Sales of residential properties were marginally higher in March than in February and the median price of both distressed and non-distressed properties also increased slightly RealtyTrac said today. Sales of single-family homes, condominiums, and townhomes were at an annual rate of 5,253,464 units in March, up 0.4 percent from February. The sales pace was 8 percent higher than in March 2013.

The median price of all residential properties was $164,500, a 1 percent increase from the previous month and 10 percent above the median price one year earlier. RealtyTrac said this was the 24th consecutive month that median house prices posted annual growth and the 10 percent March to March change was the largest of those increases.

"The housing market showed signs of coming out of hibernation in March after a sluggish fall and winter," said Daren Blomquist, vice president at RealtyTrac. "Median home prices increased on a monthly basis following six consecutive months where they were flat or declining, and increased on an annual basis by the biggest percentage since hitting bottom in March 2012.

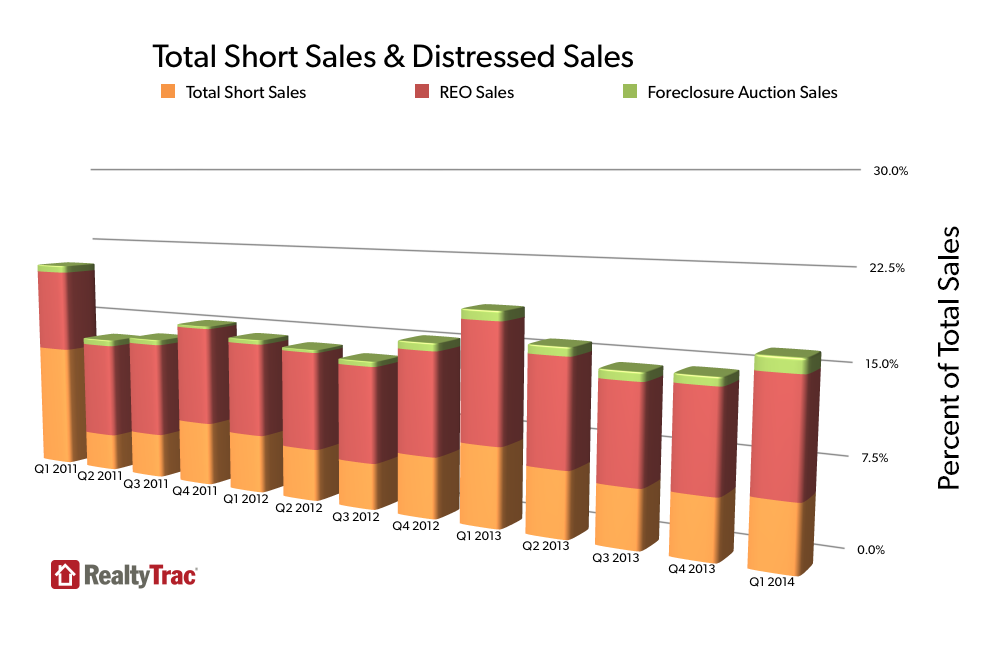

"Sales volume also increased slightly from March to February following four consecutive monthly decreases, but both annual sales volume and median prices are still below their recent peaks in October and August respectively," Blomquist continued. "Meanwhile, the distressed share of sales increased from the fourth quarter to the first quarter nationwide and in 38 states, which - along with many non-distressed homeowners regaining enough equity to list their homes for sale - is helping to ease low inventory conditions in some markets."

Investor interest in the residential market remained strong. Based on buyer mailing addresses more than one-third (34 percent) of March sales appeared to involve non-owner occupants, most likely investors or second home buyers. In addition, 7 percent of March sales were multi-parcel transactions where several properties were sold on the same date and recorded on the same sales document.

Despite the annual increase in residential sales volume nationwide, sales were down from a year earlier in six states, Massachusetts, Rhode Island, California, Connecticut, Nevada, and Arizona. Sales were also down in 21 of the 50 largest metropolitan areas including some which were notable hot spots a few months ago. San Jose saw sales fall 18 percent from a year earlier, San Francisco was down 15 percent, and Las Vegas and Phoenix decreased by 12 percent and 11 percent respectively.

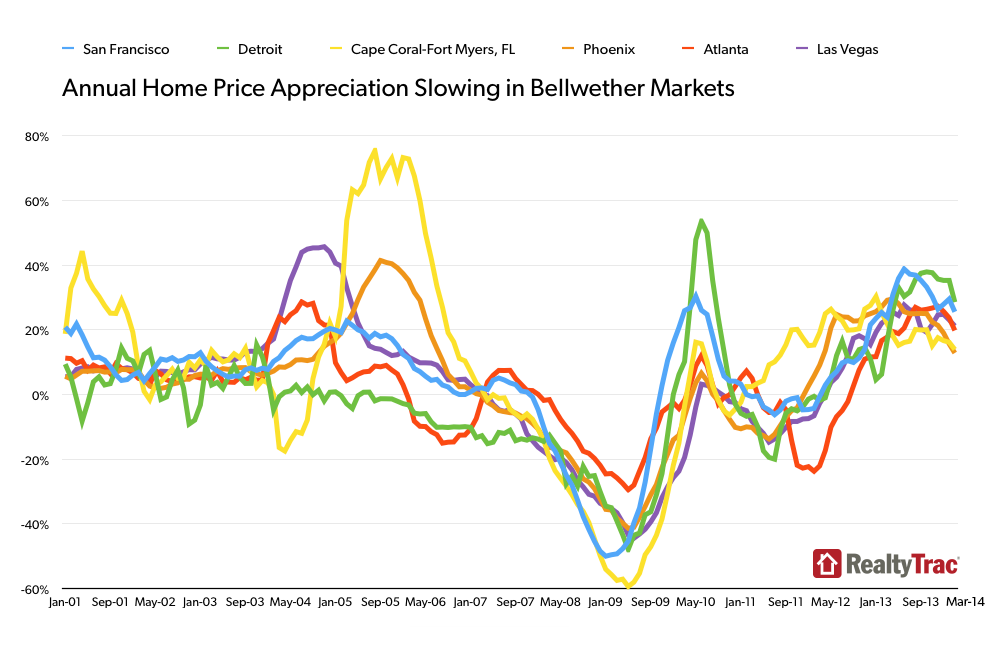

Likewise many metro areas that have seen massive price appreciation since reaching their respective troughs are now seeing more moderate price growth. The median price of a home in San Francisco has risen 94 percent after bottoming out in March 2009 and posted an annual increase of 39 percent in June of last year but by last month the appreciation had slowed to 26 percent. The median price in Detroit is 92 percent above the May 2009 trough and the area had a 38 percent annual increase in October but now the annual increase is 29 percent. RealtyTrac reports a similar pattern in Fort Myers, Phoenix, and Atlanta.

Short sales and distressed sales - in foreclosure or bank-owned - accounted for 16.4 percent of all sales in the first quarter, up from 14.5 percent in the previous quarter but still down from 18.5 percent in the first quarter of 2013. Short sales alone accounted for 5.6 percent and an additional 1.2 percent of sales nationwide took place at public foreclosure auctions.

Some metro areas are still experiencing high levels of non-equity sales. In Las Vegas, Stockton, California, Detroit, Cleveland, and Dayton combined short sales and distressed sales exceeded one third of the March total.