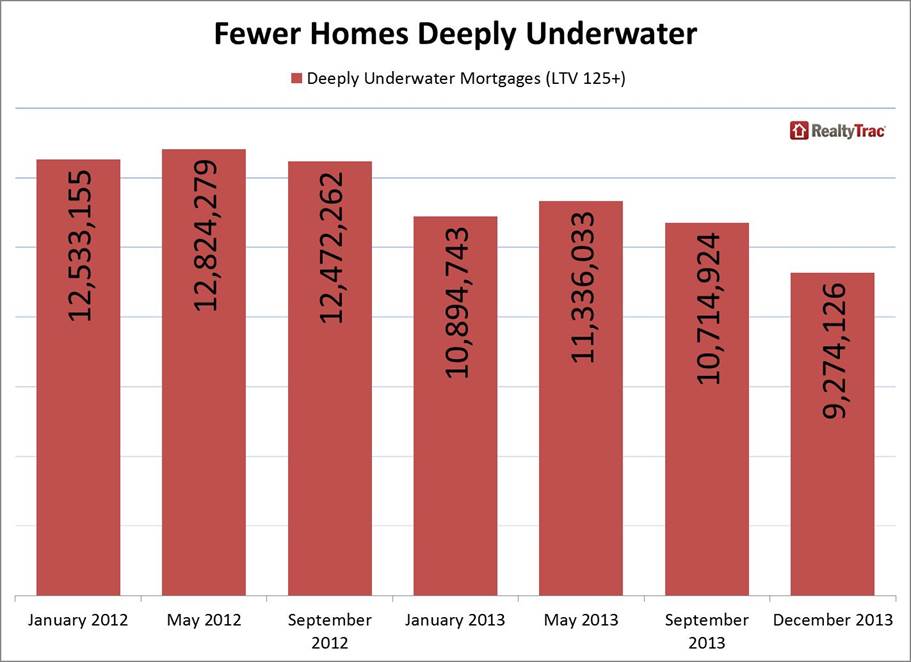

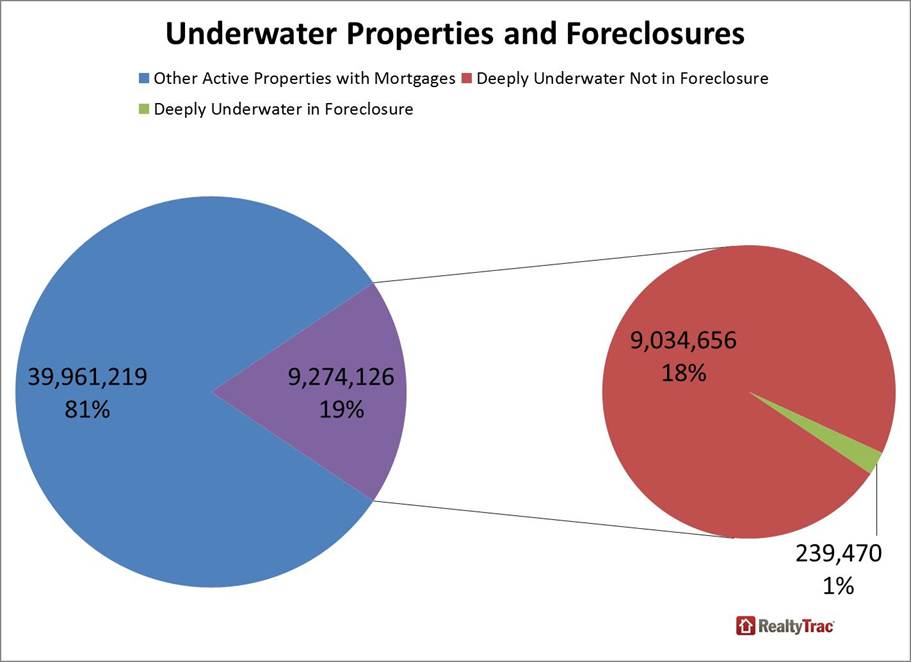

Rising home prices are returning more and more homes to a positive equity position and RealtyTrac said today that about 31 percent of the homes currently in the process of foreclosure now appear to have some value above the balances of their mortgages. The company reports that as of December homes nationwide that were seriously underwater, that is with loan-to-value ratios exceeding 125 percent, numbered 9.3 million or 19 percent of all properties with a mortgage. This is down from 10.7 million properties or 23 percent of mortgaged homes that were deeply underwater in September. At the peak, in May 2012 the numbers stood at 12.8 million properties or 29 percent.

In December, of a total of 239,470 properties in foreclosure, 48 percent were valued at least 25 percent less than their outstanding mortgage balance, 60,000 fewer than in September when 56 percent were deeply underwater. Another 31 percent had some equity in December compared to 24 percent in September.

Homeowners who retained equity during the period of plummeting prices and rising foreclosures are now also benefiting as well from rising prices and watching that equity grow. The universe of equity-rich properties, defined as 50 percent or more, grew during the fourth quarter from 7.4 million representing 16 percent of all residential properties with a mortgage in September, to 9.1 million representing 18 percent in December.

"During the housing downturn we saw a downward spiral of falling home prices resulting in rising negative equity, which in turn put millions of homeowners at higher risk for foreclosure when they encountered a trigger event such as job loss," said Daren Blomquist, vice president at RealtyTrac. "Now we are seeing the reverse trend: rising home prices resulting in falling negative equity, which in turn is giving millions of homeowners a lifeline to avoid foreclosure when they encounter a trigger event. On the other end of the spectrum, the percentage of equity-rich homeowners is nearing a tipping point that should result in a larger inventory of homes listed for sale and give the overall economy a nice shot in the arm in 2014.

Blomquist said however that millions of homeowners remain in such a deep equity hole it will take years to climb out. "The longer these homeowners remain in a negative equity position without relief in the form of a principal loan balance reduction, the more likely that foreclosure will become the path of least resistance for them."

Nevada remains the state with the highest percentage of deeply underwater properties at 38 percent. In Florida the percentage is 34 followed by Illinois (32 percent), Michigan (31 percent) and Missouri and Ohio at 28 percent. On the other side of the equation, 36 percent of properties in Hawaii are considered equity rich followed by New York with 33 percent, California, 26 percent, Montana, Maine, and the District of Columbia, all at 24 percent.