An increase in conforming loan program offerings helped boost the Mortgage Bankers Association's (MBA's) measure of credit access in October. MBA's Mortgage Credit Availability Index (MCAI) increased 1.5 percent to 128.4.

The index is based on data from Ellie Mae's AllRegs® Market Clarity® business information tool. A decline in the MCAI indicates that lending standards are tightening while increases are a sign that credit is easing.

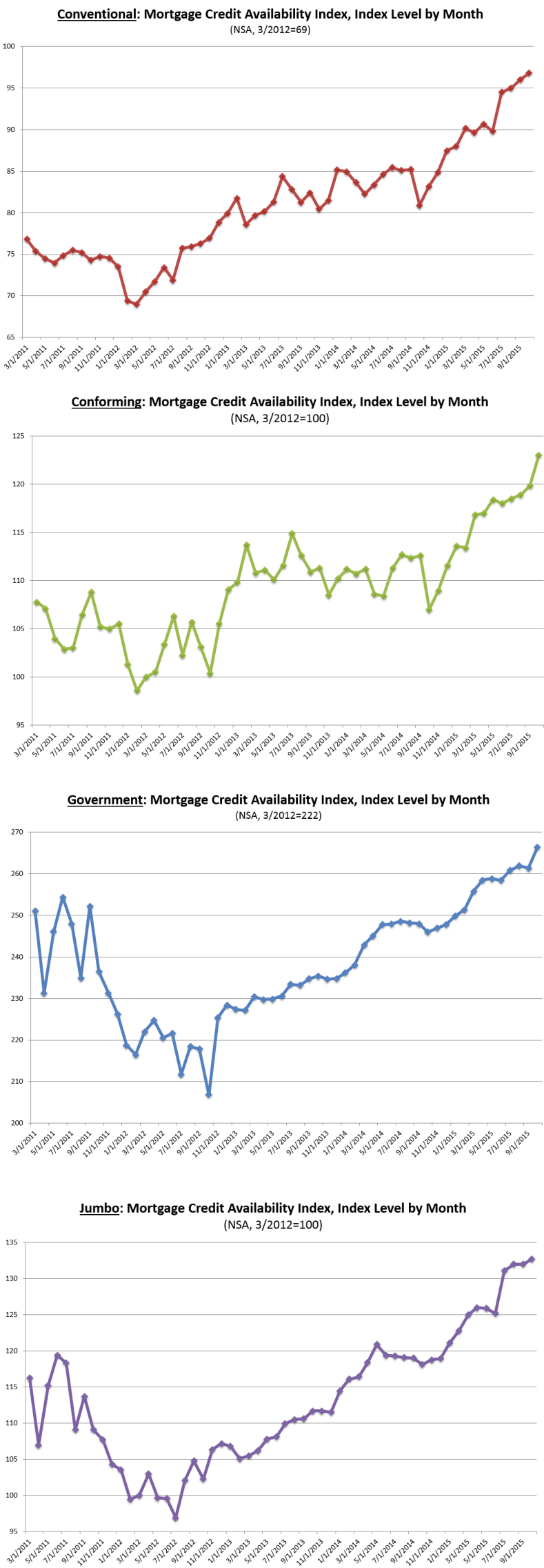

The four component indices also rose during the month with the Conforming MCAI seeing the greatest increase, up 2.7 percent. The Government component rose 1.9 percent, while the Conventional and Jumbo MCAIs were up 0.8 and 0.5 percent respectively.

"Credit availability increased in October mainly as a result of new conforming loan programs, many of which were affordable housing programs which have lower down payment requirements," said Mike Fratantoni, MBA's Chief Economist.

The Conventional, Government, Conforming, and Jumbo MCAIs are constructed using the same methodology as the Total MCAI and are designed to show relative credit risk/availability for their respective index. The Government MCAI examines FHA/VA/USDA loan programs, while the Conventional MCAI covers non-government loan programs. Similarly, the Jumbo MCAI looks at everything flagged as "Jumbo" while the Conforming MCAI examines loan programs that fall under conforming loan limits.

The composite, Conforming, and Jumbo MCAIs are benchmarked to 100 in March 2012. The Conventional and Government indices have adjusted "base levels" in March 2012. Using data from the MCAI and the Weekly Applications Survey, MBA calibrated the Conventional and Government indices to better represent where each index might fall in March 2012 (the "base period") relative to the Total=100 benchmark.