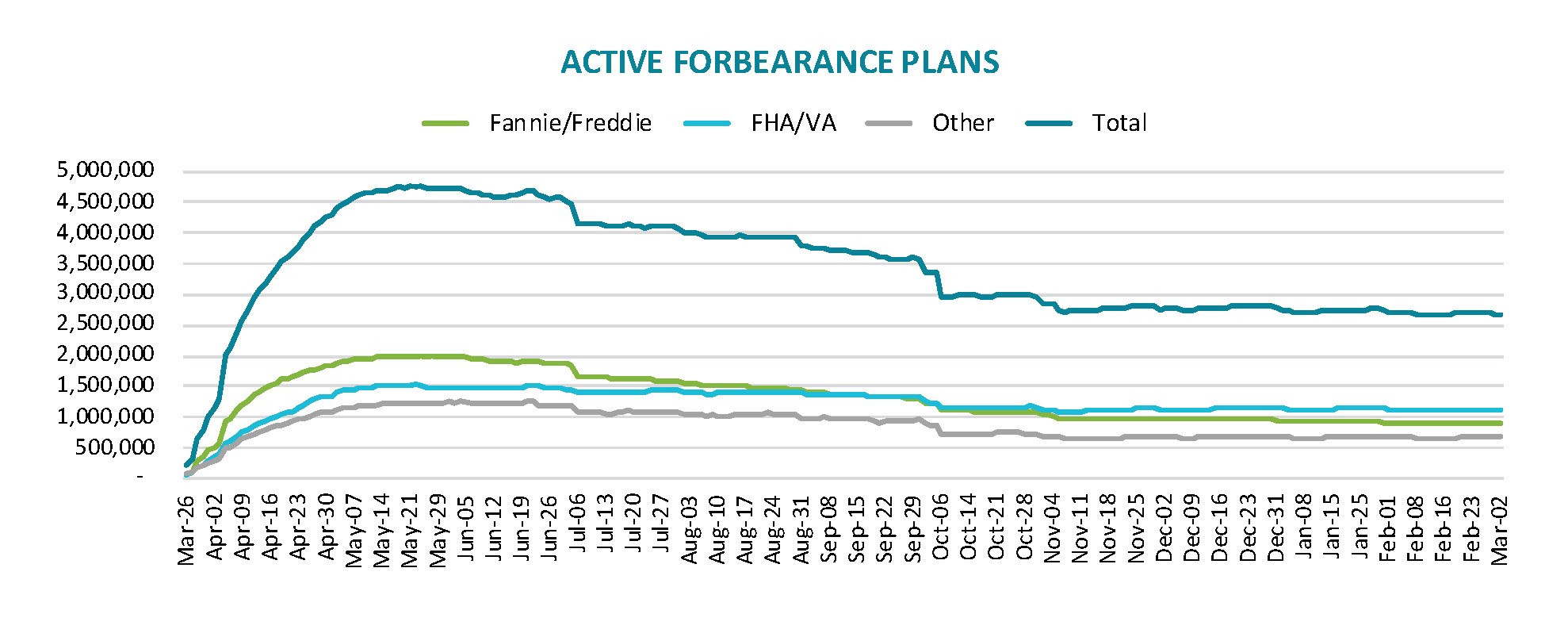

As Black Knight has repeatedly predicted, end of February expirations drove the number of mortgage loans in forbearance lower this past week. There was a decline of 22,000 loans in forbearance plans during the week ended March 2, an 0.8 percent decline. Black Knight says that there are still more than 100,000 loans in plans that expired at the end of last month that may be under review by servicers for extension or removals. Despite weekly improvement, the monthly rate of decrease slowed from 2.0 percent to 1.3 percent.

At the end of the reporting period, the company estimates that 2.69 million homeowners remain in forbearance plans, 5.1 percent of those with a mortgage loan. The largest improvement over the past week was in loans serviced for FHA and the VA. They declined by 13,000 to 1,113 million loans or 9.2 percent of those portfolios. Forborne loans serviced for Fannie Mae and Freddie Mac (the GSEs) fell by 8,000 to 895,000 or 3.2 percent of the total. Those serviced for bank portfolios or investors in private label securities (PLS) improved by a modest 1,000 loans to 677,000 or 5.2 percent.

Black Knight says 1.1 million forbearance plans are set to expire at the end of March, more than half of which will be 12-month expirations. Given recent actions the by White House, many of these homeowners will be able to extend for another three months. How many do so, the company says, will tell us a lot.