It has been almost a month since the Federal Housing Finance Agency (FHFA) announced the final goals for affordable housing for mortgages and rental activity financed by the government sponsored enterprises (GSEs) Fannie Mae and Freddie Mac. CoreLogic has now released an evaluation of these goals. In an article on the company's Insights blog, Policy Research and Strategy Analyst Stuart Quinn says that the final goals, following over 100 public comments from market participants, did not fall far the the goals FHFA originally purposed.

A balance in these rules is important, Quinn says. Setting the bar too high; extending goals to levels above where demand exists, can cause business concerns and impact safety and soundness. Setting the goal too low could lead to accusations that the GSEs are not upholding the intent of their charters. "The end result could then increase impediments to mortgage credit for deserving borrowers," Quinn says.

Purchase mortgage, refinancing, and rental categories each come with a unique set of metrics and targets and Quinn limits his comments in this post to single-family purchase goals. The principal targets for this category are: (1) low-income purchase goals defined as financing conforming and conventional loans for purchase of owner-occupied, one-to-four unit housing provided to borrowers with income no greater than 80 percent of the area median income (AMI) and (2) very low income purchase goals for such purchases at no greater than 50 percent of AMI. There are additional sub-goals for low-income areas, high minority areas and communities that have been declared a federal disaster area within the past three years.

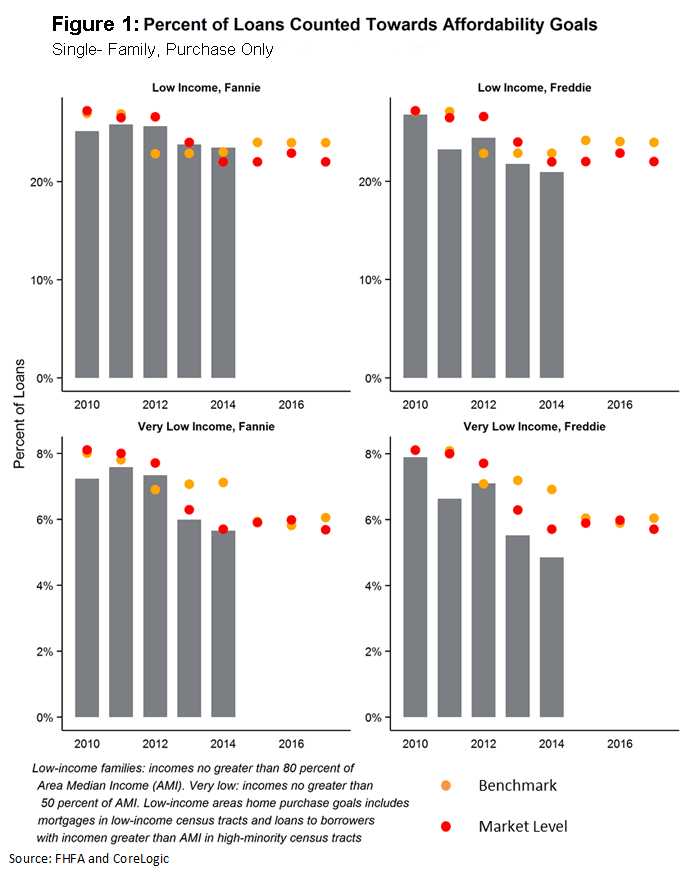

The figure above illustrates the two measurements used to evaluate success for each GSE.

- The benchmark goal is a prospective forecast estimate based off of an FHFA econometric time-series model, which examines historical market performance, as well as factors that influence the market, including home sales, interest rates, employment and a host of additional measures. Since it is a forecast, it is sensitive to volatility and market dynamics that may be presently unobservable.

- The market goal is determined retrospectively. It is based on the Home Mortgage Disclosure Data (HMDA) released by September covering the entire preceding year. The analysis considers not only loans purchased, but includes comparable loans that may have been eligible for purchase, sold via another conduit or privately securitized. This method enables FHFA and the industry to get a better sense of GSE market-wide penetration for goal oriented activities.

Meeting affordable housing goals means that both GSEs meet or exceed either the benchmark level or the market level. Any bar exceeding either colored dot indicates achieving the target goal.

For 2015 the final benchmark for low income purchases will be 1.6 percent above the market share estimate or 24 percent, an increase of 1 percentage point from the proposed rule. This leaves a higher prospective benchmark, and a larger possible spread should market data result in less than 22 percent, which is the current market goal.

The 2015 very low income purchase goal will be 6 percent, 1 percentage point below both the 2014 benchmark level and proposed benchmark level. Both 2012 and 2013 saw relatively large downward shifts for both GSEs on a percent basis. Some possible explanations for this include: banks taking on more loans for Community Reinvestment Act purposes, fear over repurchase liability to GSEs, loans without private mortgage insurance so recourse would be owed, or increased endorsement through the Federal Housing Administration channel.

There is a 2015 sub-goal for low income areas which are defined to include census tracts with median income less than or equal to 80 percent of AMI or for families with incomes less than or equal to AMI who reside in minority census tracts (minority population of greater than 30 percent). The sub-goal benchmark is 14 percent, 3 percentage points higher than the 2014 level of 11 percent and the same as the proposed benchmark.