All expected positives we've promoted aside, which includes the most recent conviction regarding the "it that shall not be named". It is time to put everything in perspective.

Before moving forward we recommend reading the precursors to this post.

First Reading: http://www.mortgagenewsdaily.com/mortgage_rates/blog/48011.aspx

Second Reading: http://www.mortgagenewsdaily.com/mortgage_rates/blog/48506.aspx

Third Reading:http://www.mortgagenewsdaily.com/mortgage_rates/blog/48989.aspx

I must clarify that I am assuming that you have read the precursors to this post...

Knowledge Base...

Yesterday morning the Treasury Borrowing Advisory Committee (TBAC) released their report on the expected borrowing needs of the US Federal Government. The report indicated that "There is near consensus that Treasury's funding needs during the next two years will be the largest in the post-war era in dollar terms, and likely also as a percent of GDP". In the their quarterly refunding announcement the Treasury noted that if current predictions are accurate the "Treasury expects to reach the debt ceiling in the first half of 2009." This implies that "FY09 net borrowing could be as high as18 percent of GDP"

PRESS RELEASE:http://www.treas.gov/press/releases/tg09.htm

Here is the breakdown of the expected borrowing needs...

The Treasury will be "offering $67 billion of Treasury securities to refund approximately $36.3 billion of privately held securities maturing or called on February 15 and to raise approximately $30.7 billion. The securities are:

- A new 3-year note in the amount of $32 billion, maturing February 15, 2012;

- A new 10-year note in the amount of $21 billion, maturing February 15, 2019;

- A new 30-year bond in the amount of $14 billion, maturing February 15, 2039.

- A new 7-yr note to be issued in Feb 2009.

Plain and Simple: The US Government needs to BORROW a lot more money. Funds they will PAY interest on...

Markets have anticipated this surge of supply by pushing the yield curve steeper and steeper...

This is alarming given the fact that US Government is facing "significant declines" in income. According to the TBAC "Receipts were down by nearly 10% in the first three months of the new fiscal year and the pace of decline appears to have accelerated in January" due to the fact that " trends in unemployment rate where closely correlated with tax receipts and that the general consensus was that unemployment rates would rise from current levels".

Plain and Simple: As job losses mount the US Government is LOSING more and more INCOME.

This is even more distressing given the fact that US Government payment "Outlays were 45 percent higher, reflecting nearly $320 billion in expenditures related to the Troubled Assets Relief Program (TARP) and the Housing and Economic Recovery Act of 2008 (Senior Preferred Agreement investments and Agency MBS purchases related to Government Sponsored Enterprises) as well as other financial market stabilization efforts."

FYI: "outlays are surging at a breakneck pace as automatic stabilizers (unemployment compensation, food stamps, etc.) kick in and the government puts in place programs to try and stabilize the financial sector."

Plain and Simple: FEDERAL INCOME < FEDERAL SPENDING. The US Government is SPENDING MORE than they are MAKING and government officials don't anticipate this spending trend to slow in 2009. So the US DEFICIT will continue to GROW.

RECAP SO FAR: As our economy deteriorates the US government will be forced to continue to stabilize the economy by rapidly expanding their borrowing rate to finance supportive spending. As the US Government increases its borrowing rate and the budget deficit grows, larger interest payments (on the debt they issue) will lead to a larger budget deficit.

How this Relates to Mortgage Industry

In the period between January 22 and January 28, the Federal Reserve completed $16.836bn in MBS transactions. $7.190bn of that $16.836bn was spent on Fannie Mae MBS. $4.705bn of that $7.19bn spent on Fannie MBS was used to specifically buy Fannie Mae 5.5s. MBS.

As a mortgage/real estate professional your first response might be..."If the Federal Reserve's goal is to support the mortgage market...Why would the Fed Buy Fannie Mae 5.5 MBS? That doesn't help lower borrowing rates!!!

You're right. Questions like this are logical given the media driven consensus perception of the Federal Reserve's role in stabilizing our economy. In order to properly understand why the Fed would choose to buy 5.5 MBS vs. 4.5 MBS one must remove their mortgage hat and put on their banking hat, but keep your mortgage hat close because you will need it.

Our Answer to your Question: To Offset an Outgoing Cash Flow with an Incoming Cash Flow!!!

Reminders:

- The US Government needs to BORROW a lot more money. Funds they will PAY interest on...

- As job losses mount the US Government is LOSING more and more INCOME.

- FEDERAL INCOME < FEDERAL SPENDING. The US DEFICIT IS GROWING...IF LEFT UNCHECKED THIS WILL NO LONGER BE OUR PROBLEM....IT WILL BE OUR CHILDREN'S CHILDREN'S PROBLEM

A government that runs a budget deficit must sell bonds to pay for their purchases not covered by taxes. That government must pay interest on those bonds. When spending/debt issuance is expected to increase the fundamental implication of this is taxes must be raised to offset the increase in interest expense from borrowing. Well raising income taxes reduces the incentive to work which lowers potential GDP...and taxes on capital income lowers the quantity of savings and investment which in turn slows the growth rate of real GDP....this doesn't appear to be the most effective strategy for avoiding a government spending induced deflationary spiral. Different strategies must be employed...an out of the box strategy that accomplishes multiple goals.

(FYI crowding out effect is still possible but not while Fed is artificially flattening the yield curve)

What if the Federal Reserve managed to offset the US Government's increasing outgoing interest expense with a stable incoming cash flow...one that exceeds the US Government's cost of borrowing. That would help slow the pace of an increasingly enlarging budget deficit right?

The Federal Reserve could achieve this by manipulating the yield curve in such a way that they created a positive carry trade for themselves.

How are they doing that? By purchasing Treasuries (bills notes bonds and TIPs), commercial paper, Agency Debt (FN and FRE bonds), MBS, and ABS. By participating in reciprocal currency arrangements, repo agreements, term credit auctions, liquidity facilities, bailouts, swaps and special drawing rights accounts...

Plain and Simple: The Fed is manipulating borrowing costs of all kinds

To break it down in clearer terms...The Fed would need to offset the interest the US Government must pay out (on the Treasury Bills, Notes, and Bonds) with income they receive from a debt security they own.

As a portfolio manager the Federal Reserve would need to search for a fixed income security that matched the timing of their cash flows (receive income in time to pay liabilities), they would also need to ensure maturity of the income stream matched maturity of their liability stream.(There are many other considerations that need to be made, however for the sake of progressing I will not go deeper into fixed income portfolio management)

So what is the average maturity of Treasury Debt?

The TBAC report indicates that the average maturity of the overall marketable debt portfolio "has already fallen from a range of 60 to 70 months which existed from the mid 1980's until 2002 to a level of 48 months more recently."

Furthermore the minutes from the meeting of the TBAC indicate that "Bills currently represent about 33 percent of outstanding marketable debt, and while demand remains robust, Treasury recognizes the need to monitor short-term issuance versus longer dated issuance. As a result, Treasury is balancing the borrowing profile to address these large financing needs (in the short to medium term) while also preserving flexibility to address cyclical or structural shifts."

Plain and Simple: The Treasury Department is trying to extend the time frame that their debt will come due. But the fact that they had to issue so many Bills (to pay for TARP and MBS purchases) they know the process will be slow.

So what debt instruments can the Federal Reserve purchase for their fixed income portfolio to offset the Treasuries debt portfolio?

From the last FOMC statement:

"The Federal Reserve continues to purchase large quantities of agency debt and mortgage-backed securities"

Plain and Simple: The duration of the agency debt (FN/FRE bonds) and mortgage backed securities that the Federal Reserve is purchasing most effectively matches the maturity of the Treasury's debt portfolio.

In the mean time the Federal Reserve is also managing to support the housing market. They are killing two birds with one stone. At the time of these purchases the Fannie Mae 5.5 MBS just happened to provide the best offsetting cash flow for the price they paid...it had the best relative value!

(I know the value of the 5.5s embedded call option is somewhat of an unknown...however as long as the Federal Reserve continues to manipulate interest rates they can control their portfolio's duration)

One may question this "positive carry" strategy citing that if the Fed keeps issuing more supply of debt, yields will continue to rise and TSY funding costs will rise. I respond with this chart of Treasury borrowing costs.

Plain and Simple: The US Government is locking in their borrowing costs at all time lows.

MBS GOING FORWARD....

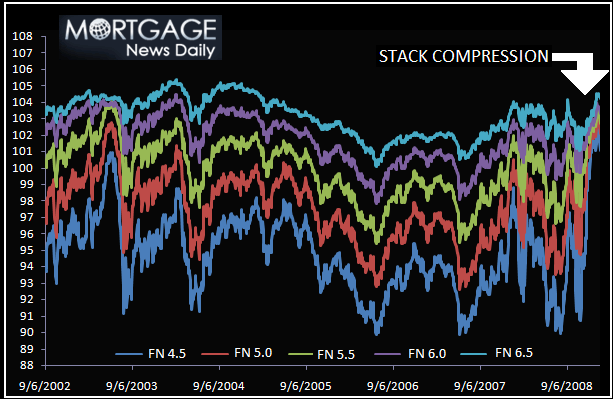

After the Fed announced its plan to support mortgage markets, the MBS current coupon (MBS trading closest to, but not above, 100-00) went "down in coupon" at a feverish pace until it settled below 4.00%. When the stack compressed (spread between prices of 4.0 MBS and 6.0 MBS tightened) in late December/early January and lenders didn't come through with their end of the deal. The entire stack was trading at a premium (over 100-00) and prepayments were not as wide spread as expected....traders were then left in quite the predicament.

Do they wait to buy more 4.0s and 4.5s? How long will they have to wait? How risky would it be to buy "up in coupon"?

The resulting trade was a little of both which pushed the stack into a stagnant state. While day traders rode the wave of Fed spending lenders desperately tried to hedge their pipelines amidst multiplying fall out. The MBS current coupon slowly started increasing from its below 4.00% levels. More recently the run up has felt increasingly cumbersome...lenders have been quick to re-price for the worse and slow to pass along gains. Which brings us to present day...

As long as the yield curve stays positively sloped the Federal Reserve will be able to continue trading with positive carry. The Federal Reserve will also maintain its mandate to support the housing market by keeping mortgage rates relatively low.

Here are your roadblocks to a REFI BOOM...

GSE Guarantee Fees: We believe the GSEs have been passing along higher guarantee fees via higher rate sheet mark ups. Plain and Simple they need money.

Originator Operational Capacity: Fall Out has increased lender hedging costs markedly. Uncertainty about pull through forced lenders to protect themselves. As lender's add operations staff this added cost will diminish. Listen out for more comfortable communications from your investors regarding turn times and the availability of 15 day locks.

Servicing Premiums: Delinquencies increase the cost of servicing a loan. These costs will be passed along to borrowers, we do not expect this additional cost to go away anytime soon.

Unfortunately, due to the previously described constraints on the fixed income market we DO NOT KNOW when "it that shall not be named" will re-ignite. We can however say that we KNOW lenders are preparing themselves for a 4.5% mortgage rate environment. We also know that the MBS market remains at the ready to buy "down in coupon". For now continue to educate your borrowers on what is going on in the mortgage market and for Pete's sake be sure to read the GUT-FLOP to protect your pipeline.

My float boat is out to sea but its sails are currently luffing in the wind....