Redfin, the large national real estate firm based in Seattle, is reporting that, while sales of homes costing over $1 million is still outpacing the rest of the market, the source of these sales is changing. The company says that the luxury housing market, which was the first segment to recover after the housing crisis, continues strong, driven by a record high stock market, low interest rates and by foreign investors.

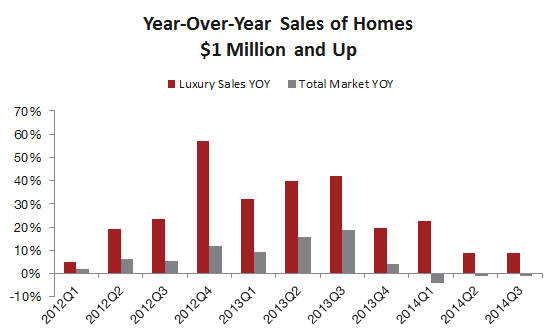

Sales of home costing more than $1 million increased by 9 percent in the third quarter of 2014 even as all home sales were down 1.2 percent when compared to the third quarter of 2013. However Redfin says that overseas investment in these homes is beginning to flag and those markets which have benefitted the most from foreign investors are seeing "a steady and dramatic decline in sales of million-dollar-plus homes." Those cities where there is less reliance on investors, both foreign and domestic, are still seeing a steady increase in high-end sales.

The definition of luxury is, of course, as local as any other facet of real estate. Redfin points out that there are parts of the country where a million bucks will buy little more than an average home and many California cities fall into that category. Thus it is not surprising that four of the top five cities in terms of expensive home sales were in California; San Francisco, Los Angeles, and San Jose with San Diego at number five. But other cities that are considered affordable were among the top ten - Chicago in fourth place and Houston in sixth, both beating out Washington, DC (number 7); Seattle (8), and Boston (9) which have higher housing costs in general. Another California city, Newport Beach, rounds out the top ten list.

The average increase for the 385 cities that had million-dollar-home sales in the third quarter was 17 percent but in Houston those high-end sales were up 42 percent from the third quarter of 2013. Redfin said this increase was "driven by a shift in homebuyer demand toward luxury properties." Redfin agent Tara Waggoner said that Houston benefits from a strong and diverse job market and that many people are coming into the area through job transfers from the coasts. "Those people are shocked at how much home they can get for $1 million in Houston," she says.

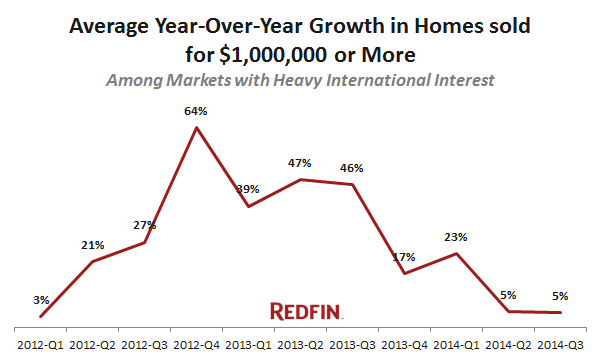

Redfin looked at seven markets which have previously benefitted from heavy international buyer participation. The seven, Los Angeles, Orange County, Riverside-San Bernardino, Miami, Orlando, Fort Lauderdale and Las Vegas, still have strong sales in the $1 million plus category but growth has stalled, dropping on average from 46 percent to 5 percent. However in Los Angeles and Orange County growth in million-dollar-home sales has flatlined; in Las Vegas it has been negative for the last three quarters.

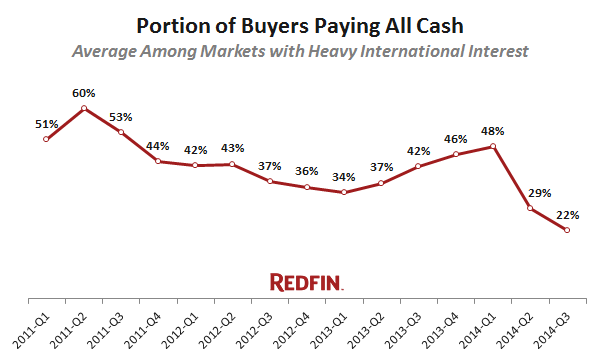

Like foreign investment, all-cash deals are also no longer the norm. In those seven cities that have relied heavily overseas investment cash transactions have fallen from about 48 percent of million dollar sales at the beginning of this year to 22 percent in the third quarter. In Los Angeles cash sales have fallen to 10 percent.

With rising interest rates these expensive homes will become even more costly while at the time the supply of these homes was down 13 percent from a year earlier. Redfin says that, "Tight inventory means that any post-crisis deals in high-end real estate have all but disappeared."

Looking forward the company says that luxury home sales will continue strong for the rest of this year and the next but, at just under 3 percent of the market, those sales will have a limited impact on overall market growth. "This sector of the market, particularly in the places that have typically had strong foreign interest, will need traditional (and well-heeled) buyers to offset disappearing demand from international investors."