Senior executives polled recently by Fannie Mae expressed increased optimism about the demand for purchase mortgages and their own profitability, at least over the short term the company said today. The results of Fannie Mae's Mortgage Lender Sentiment Survey for the second quarter showed confidence among mortgages lenders that home prices would continue to increase as would the demand for purchase mortgages while fewer report further tightening of credit restrictions.

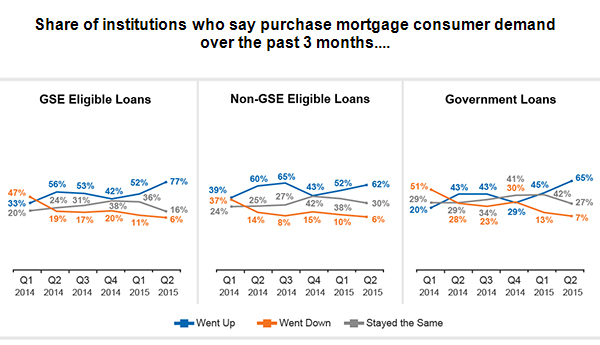

The share of respondents to the survey who said the demand for purchase mortgages had climbed over the last three months increased substantially, exceeding 20 percentage points compared to responses from the first quarter survey for GSE-eligible and government loans and reaching a survey high for each of 77 percent and 65 percent respectively. Those reporting increased demand for non-GSE eligible loans increased from 52 percent to 62 percent.

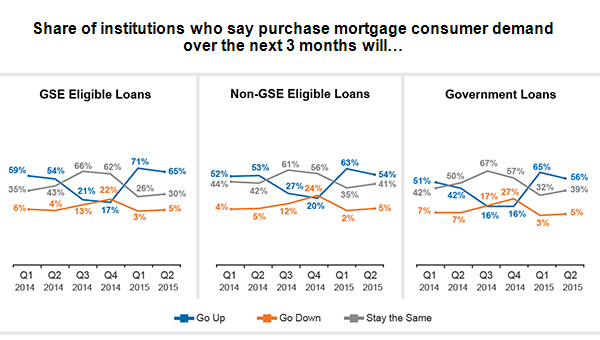

The increased optimism did not extend forward as the share of lender expecting growth in demand over the upcoming three months was down from the first quarter. The decrease however was reflected in an increase in those expecting demand to remain static rather than to fall. Fannie Mae said that those expecting an increase in demand remained higher than in 2014 surveys and the second quarter decrease could reflect seasonal factors.

"This quarter's results showed that the growing optimism of lenders has been rewarded," said Doug Duncan, senior vice president and chief economist at Fannie Mae. "The share of lenders reporting increased purchase mortgage demand over the prior three months reached a survey high for both GSE-eligible and government loans. At the same time, the positive gap grows between lenders reporting loosening or maintaining existing credit standards, relative to those reporting tightening. While not matching first quarter 2015 levels, the profit margin and purchase mortgage demand expectations over the next three months remain above the 2014 readings. The results, when taken together with the continued positive trend in consumer attitudes shown in the recently released National Housing SurveyTM, reinforce an increasingly optimistic outlook for housing in 2015, consistent with our forecast. We expect a continued housing expansion in 2015 after an uneven and disappointing 2014."

Credit tightening observed last year has continued to gradually trend down. Over 80 percent of lenders however said that standards for all three types of loans had remained basically unchanged over the last three months.

Lenders are decidedly less upbeat than consumers about the ease of getting a mortgage. While 50 percent of consumers responding to the National Housing Survey (NHS) question thought it would be easy for them to get a mortgage only 18 percent of lenders thought the process was easy for consumers. This was a drop of 10 percentage points from the Q1 survey.

Fannie Mae said the executives are increasingly optimistic, and significantly more so than the general population of consumers, about future home prices. This quarter, the share of lenders expecting home prices to go up over the next 12 months reached a survey high of 70 percent. Only 49 percent of consumer's participating in Fannie Mae's National Housing Study in May expected home prices to rise over the next 12 months.

There was also a dramatic difference between lenders and consumers when it comes to the economy in general. While a majority (52 percent) of those surveyed by the NHS thought the economy was on the wrong track only 29 percent of lenders believed this although that sentiment had increased by 8 percentage points since the Q1 survey.

Most institutions reported that they expect to maintain their strategy in relation to secondary market outlets over the next 12 months. More lenders expect to increase rather than to decrease the shares of loans originated and then sold to GSEs. The majority of institutions expect their current mortgage servicing rights (MSR) execution strategies to stay about the same over the next 12 months.

Although lenders' profit margin outlook across institution sizes fell slightly this quarter from the first quarter with more lenders reporting decreased profit margin expectations over the next three months, it remains similar to the 2014 readings.

The Mortgage Lender Sentiment Survey polls senior executives of its lending institution customers on a quarterly basis to assess their views and outlook across varied dimensions of the mortgage market. The recent survey was conducted between May 7, 2015 and May 17, 2015.