as quality of workforce skills, labor-force opportunities, and access to credit. Nonetheless, the demographic bulge represented by the millennials will boost home sales in the future and is likely to boost rental demand as well.