Today's Fed announcement isn't likely to contain any major revelations for the bond market, nor to cause any significant volatility. Logical conclusion based on recent comments or famous last words? One can never be sure when it comes to the Fed. There's always a small risk that the Fed will surprise us, even when it doesn't seem likely. What we CAN be sure of is this: to whatever extent any of the this week's Treasury weakness is attributable to pre-Fed apprehension, an as-expected announcement could be helpful this afternoon.

To be clear, this isn't a prediction. In fact, I don't think yesterday's weakness had much--if anything--to do with the Fed. They've been very clear about their current policy stance and unless they've drastically miscommunicated, we'd need to see several more NFP prints in the 1 million neighborhood before they were close to claiming victory on HALF their objective.

Then there's inflation... Given that we're waiting a few months to get over some perceived hump of supply-chain disruptions and "base effects" (the mathematical influence of last year's aberrant inflation numbers on today's year-over-year levels), it's not even possible for the Fed to be at all concerned about inflation yet. And they'd need to be if they were going to surprise markets with some new talk of tapering. So I will go out on a limb and say it's drastically premature to conclude that bonds are feeling any pressure from a potential tapering signal (as several respectable journalists have suggested).

This isn't to say inflation cues aren't becoming more legitimate. Indeed, the popular "inflation breakeven" measurement (10yr Treasury yield minus 10yr Treasury Inflation Protected Security yield) is as high as it's been since 2013 and has risen in April even as 10yr yields moved lower.

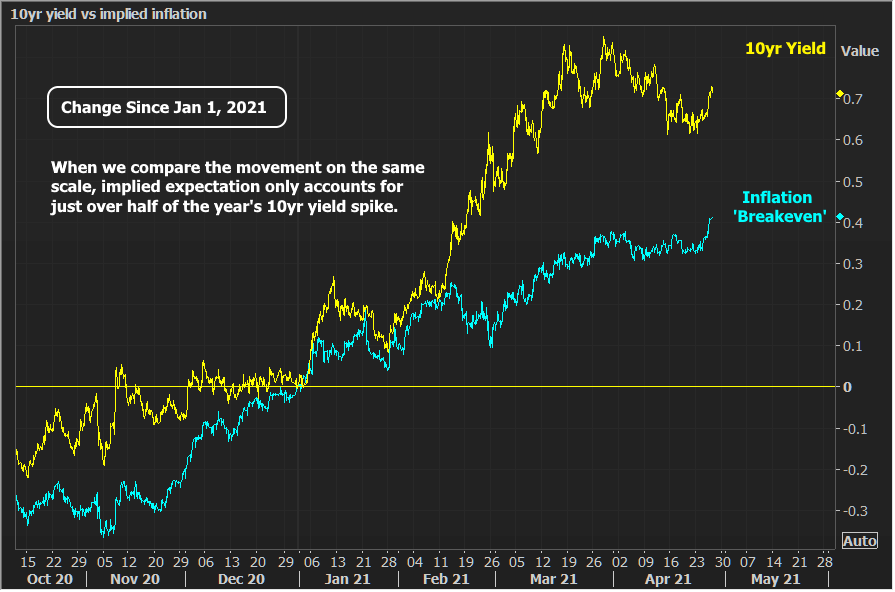

Considering all of the stimulus and accommodation in play--not to mention the covid-driven supply chain disruptions--it would be a shock if inflation expectations were NOT pushing longer-term highs. That's the idea, after all. If anything, it's a surprise that inflation hasn't picked up faster. The chart above is a bit too persuasive in that regard because it uses a different axis for inflation.

If we normalize the lines by focusing on the absolute change, we can see just how small the inflation impact has been in 2021. Up until the past few weeks it accounted for less than half of the upward pressure on rates (historically, when bonds are worried about inflation, we see breakevens moving at least as quickly as yields themselves).