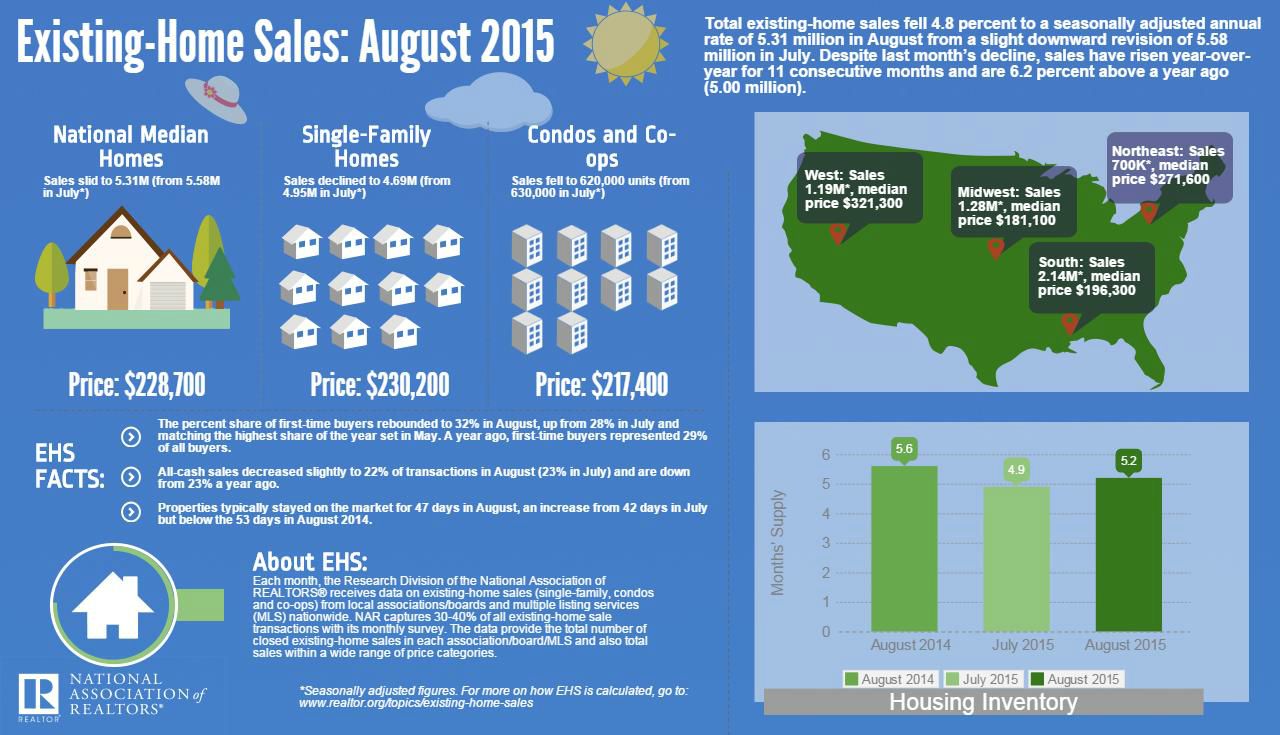

Even as the market share of first-time buyers continued to inch up, overall sales of existing homes declined in August. The National Association of Realtors® (NAR) said today that total existing home sales fell 4.8 percent to a to a seasonally adjusted annual rate of 5.31 million units in August from a slight downward revision of 5.58 million in July. The dip came on the heels of three straight months of increases and despite slowing price growth.

Existing home sales are completed transactions that include single family homes, townhomes, condominiums, and co-ops. While August sales were down, NAR notes that sales have now risen year-over-year for 11 consecutive months with August 2015 sales registering a 6.2 percent gain from a year earlier when sales were at a 5.0 million rate.

Single-family home sales declined 5.3 percent to a seasonally adjusted annual rate of 4.69 million in August from 4.95 million in July, but remain 6.1 percent higher than the 4.42 million pace a year earlier. Existing condominium and co-op sales declined 1.6 percent to a seasonally adjusted annual rate of 620,000 units in August from 630,000 units in July, still a solid 6.9 percent higher than the 580,000 unit pace in August 2014.

Lawrence Yun, NAR chief economist, says home sales in August lost some momentum to close out the summer. "Sales activity was down in many parts of the country last month - especially in the South and West - as the persistent summer theme of tight inventory levels likely deterred some buyers," he said. "The good news for the housing market is that price appreciation the last two months has started to moderate from the unhealthier rate of growth seen earlier this year."

The median price for all existing housing types was $228,700, representing annual appreciation of 4.7 percent from the median of $218,400 in August 2014. The increase was the 42nd consecutive year-over-year gain. The median existing single-family home price rose 5.1 percent from last year to $230,200 and the median existing condo price was up 2.2 percent to $217,400.

Existing home inventories gained a bit of ground; rising 1.3 percent to 2.29 million homes, a 5.2 month supply compared to 4.9 months in July. The current inventory is 1.7 percent lower than in August 2014.

"With sales and overall demand higher than a year ago and supply mostly unchanged, low inventories will likely continue to limit options for those looking to buy this fall even with the overall pool of buyers shrinking because of seasonal factors," adds Yun.

The percent share of first-time buyers rebounded to 32 percent in August, up from 28 percent in July and matching the highest share of the year set in May. A year ago, first-time buyers represented 29 percent of all buyers. Individual investors accounted for 12 percent of existing home sales in August, 1 percentage point lower than in July. All cash sales decreased from a 23 percent share of sales in July to 22 percent in August. Sixty percent of investors paid cash in August.

Distressed sales, foreclosures and short sales, remained at a 7 percent in August for the second month, matching the lowest share since NAR began tracking in October 2008, Five percent of sales were foreclosures that sold at an average discount of 18 percent below market value and 2 percent were short sales, averaging discounts of 12 percent

Yun says when the Federal Reserve finally decides to left short-term interest rates he doesn't expect a pronounced impact on mortgage rates or overall housing demand. "With job growth holding steady, prospective buyers can handle any gradual rise in mortgage rates - especially if today's stronger labor market finally leads to a boost in wages and homebuilding accelerates to alleviate supply shortages and slow price growth in some markets," he said.

Properties typically stayed on the market for 47 days in August, an increase from 42 days in July but below the 53 days in August 2014. Short sales were on the market the longest at a median of 124 days while foreclosures sold in 66 days and non-distressed homes took 45 days. Forty percent of homes sold in August were on the market for less than a month.

According to a NAR survey of its Realtor members conducted in August, more than 80 percent of respondents indicated they had taken some sort of training (webinar, class, etc.) to prepare for the October implementation of the TILA-RESPA Integrated Disclosure rule (TRID). NAR President Christ Polychron said "As the ruling goes into effect next month, communication is crucial between all parties involved in a real estate transaction to ensure consumers get to closing seamlessly and without delay. NAR will monitor the progress of the rule in the weeks ahead and will share any concerns that arise as part of our continued partnership with the Consumer Financial Protection Bureau."

None of the four major regions experienced existing home sale increases in August. Sales in the Northeast were at an annual rate of 700,000, unchanged from July and 6.1 percent above a year ago. The median price in the Northeast was $271,600, annual appreciation of 2.4 percent.

In the Midwest sales declined 1.5 percent to a rate of 1.28 million but remain 5.8 percent above the previous August. The median price in the Midwest was $181,100, up 4.0 percent from a year earlier.

Existing-home sales in the South fell 6.6 percent to an annual rate of 2.14 million but 5.9 percent above August 2014. The median price in the South was $196,300, up 6.0 percent year-over-year.

Sales in the West dropped 7.8 percent to an annual rate of 1.19 million 7.2 percent above a year ago. The median price in the West was $321,300, up 7.1 percent over 12 months.