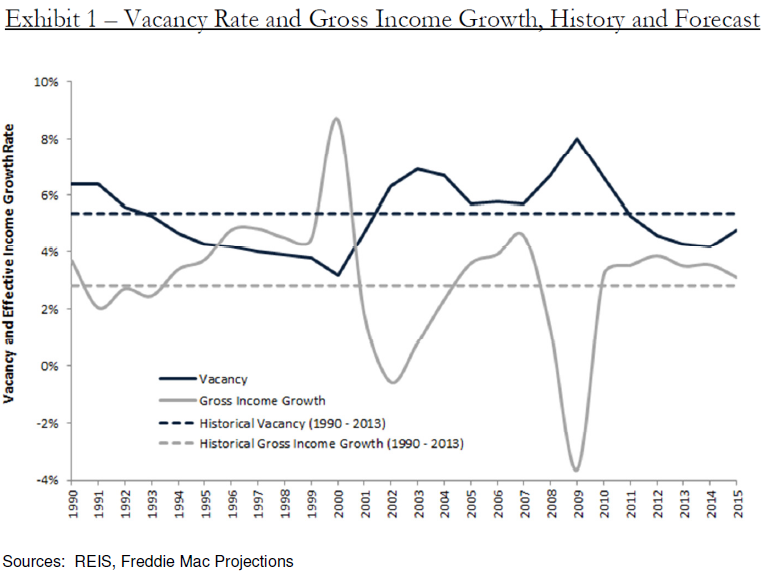

The multifamily market outperformed many predictions in 2014; vacancy levels, despite a flood of new properties, declined by 10 basis points from 2013 to a 13-year low of 4.2 percent. Revenue per unit rose, continuing the pattern that has led to a 20 percent increase over the last five years.

Freddie Mac's economists are predicting that, while easing a bit from 2014, this year will be another strong one for the sector. Its 2015 Multifamily Outlook projects that demand, driven by the millennial generation, will remain strong but construction of units in buildings with five or more will continue to trend upward so vacancies will rise.

Supply, they say, could actually outpace demand this year and the vacancy rate will probably rise by 60 basis points to 4.8 percent by year-end. This however is still below the historic average of 5.4 percent. This negative is tempered by an unknown; how much pend-up demand will be unleashed as households form that would have been formed earlier were it not for the recession.

Adding to the favorable outlook is the overall economy which is expected to grow 3 percent this year and an unemployment rate that is closing in on the Federal Reserve's definition of full employment. The later should translate into rising wages which in turn should encourage more household formation and increasing demand for rentals.

Other factors that could drive the multifamily market in one direction of the other is how the price of oil will impact employment in energy-dependent economies and the trajectory of interest rates.

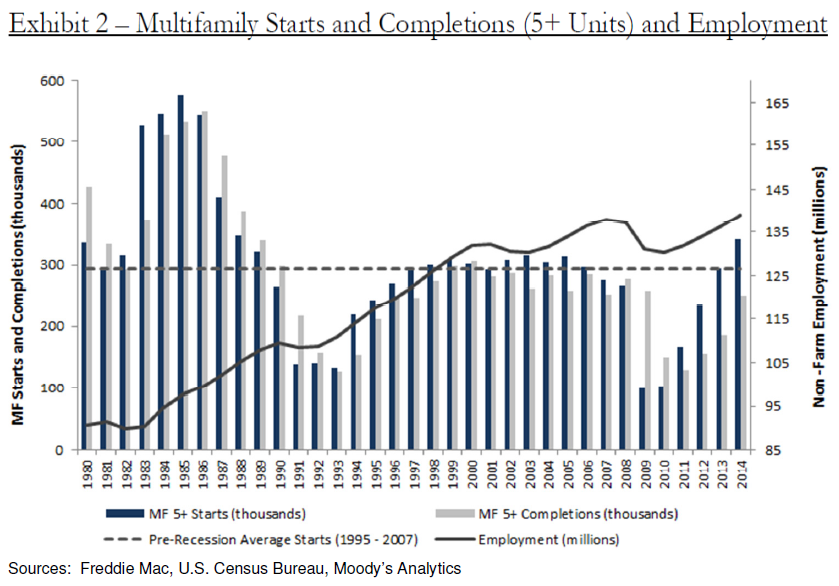

Completions of multi-family units are expected to surpass their long-run average this year and remain above average for several more years while at the same time demand, due to favorable demographic trends and expansion of the labor market, will remain strong and result in continued rent growth this year driven by the coming of age of peak number of millennials which should continue through 2023.

There is considerable lag between starts and completions of multi-family housing. In 2014 completions increased by about 67,000 units or 36 percent year-over-year to a total of 251,000 units. This was 18,000 below the long-run average from 1995-2007. The pace of construction is expected to slow but permits are still increasing so starts and completions will continue to increase for several more years.

Vacancy rates will not only rise nationally but in most Metropolitan Statistical Areas (MSAs) as well as new construction comes on line and rents are expected to respond accordingly. While growth will moderate from 2014, rents will still rise by 3.1 percent. They will, however grow more slowly in many areas and become flat or even decline in some markets.

The report says Freddie Mac estimated last year that the supply of new multi-family units needs to be around 440,000 annual to meet demand including that from households that delayed formation during the recession. While completions will rise above the historic average of 270,000 this will not meet long-term demand. "While the timing of the realization of pent-up demand is hard to predict, they expect that the wave of current supply will not disrupt the market and will be absorbed within the mid-term."

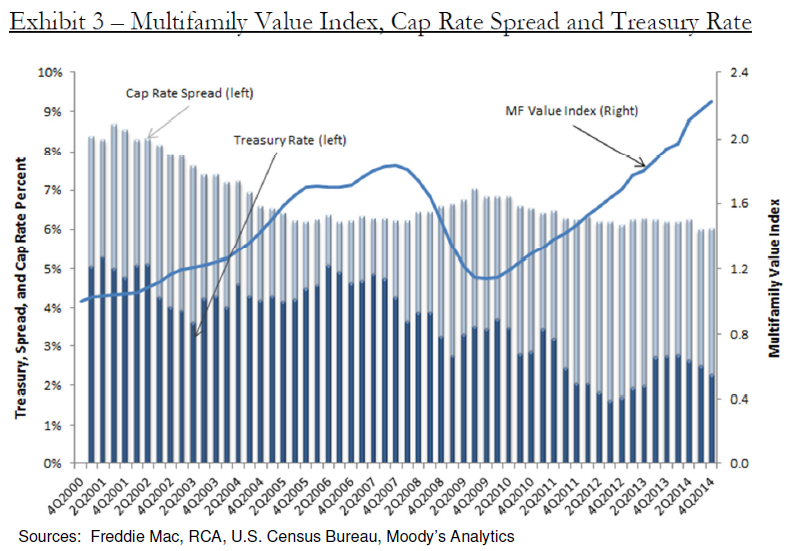

Consistent with the revenue growth noted above, property prices also advanced robustly in 2015, rising about 15 percent and this appreciation is expected to continue. Cap rates decreased by 16 basis points during the year, ending at 6 percent and Freddie Mac anticipates that cap rates will stay below that rate for the year.

Multi-family origination volume ended the year about $185 billion, $13 billion more than in 2014 due to a strong second half of the year. That finish can be attributed to declining interest rates, increasing construction completions, and increasing property prices. Freddie Mac expects that investors will take advantage of low rates by refinancing debt or funding new completions and expects another substantial year for multifamily originations. It also expects that the sharp increase in commercial mortgage-backed security conduits, while still only a small share, will continue.

Another unknown is energy prices. A continued decline could affect the economy in contradictory ways; lower prices are likely to lead to more economic growth but energy dependent areas could be hurt by layoffs and cuts in capital spending. The biggest concern is in Texas, especially Houston but the area is more diversified than during the last energy crisis so it is unlikely it will fall into a recession.

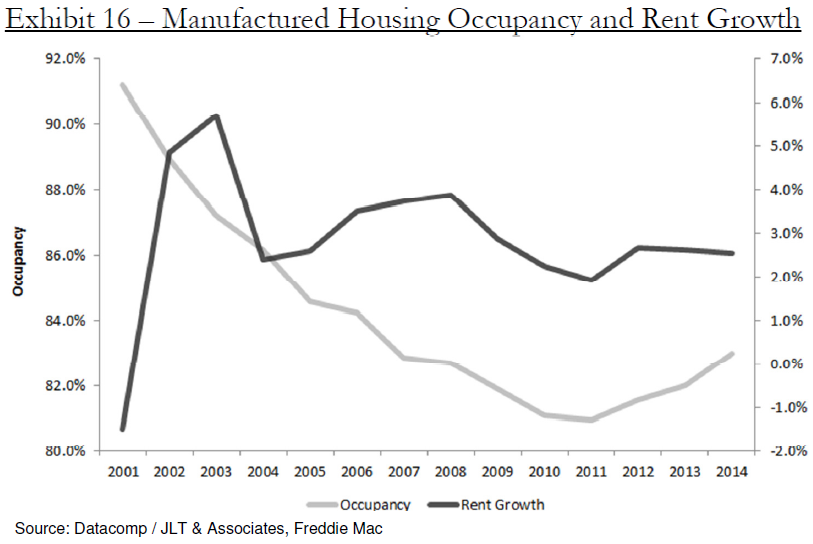

The report contained a special section analyzing manufactured housing which has seen growing popularity in response to the growing unaffordability of traditional housing. Average rent for manufactured housing in was $450, which was 42 percent lower than the median for a traditional multifamily unit.

Nationwide 6.7 million households reside in this housing or 5.8 percent of total households. About one-third of these are renters. More than half of manufactured units are located in six states in the Southeast Region and California and Texas and is more prevalent in smaller cities and municipalities. After falling during the recession, occupancy in this housing is trending up while rent growth remains below pre-recession levels.

Freddie Mac says it expects the supply of manufactured housing that will be delivered this year to surpass pre-recession levels; market dispersion will become more pronounced, and the housing is expected to be a vehicle to help bridge the housing affordability gap.