The increase in bank repossessions or completed foreclosures in April even as other foreclosure statistics declined may indicate that the housing crisis is in its final stages RealtyTrac said today. While foreclosure filings overall, including default notices, scheduled auctions, and completed foreclosures, were down 1 percent in April, to a total of 115,830, there were 30,056 completed foreclosures, a 4 percent increase from March.

"The rise in bank repossessions in many states is a sign that those markets are working through the final remnants of foreclosures left over from the recent housing crisis," said Daren Blomquist, vice president at RealtyTrac. "Many of these bank-owned homes are bottom-of-the-barrel properties in terms of location or condition, but they will provide some much-wanted inventory of homes for sale in some markets in the coming months. Investors and other buyers willing to do more extensive rehab will likely be best-suited for these incoming REOs."

In addition to decreasing 1 percent from the previous month, total foreclosure filings were down 20 percent compared to April 2013 and completed foreclosures were 14 percent lower than a year earlier. One in every 1,137 U.S. housing units received some type of foreclosure filing during the month.

Auctions were scheduled for 49,239 properties nationally, down 3 percent from March and a 21 percent decrease from one year earlier. It was the 41st consecutive month when these filings decreased on a year-over-year basis.

Foreclosure starts were also down, declining 2 percent from March and 22 percent from April 2013. This was the 21st month in which there was an annual decrease.

Bank repossessions increased from the previous month in 26 states and were up from a year ago in 16 states, including New York where there was a 142 percent increase, Oregon (+91 percent), New Jersey (+58 percent), Illinois (+55 percent), and Indiana (+52 percent).

Scheduled auctions increased from the previous month in 22 states and were up from a year ago in 17 states, including Oregon (+229 percent), Utah (+101 percent), Colorado (+87 percent), and New Jersey (+73 percent.

Foreclosure starts, which are scheduled auctions in some states, increased from the previous month in 26 states and were up from a year ago in 16 states, notably in Massachusetts where starts doubled year-over-year and Indiana where they increased by 60 percent.

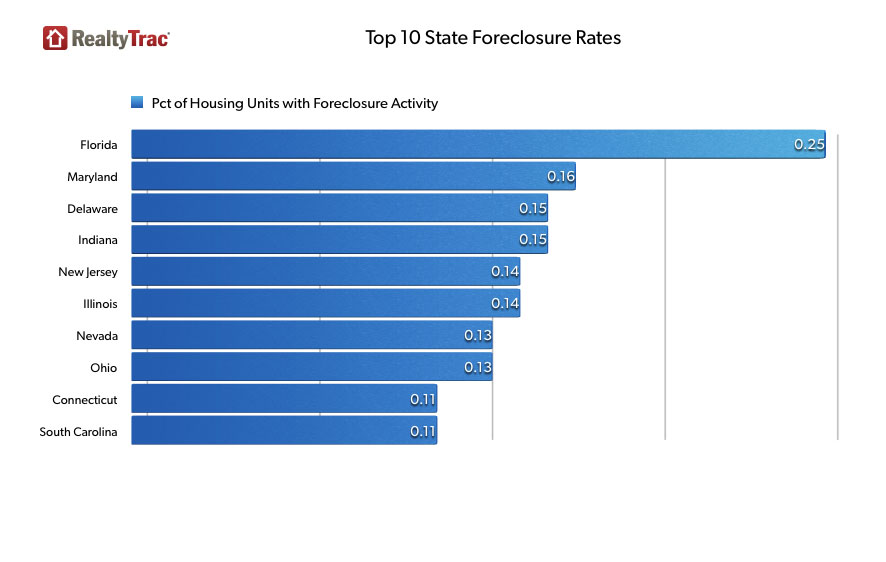

Despite a year-over-year decrease in foreclosure activity Florida still topped the nation with the highest foreclosure rate for the seventh straight month. One in every 400 housing units had a filing during the month, almost three times the national average. Maryland had the second highest rate with its 22nd consecutive annual increase. One in every 624 housing units had a filing during the month. Delaware, with one in every 657 units having a filing had the third highest rate. Its rate was up 8 percent from a year earlier and has increased on an annual basis for 11 of the last 14 months.

The other states in the top ten and the housing units per filing were Indiana (681), New Jersey (700), Illinois (700), Ohio (750), Nevada (770), Connecticut (887), and South Carolina (890).

Eleven of the 20 highest foreclosure rates in metropolitan statistical areas with a population of 200,000 or more were in Florida, led by Orlando at No. 1. One in every 289 Orlando housing units had a foreclosure filing in April, nearly four times the national average.