Lender Processing Services (LPS) notes a "marked upturn" in delinquency rates in its September Mortgage Monitor released this morning. The company said that there is usually a seasonal rise in delinquencies in September, but the 7.7 percent increase from the August rate is the largest monthly increase since 2008. However, Senior Vice President Herb Blecher said it is important to view the date in its proper context.

"September's

increase in the delinquency rate was indeed significant, but the overall trend

is still one of improvement," Blecher said. "Despite the monthly

jump, delinquencies are down 30 percent from their January 2010 peak, and our

analysis revealed some interesting factors related to the spike. Of course, one

month's data does not indicate a trend. We will be monitoring these factors

over the coming months to see how the situation develops."

Blecher continued, "September 2012 was notable in its short duration of

business days and virtually all transactional or operational metrics we

observed declined in volume for the month; foreclosure starts, foreclosure

sales, delinquent cures and loan prepayments all dropped from their August

levels. It is important to note that we also saw the percentage of re-defaulting

modifications contributing to the delinquency rate actually declined from the

month prior."

The total national delinquency rate in September was 7.40 percent compared to 6.87 percent in August. Despite the month-over-month spike, the September rate is down 4.2 percent from the rate in September 2011 of 7.72 percent.

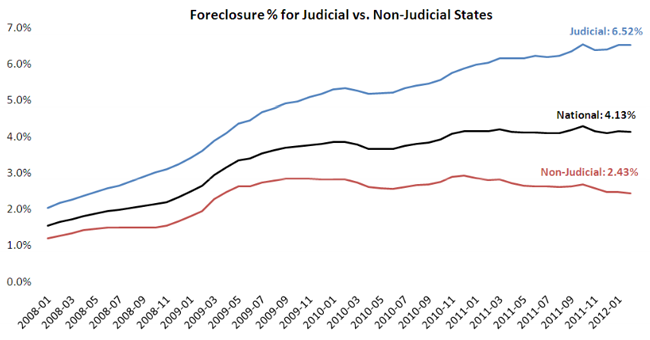

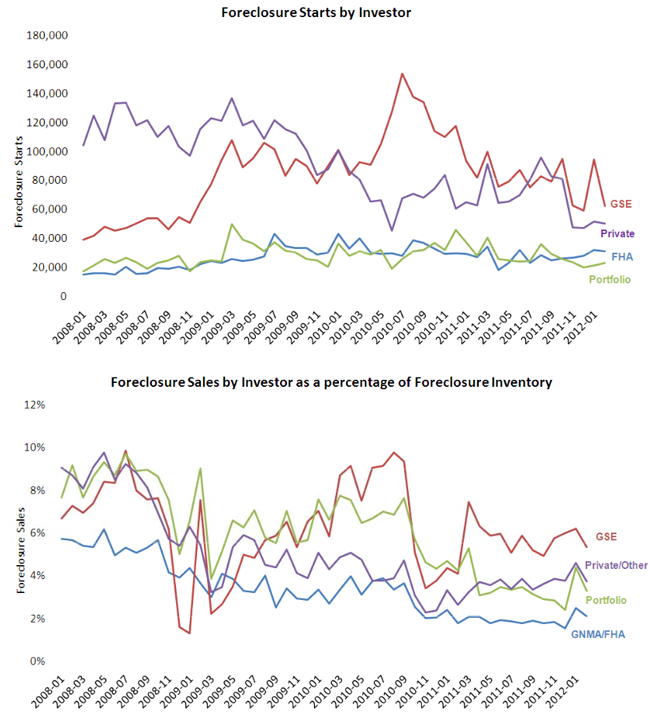

The presale inventory rate in September was 3.87 percent compared to 4.04 percent in August and 4.18 percent the previous September. A wide disparity remains among the states according to their foreclosure process; the foreclosure inventory is at 6.26 percent in states where courts are involved in foreclosures and 2.17 percent in non-judicial localities. Both judicial and non-judicial states, however, seem equally focused on loss mitigation activities with little difference between the two in the relative numbers of loan modifications and short sales.

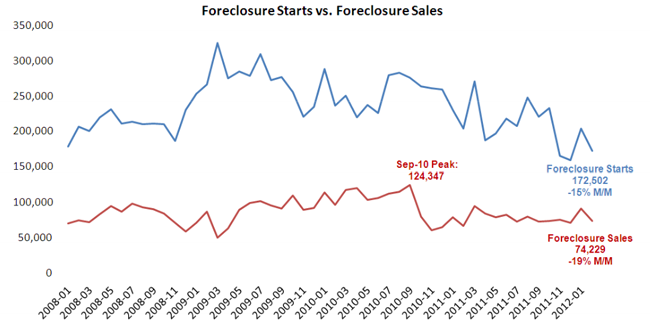

Foreclosure starts in September numbered 159,078 compared to 201,173 in August and 220,764 in September 2011. This represents declines of 20.9 percent and 27.9 percent respectively.

The states with the highest percentage of non-current loans including both delinquencies and foreclosures are Florida, Mississippi, New Jersey, Nevada, and Louisiana.

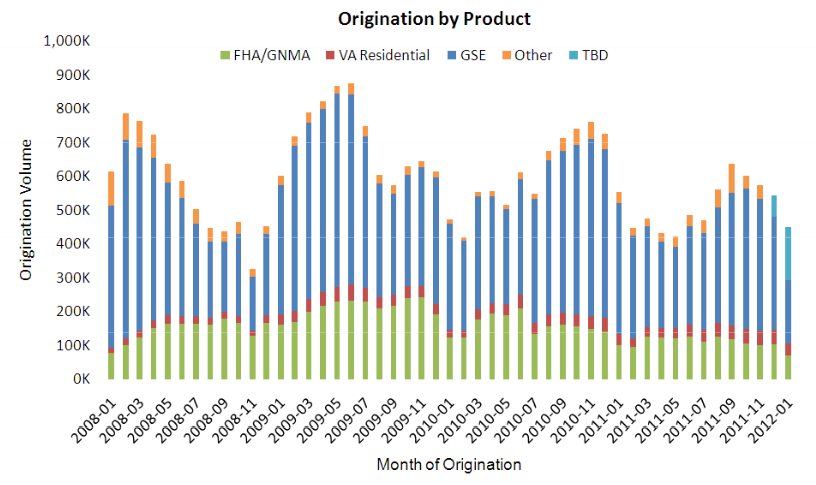

Newly available origination data also provided additional insight into the increase seen in August's prepayment rates. After allowing a month for loan data to board, originations in August were found to be up 13.2 percent month-over-month and 42.1 percent year-over-year, reaching their highest point since 2009. The data shows that high loan-to-value HARP originations made up nearly a quarter of August originations.