Ok so if you didn't read yesterday's end of day post, once again please do so it will benefit you greatly.

We referred to several reasons for the massive spread tightening that has occurred post roll. That said yes we do feel like this spread tightening will continue and mortgage rates will go lower in the future. In the short term there a few factors that we feel may contribute to some sell offs though.

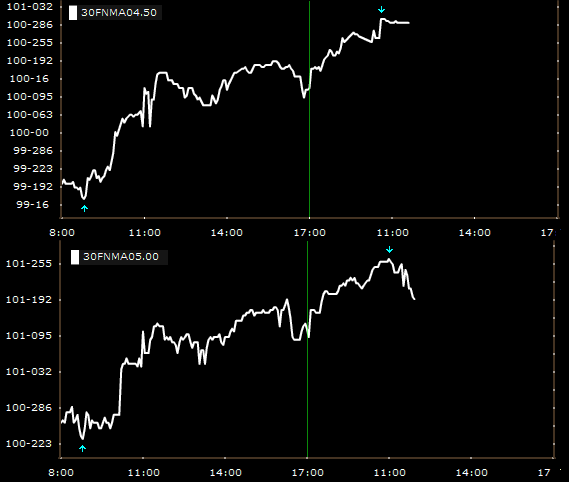

Even though we expect lower rates everyone must remember that loans are closing and deals are being done right now. This means that loan officers are locking loans and most likely doing so when the time (your wallet) feels right. Well this recent spread tightening is going to initiate an intense "locking of loans" period. When this occurs lenders must protect themselves...they will hedge their position by selling MBS...flooding the market with supply means worse rates. The big question is how much and how long any retracements and retests will last. This feeling is evident today....supply is light and market participants are short MBS markets as they await this influx of available for sale MBS....

Short termers and those of you with thin pipelines---rates are great right now. Stay glued to our recommendations. Utilize your float down options if you are able...either way keep your lock trigger finger stretched out and nimble.

Longer term rate watchers. The Fed is expected to continue to artificially tighten spreads. What we mean is any excess supply that gaps up the spread will be met with a government bid. But we dont know how quickly they will do so....

The semi-bad news: Unfortunately lenders have been a bit hesitant to pass through the recent gains to borrowers. Before the flood gates open and 4.5 rates are paying yield spread some stability needs to return to the MBS market. The Fed should provide this stability...unfortunately stability is measured over time...if the close to par coupons can stay in a semi tight range investors will be more willing to let loose the additional juice they currently have baked into their rate sheets.

Currently Bids are off the morning highs...swaps are on the rise....selling may intensify

FN 4.5: +5/32 at 100-16

FN 5.0: +5/32 at 101-16

FN 5.5: +3/32 at 102-01

FN 6.0: +2/32 at 102-18

FN 6.5: +3/32 at 102-31