Completed foreclosure dropped precipitously in October compared to September, although they were down to a significantly lesser extent from a year earlier. While the foreclosure crisis is no longer front-page news, CoreLogic's October National Foreclosure Report, released today points out that completed foreclosures in October were nearly double the number in more "normal" times and are a major factor inhibiting a return to normal levels of new home construction.

During the month there were 41,000 completed foreclosures nationally compared to 62,000 in September, a -34.1 percent change. The October number was down 14,000 or 26.4 percent from a year earlier and was 65 percent below the peak of completed foreclosures in September 2010. It was the 25th month of double digit year-over-year declines in the inventory of foreclosed homes.

Still, CoreLogic points out that from 2000 to 2006, before the decline in the housing market, completed foreclosures averaged 21,000 per month. Since 2008 there have been approximately 5.3 houses repossessed by lenders.

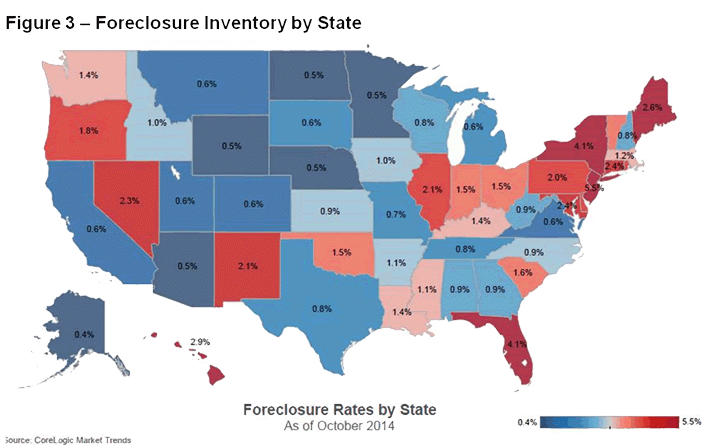

The foreclosure inventory, the number of homes in some stage of foreclosure, numbered 605,000 units in October compared to 875,000 a year earlier, a decrease of 30.9 percent. October is the 36th consecutive month in which the inventory has declined and it was down 2.1 percent compared to the previous month. The foreclosure inventory represents 1.6 percent of all homes nationwide with a mortgage, down from 2.1 percent in September and 2.2 percent in October 2013. The October inventory rate is the lowest since May 2008.

"While there has been a large improvement in the reduction of foreclosure inventory, completed foreclosures remain high and serve as one of the obstacles to new single-family construction," said Sam Khater, deputy chief economist for CoreLogic. "Until the flow of completed foreclosures declines to normal levels, new-home construction will not pick up because builders have little incentive to compete with foreclosure stock."

CoreLogic president and CEO Anand Nallathambi pointed out that not only is the foreclosure inventory at a new low but seriously delinquent loans are also tending down. "At current rates, we can expect the foreclosure inventory to slip below 500,000 units during 2015," he said.

Every state but West Virginia and the District of Columbia posted double-digit declines in foreclosure inventory year over year and in 19 states these were greater than 30 percent. The largest decreases were in Florida (44.9 percent) and Utah (41.6 percent.) West Virginia posted the smallest change, -8.9 percent while and the District of Columbia's inventory increased 17.3 percent.

The five states with the highest number of completed foreclosures for the 12 months ending in October 2014 were: Florida (118,000), Michigan (45,000), Texas (36,000), California (29,000) and Georgia (28,000).These five states accounted for almost half of all completed foreclosures nationally.

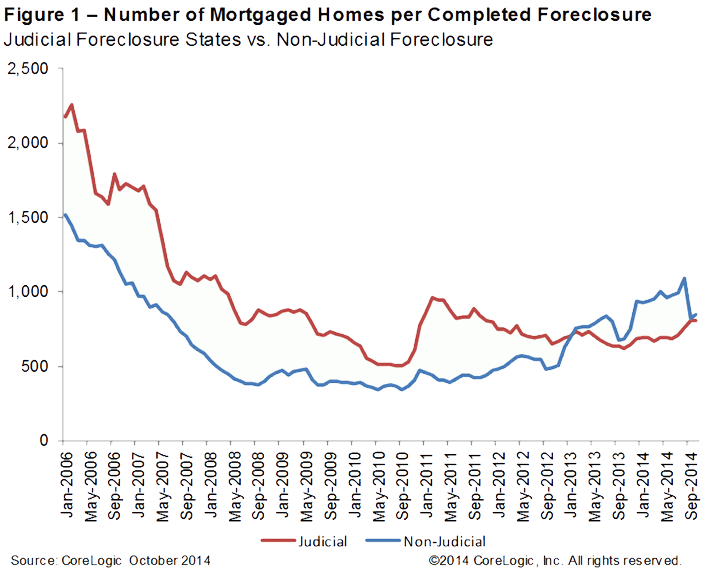

The five states with the highest foreclosure inventory as a percentage of all mortgaged homes were: New Jersey (5.5 percent), Florida (4.1 percent), New York (4.1 percent), Hawaii (2.9 percent) and Maine (2.6 percent). All five are judicial foreclosure states.