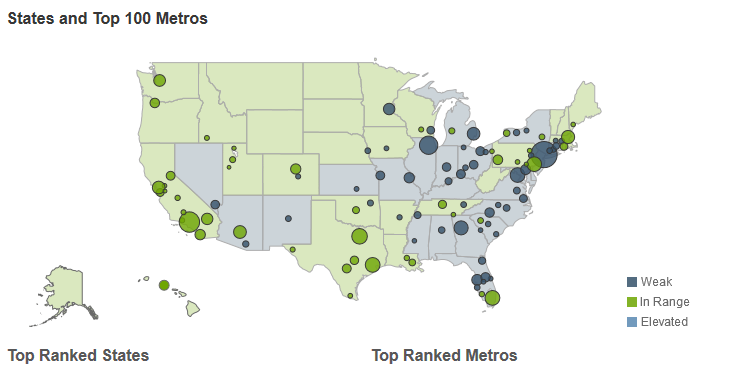

Two Pennsylvania metropolitan areas, Scranton and Harrisburg, won the MiMi seal of approval in August. Freddie Mae said the two moved into what it considers the outer range of stable housing activity during the month. This bring the total of "stable" metros to 47 of the 100 largest ones in the country. Twenty-nine states and the District of Columbia are also within the stable range on the Multi-Indicator Market Index.

Freddie Mac constructs the MiMi to monitor and measure the stability of the nation's housing market as well as those of the states and large metropolitan areas. It uses its own proprietary data along with local market data to assess where each single-family housing market is relative to its own long-term stable range. The company looks at home purchase applications, payment-to-income ratios to measure changes in home purchase power based on house prices, mortgage rates and household income, proportion of on-time mortgage payments, and the local employment picture.

The four indicators are combined to create a composite MiMi value for each market. Monthly, MiMi uses this data to show, at a glance, where each market stands relative to its own stable range of housing activity. MiMi also indicates how each market is trending, whether it is moving closer to, or further away from, its stable range. A market can fall outside its stable range by being too weak to generate enough demand for a well-balanced housing market or by overheating to an unsustainable level of activity.

The national MiMi value stands at 81.2, indicating a housing market that is on its outer range of stable housing activity, while showing an improvement of +0.27% from July to August and a three-month improvement of +2.54%. On a year-over-year basis, the national MiMi value has improved +6.16%. Since its all-time low in October 2010, the national MiMi has rebounded 37%, but remains significantly off from its high of 121.7.

The highest MIMI values are in North Dakota (96.9), District of Columbia (103.9), Hawaii (93.5), Montana (93.2), and Utah (90.3). Among the 47 metro areas within stable range the top five are Fresno (99.4), Austin (96.6), Honolulu (94.1), Salt Lake City (93.3) and Los Angeles (93).

The greatest improvements among states on a yearly basis occurred in Florida (+14.07%) which also had four of the five top improving metro areas, Orlando, Cape Coral, Tampa, and Palm Bay. Denver was ranked as number four. The other states with big annual increases were Oregon (+12.02%), Nevada (11.75%), Colorado (+11.28%), and Washington (+10.41%).

In August, 48 of the 50 states and 98 of the top 100 metros were showing an improving three month trend. The same time last year, 35 of the 50 states plus the District of Columbia, and 71 of the top 100 metro areas were showing such improvement.

Freddie Mac Deputy Chief Economist Len Kiefer said, "The nation's housing market continues to improve riding the wave of the best year in home sales since 2007. With the MiMi purchase applications indicator at its highest level in more than seven years we expect home sales to remain strong. Low mortgage rates are fueling the recovery across the country. Places like Denver, Austin and Salt Lake City, and most markets in California, are seeing robust home purchase demand and in many cases double-digit growth over last year."

"Buoyed by strong employment growth, housing supply is struggling to keep pace with demand, which is driving house prices higher. Fortunately, low mortgage interest rates are helping to keep homebuying affordable for some prospective homebuyers. Nationwide, housing markets are getting back to their long term benchmark averages, but they still have room for improvement. We're expecting housing to sustain its momentum going into yearend, but we're going to need stronger income growth to carry housing throughout 2016."