FN 4.0: +0-02 at 100-08

FN 4.5: +0-02 at 101-23+

FN 5.0: +0-02+ at 102-09

FN 5.5: +0-00+ at 102-20+

FN 6.0: unchanged at 103-00

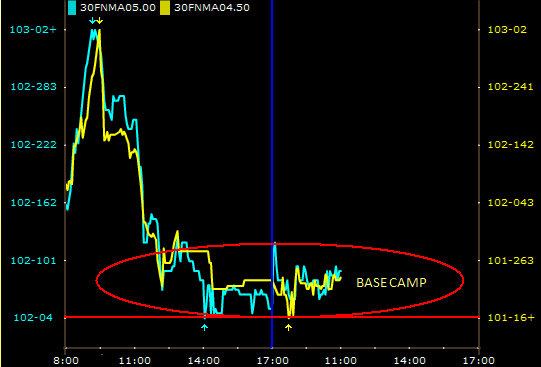

Our government funding buddy was MIA yesterday when originators dumped their supply of MBS. You guys must have locked loans at a feverish pace after the FOMC statement!!! As Matt pointed out yesterday it was almost too much of a coincidence to ignore the ceiling provided by the 2003 high. Whether or not this price level remains a strong resistance is yet to be seen but again....big coincidence. This morning the MBS stack is resting at base camp, we have reached a point where loan originations need to start reflecting THE COUPONS THE MARKET IS REQUESTING(yes I am yelling)...the lower coupons (the 4.0s and 4.5s) are trading above par, but without originator supply of 4.0-4.5 loans there is nothing to deliver on settlement date....therefore there will be less willingness to sustain a down in coupon bias (for now).

We are indeed in a bit of a "waiting period"....COME ON ALREADY LENDERS!!!! (yes definitely yelling again!!!) Last I checked the MOST aggressive lender was near 4.5 at par yesterday, rates are marginally worse and a 4.5 coupon is trading well over par!!!! Someone needs to make a move here...hint hint Ben and Hank..provide a little more confidence please??? We know that you guys were planning on forking over that $500bn late in the month at the earliest...but we're stalling out here and even beginning to see an up in coupon bias as we approach end of year.

The general outlook for our economy is FOUL....anyone know what gold backwardation is????????? We will explain later but this is a possible indicator of gold returning to its status as the world's reserve currency, basically it means stuff your mattresses with cash. Unfortunately this sentiment translates into a "protectionist" trading mentality throughout capital markets...except Treasuries...the yield curve continues to be the source of the flight to safety LIQUID trade

We will be reconsidering the risk/rewards of floating as we monitor the trading flow today...if this pessimistic waiting game continues and we believe the market will reallign is coupon stance we may start issuing lock recommendations...that is lock recommendation until year end. On January 1, 2009 we hit the reset button...old school nintendo style

Source:Nintendo