RealtyTrac released both its September and third quarter data on foreclosure activity on Thursday. A total of 109,130 U.S. properties had foreclosure filings in September 2015, down less than 1 percent from the previous month but up 2 percent from a year ago. U.S. foreclosure activity has increased on a year-over-year basis in six of the last seven months.

The company tracks first-time filing of default notices, scheduled foreclosure auctions, and bank repossessions or completed foreclosures. Given how marginal the monthly changes have become we are reporting detailed breakdowns only for the quarterly data. Overall foreclosure fillings over that three month period that ended September 30 were down 5 percent compared to the second quarter and was 3 percent higher than in the third quarter of 2014.

The annual increase in the third quarter marked the second consecutive quarter where U.S. foreclosure activity increased on a year-over-year basis following 19 consecutive quarters of year-over-year decreases. Total filings during the quarter were at the rate of one in every 404 U.S. housing units.

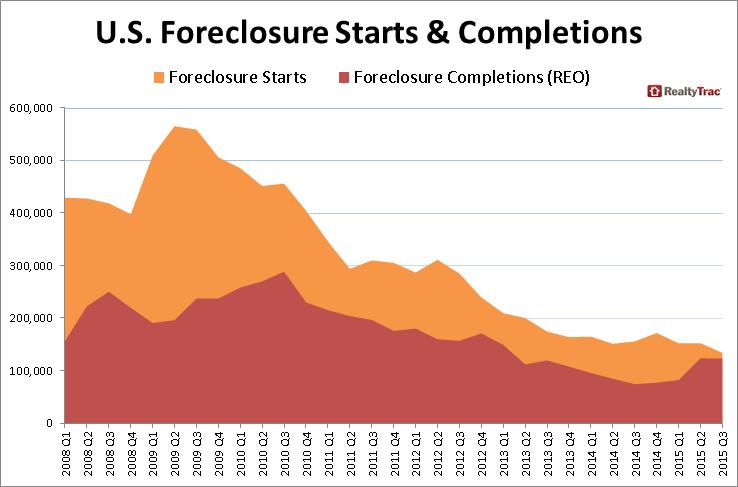

The foreclosure process was begun during the quarter on 133,811 U.S. properties, a decrease of 12 percent from the previous quarter and 14 percent from a year earlier. It was the fewest foreclosure starts in any quarter since 2005.

Completed foreclosures totaled 123,040 during the quarter, 1 percent fewer than in the second quarter but a whopping 66 percent above the same quarter in 2014, the largest increase in lender repossessions since RealtyTrac began tracking them in 2008.

"The widespread rise in foreclosure activity in the third quarter compared to a year ago is the result of two starkly different trends taking place," said Daren Blomquist, vice president at RealtyTrac. "In states such as New Jersey, Massachusetts, and New York, a flood of deferred distress from the last housing crisis is finally spilling over the legislative and legal dams that have held back some foreclosure activity for years. That deferred distress often represents properties with deferred maintenance that will sell at more deeply discounted prices, creating a drag on overall home values. On the other hand, in states such as Texas, Michigan and Washington, the third quarter increases are a sign that the foreclosure market has settled into a normalized pattern close to or even below pre-crisis levels, and in those states the overall housing market should easily absorb the additional foreclosure activity with little impact on home values."

Florida finally lost its grip on the top spot among states for foreclosure activity, slipping to second place behind New Jersey. Activity in the Garden State increased 27 percent from a year ago giving it a foreclosure rate of one filing for every 171 housing units, more than twice the national average. Foreclosure starts decreased by 28 percent from a year ago but scheduled foreclosure auctions increased 61 percent, and bank repossessions jumped 351 percent. Perversely the last two figures are actually positive developments. New Jersey, a judicial foreclosure state, has had one of the longest foreclosure timelines in the country and a tremendous foreclosure backlog. These numbers are likely an indication the pipeline is finally starting to clear in earnest.

Overall foreclosure activity in Florida was down 17 percent from the third quarter of 2014 to a rate of one in every 186 housing units. Starts decreased 28 percent and scheduled foreclosure auctions were down 46 percent year-over-year but third quarter bank repossessions increased 34 percent year-over-year.

The third highest level of foreclosure activity was in Nevada - up 13 percent from a year ago - with a rate of one in every 194 housing units receiving a foreclosure filing. Nevada foreclosure starts decreased 14 percent from a year ago, and scheduled auctions were down 14 percent, but bank repossessions in Nevada increased 255 percent from a year earlier. Rounding out the top five states were Maryland with one filing for every 220 households and Illinois at one in 281.

With one in every 97 housing units with a foreclosure filing Atlantic City, New Jersey, posted the nation's highest foreclosure rate in the third quarter among metropolitan statistical areas with a population of 200,000 or more. The remaining states in the top five were all in Florida, Jacksonville, Deltona Beach, Tampa, and Miami.