Good Morning MBS World...

Before MBS trading opened for the day, the prospects for spread tightening looked bright as the intermediate to long end of the yield curve sold off overnight into the NY session. Although spreads tightened a bit it was more a function of TSY selling than MBS buying. It appears that many of you took our advice last night and locked up some loans ...originators dumped supply into MBS markets this AM, a big reason for the morning price drops. Other than that the coupon roll and the general illiquid end of year profit taking/balance sheet bolstering activities have made trade strategies more anxious than usual

Fortunately things have brightened up a bit. The entire coupon stack has gone green and the MBS is contributing to further tightening to the curve

FN 4.5: +11/32 at 100-06 GN: +10/32 at 100-23

FN 5.0: +6/32 at 101-06 GN 5.0: +8/32 at 101-22

FN 5.5: +5/32 at 101-25 GN 5.5: +6/32 at 102-08

FN 6.0: +2/32 at 102-13 GN 6.0: +4/32 at 102-26

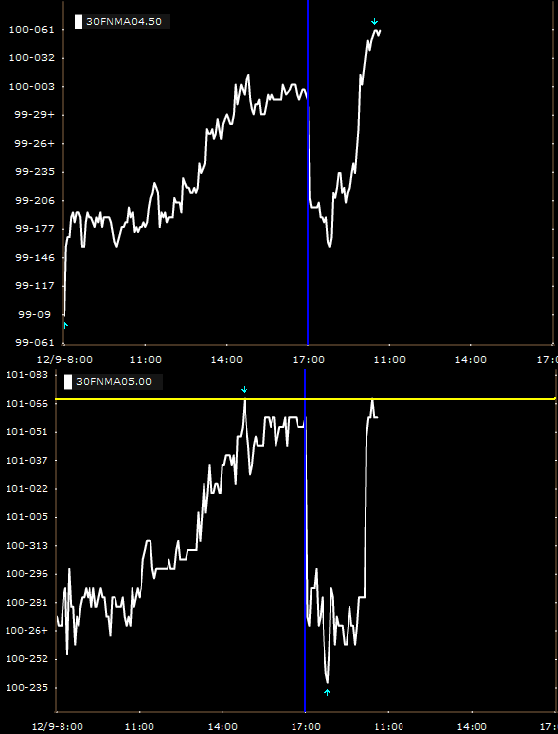

Check out the spike in the 4.5 and 5.0...

So there is a new wind is the sails of the float boat....hopefully it wasn't just a brief gust though. Investors may be slow to publish rate sheets this morning due to this volatility..lenders who priced at pre 10AM levels should reprice for the better. Will update in the event of another turn around

Data

At 7AM the MBA reported Application Activity...for the week ending December 5, 2008 the Refi index unexpectedly dropped 0.9% and the purchase index dropped 17.4%. The four week moving Market Index average is up 17.4%. The average rate for a 30 year fixed mortgage dropped to 5.45% from 5.47%.

The Refinance Share of application activity jumped up to 73.7% of total applications from 69.1% the previous week