Tic Tock Tic Tock Tic Tock Tic Tock Tic Tock.......yaaaaaaaaaaawn

It was an uneventfully weary Monday in MBS world...not really any data to digest, 48-hour Class A notification (EXPLANATION) begins tomorrow, and the stock lever just isn't wound too tight these days. Volume was below normal and markets felt quite Christmassy (end of year lack of liquidity) as we await the MBS's expected holiday dowry from jolly 'ol Ben Bernanke and Hank Paulson. We expect this quantitative easing effort to fill your stockings with 4.5% rate sheet joy, unfortunately we don't know if the sleigh is en route or still parked in the garage....all we can do is lay out our $500 billion wish list next to a plate of troubled assets and hope Ben and Hank sniff it out and come a probing!

Ok enough Holiday Analogies

As equities applauded an automaker rescue report today the yield curve sluggishly steepened and MBS tightened a bit to Treasuries. The MBS stack was marginally tighter to swaps as well, for the moment this is reason to soberly shout YAY (Eeyore voice) but no reason to break out the New Year's champagne 23 days early.

We apathetically announce positive pricing progress because MBS market participants still appear confident good times are ahead...this is visible in the stronger performance of forward rolls. Our darker side would push us to remind you that we waited for MBS money in September nto October all the way through November for a mortgage specific rescue strategy. This time is different though right? Hank and Ben are feeling the pressure of a new administration pushing for answers and searching for a scapegoat. This ploy to correct the world's problems has some merit. RIIIIGHT?!?!?!?

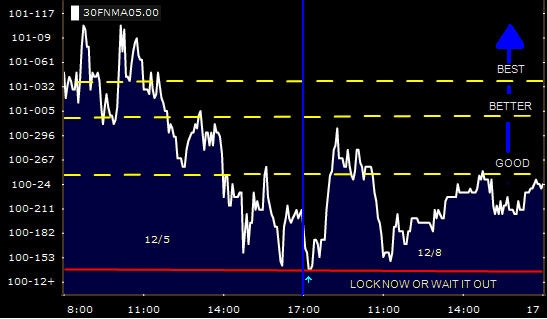

While we patiently pass the time until Ben and Hank endorse the MBS check we will continue to provide an updated range for you antsy short timers looking to "take the money and run". As Matt advised early this afternoon, the newly formed triple bottom FN 5.0 price level will serve as our most recent "lock now or join the waiting game" support level. FYI we will not panic if spreads widen up pre-Fed purchases. As for resistance here are some short term momentum forming price levels...

Pre-"MBS rescue plan 2.0" price data null and void due to the trading irregularities that have materialized after multiple Government capital market interventions. In other words, the rules keep changing in the middle of the game. So we have decided to keep our studies relatively short term until we see a new trend forming. Just remember if you have the time to wait it out, barring any unfulfilled promises, rates will be lower once the limitless Treasury credit card gets swiped for MBS purchases.

Quick Notes:

Today the Treasury announced they will auction off $28 billion in 3 year Treasury notes and $16 billion in 10 yr notes. The 3 yr note auction is $3 billion more than the previous $25 billion offering and the 10 year note auction is $4 billion smaller this go round.

The War Room famous Neel Kashkari gave a heartwarming TARP update today. To sum it up he said once confidence picks up...bank lending will pick up as well. He also reminded us that: "lending won't materialize as fast as any of us would like, but it will happen much faster as a result of having used the TARP to stabilize the system and increase capital in our banks" and also "Banks, in turn, have obligations to their communities to continue making credit available to creditworthy borrowers and to work with struggling borrowers to avoid preventable foreclosures."

His full speech is available on the Treasury website if you fancy a dry read.

Not much in the form of data tomorrow...

Pending Home Sales Index at 10AM...we expect worse than last month type numbers. Estimating near 86-87 level. In mortgages...tomorrow begins 48-hour Class A notification.

The devil on my shoulder again reminds me...

"Waiting is a trap. There will always be reasons to wait. The truth is, there are only two things in life, reasons and results, and reasons simply don't count." - Dr. Robert Anthony

I just flicked the devil off my shoulder