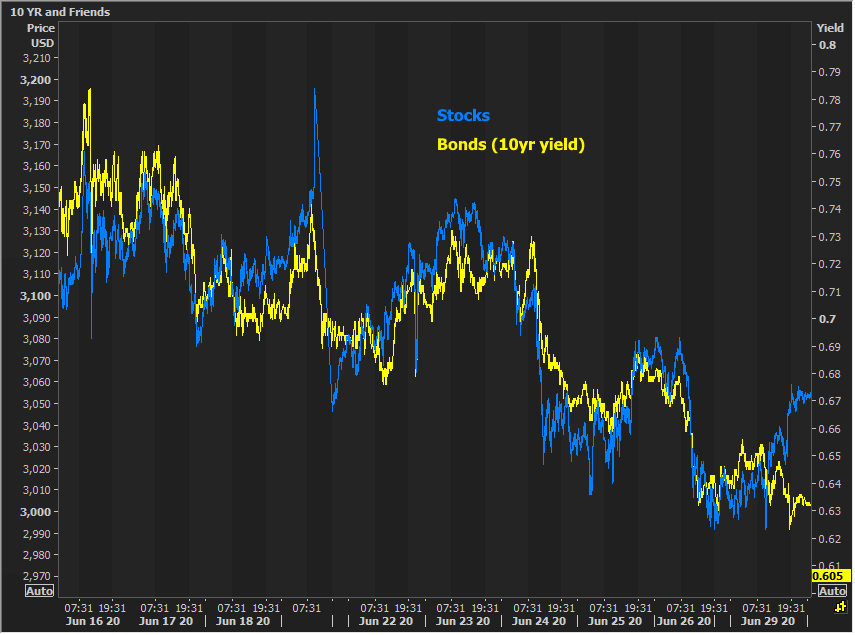

One of the market themes that has been most noticeable and most reliable post-covid is that of the "stock lever"--our in-house term for the phenomenon whereby stock prices act as a lever for bond prices. If we're following bonds in the form of yields (instead of prices), the stock lever results in 10yr yields and stock prices following each other in lock-step at times. Here's an example:

But as I frequently like to point out, the correlation breaks down over longer time frames for a variety of logical reasons--not the least of which being that stocks are tied to company valuations that can grow indefinitely while bond yields are interest rates that would ideally hold a sideways range over time.

Now we're starting to see the correlation break down over shorter time horizons as well. This one is more of a surprise at first glance, because our baseline assumption is that both sides of the market are intently focused on the coronavirus narrative where positive/negative updates should logically promote the correlation (i.e. good news on covid would push stocks and bond prices higher together and vice versa).

The overnight trading hours offered another a fresh example of a short term divergence as stocks jumped higher but bonds were content to maintain a trajectory of modest improvement.

Again, this is something we're seeing more of in the past few weeks. Incidentally, we're seeing more of something else in the past few weeks too: EARNINGS. Long story short, the stock market is reacting (at times) to earnings releases, and the bond market doesn't care about such things nearly as much as covid headlines. In other words, the tradeable information is stock-specific, and that's what accounts for these shorter-term divergences.

With those modest overnight gains, bonds are starting the day very much inside the downtrend we've been following as well as the broader sideways range. Volume and volatility has been light all week. It would take information that likely doesn't exist yet in order for that to change.

There's a smattering of econ data on tap, but given the absence of any clear reaction to yesterday's far more important line-up, we shouldn't expect miracles from today's line up.