Does everyone remember two days ago when we wrote about a bias towards short term selling and worsening rates due to expected originator hedging activites and perhaps some profit taking???

That's what happened this morning. Orginators sold and the MBS did some cliff diving. The good news is the supply appears to have been eaten up by some real money buyers....the Treasury Department!!! This gives us a warm feeling...so far the government hasnt broken their promise to try their darndest to jumpstart the housing market with lower rates. This provides confidence to market participants and creates a multiplier buying effect. The general feeling in MBS world is lower rates ahead.

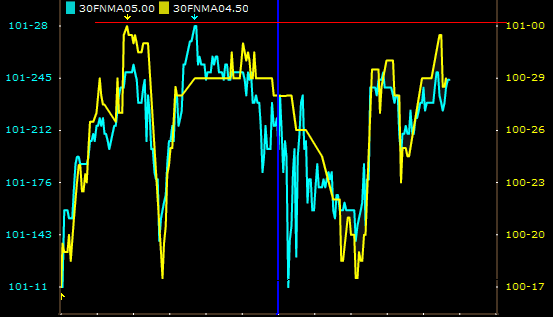

Here is a snapshot of pricing. Up in Coupon into the close....

FN 4.5: -1/32 at 100-26

FN 5.0: +1/32 at 101-24

FN 5.5: +3/32 at 102-08

FN 6.0: +2/32 at 102-22

FN 6.5: +2/32 at 103-02

Unfortunately, although the stack is off lows for the day, spreads have gapped up a bit since early afternoon. Investors will be reluctant to pass through additional gains for the day but if you havent recieved a reprice for the better since rates were published you could see a few more bps passed though, but expect any gains to nominal.

We expect markets to be traded progressively more thinly into the FOMC meeting next week....