When the question is asked whether or not it is a good time to buy a house the flip side is always "or is it better to rent?" The answer usually has both a head/heart and a financial component with timing thrown in for good measure. The head/heart thing can't be measured and can cut in favor of either renting or buying and might do both in a matter of hours. But in a recent article in CoreLogic's Insights blog, economist Shu Chen lays out a way of quantifying the other two.

Chen says the decision to rent or buy, is always major and it is now confronting millennials who are establishing households or may be moving to a different city to start a job. No one wants to buy when the market is topping out and right now, seven years after the bust, home prices, especially those in the lower cost tier, have returned to pre-crash levels. There is talk of another housing bubble and some data presumes that there are markets that are already overvalued with prices still rising. With rates about to increase is this still a good time to buy?

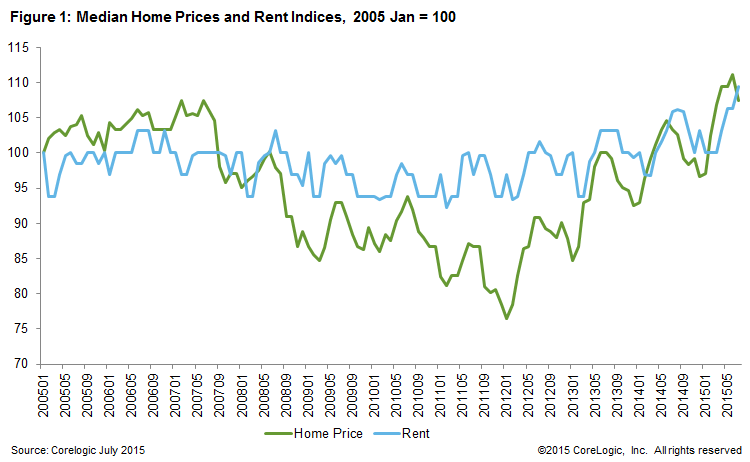

CoreLogic chose 30 Core Based Statistical Areas (CBSA) based on their Multiple Listing Service coverage over the last ten years and indexed both the median home price and rent to 100 as of January 2005. They found that rents, unlike houses, did not experience a significant price decrease during the crisis and continued to increase as the home buying market recovered. The median home price set a new peak this past June, 3.5 percent above the pre-crisis peak and up 40.5 percent from the January 2008 trough. Rents however were more stable.

During the crisis rents remained more stable, with demand shored up by the number of households exiting homeownership through foreclosure. Starting in 2012, as home prices began to rise rents did so as well, lagging home price trends by one or two months. Chen says as the housing market continues to heal and if inventories of homes for sale remain low, the rental market is likely to remain robust.

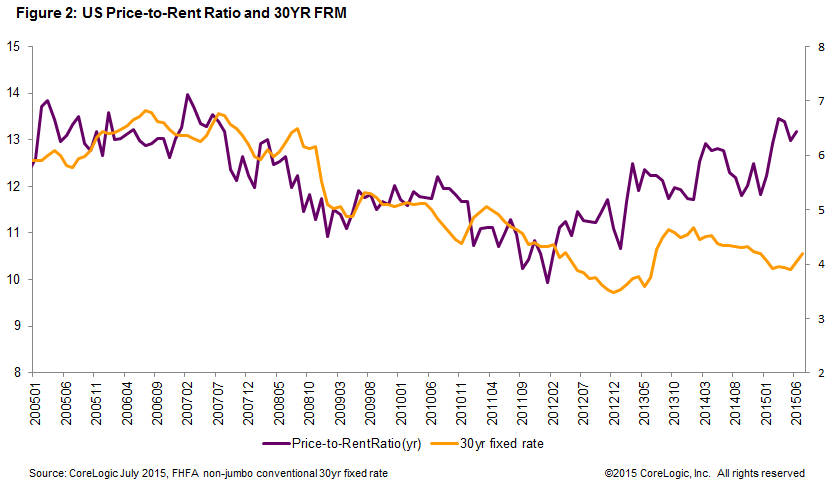

Taking the CoreLogic median home price and dividing it by the MLS median rent, CoreLogic derived a ratio that allowed them to compare home prices to rents. A lower price-to-rent ratio indicates it is a good time to buy. In January 2012 that ratio dropped to 9.9, 71 percent of the peak reached in 2007. The market is still adjusting from the crisis and the price-to-rent ratio is up 24.5 percent from its trough and is only 11.4 percent below the 2007 peak.

Figure 2 shows the price-to-rent ratio from January 2005. The ratio is calculated by dividing the CoreLogic median home price by the MLS median annual rent. This measure allows us to compare home prices to rent amounts. A lower price-to-rent ratio indicates a good time to buy. In January 2012, the price-to-rent ratio dropped to 9.9, which is only 71 percent of the peak in February 2007. Figure 1 shows that home prices dropped more than rent did during the crisis. We can see that the market is still adjusting after the crisis, but interest rates can't remain low for too long. The price-to-rent ratio is up 24.5 percent from the trough nationally and is only 11.4 percent below the peak.

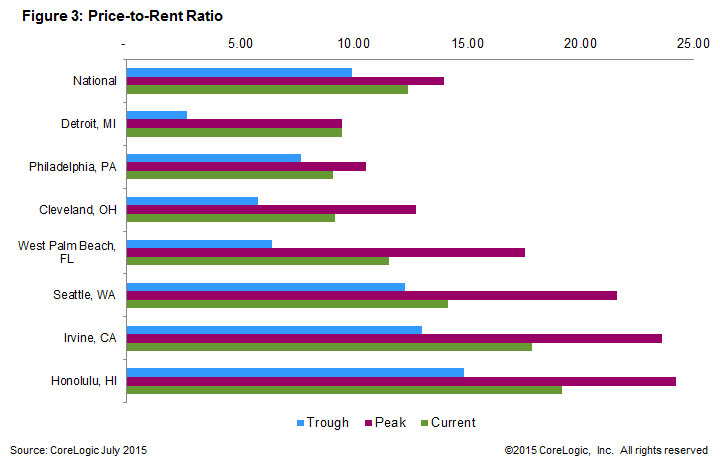

Detroit reached a new peak in July 2015, and is up 5.9 percent from the pre-crisis peak. West Palm Beach, Fla. and Cleveland, Ohio are up 80.3 percent and 58 percent from their troughs, respectively. Seattle has the smallest ratio increase, at 15.5 percent from the trough.

Figure 3 indicates that the national price-to-rent ratio has actual operated along a fairly narrow path over the last ten years and that nationally at least the financial argument for buying probably still prevails, especially as rates remain low. While CoreLogic only shows a few of the CBSA numbers, in most of those prices still have a way to go before rent is a better financial option.