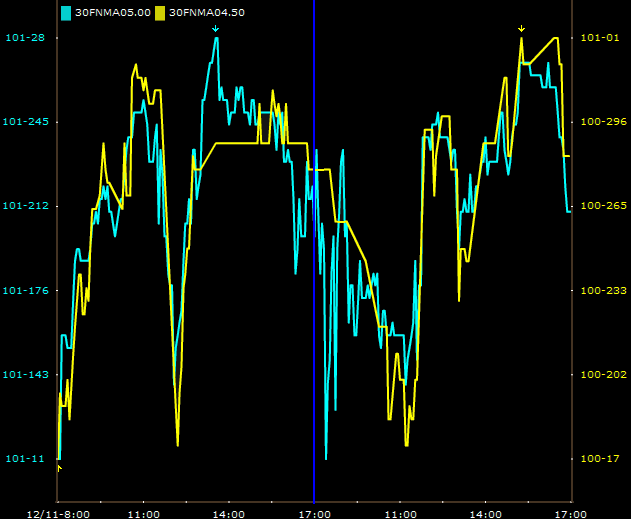

At the 3pm close Friday the FN 4.5 MBS was trading up 6/32 to 100-29 and the FN 5.0 was bid up 3/32 to 101-24...BUT in after hours trading each coupon sold off 3 ticks. So in terms of your rate sheets the 4.5 closed up 3/32 at 100-26 and the 5.0 was unchanged for the day at 101-21.

Friday was a volatile session with the anticipated originator selling providing a source of excess supply early in the morning. Fortunately real money bidders (the Treasury Department) saved the day by eating up the surplus of supply. Volume was about twice as normal for the day.The 5.0 bid swung in an 18 tick range and the 4.5 range was 19 ticks wide... the 4.5 did hit a 1 week high of 100-31 late in the afternoon.

For the week the FN 4.5 was up 50/32 and the FN 5.0 was up 40/32.

The Fed's all out quantitative easing effort has restored MBS confidence and provided a general "LONG ON MBS /DOWN IN COUPON" trading bias....meaning the recent Treasury and Fed rhetoric and corresponding "putting of the money where the mouth is" has re-established some of the trust MBSers lost following unfulfilled post-TARP promises. Remember Ben and Hank's newest plan to save the world revolves around the real estate sector....and part of the strategy is low mortgage rates. So the Feds will be monitoring interest rates to ensure tighter spreads. To put it simply the government is artificially supporting MBS and mortgage investors are responding by compressing the coupon stack and moving farther and farther down in coupon. We have our fingers crossed for NO MBS TAPE BOMBS....if all goes as planned/promised, mortgage rates will go lower and proper yield spreads will return to rate sheets.

The upcoming week's trade will be influenced by Tuesday's heavily anticipated FOMC meeting/Target Lending Rate adjustment announcement.Consensus is a 50bp cut which would lower the target overnight lending rate to 0.50%. Typically trading is more tempered in pre-FOMC meeting sessions...so we expect an aura of awaiting to loom over trade activity early in the week.

Tomorrow we get the Treasury International Capital data. This report tracks the flow of investment entering and leaving the US...we will be checking out how much China is investing in US Treasuries.

Industrial Production: Consensus is 75.7% vs. previous 76.4%

NAHB Housing Market Index: the November reading was a record low 9 vs. the previous record of 14, set one month earlier in October. Can we break the record again?

Empire State Manufacturing Index: consensus is -27.5 vs. previous month -25.4....another record low expected to be broken.

Market participants will also keep a close eye on the White House for any new proposals to provide a loan or some sort of rescue funds to the automakers.