Late in the day the Wall Street Journal broke a story that Hank Paulson is plotting a scheme to jumpstart the continually collapsing housing market. According to unnamed sources who are "familiar with the matter" Hammering Hank is planning to artificially lower mortgage rates to the 4.5% range, the idea is to give struggling homeowners the ability to qualify for a refinance and maybe even light a fire under prospective home buyer's proverbial keester. If this doesn't work maybe the Treasury Department will arrange for a systematic torching of the excess supply of "Agrestic" style cardboard box homes.

Now that I think of it, I am not too sure we need Hank's plan....this morning the Mortgage Bankers Association reported that the $600bil Fed/Treas. mortgage plan announcement lowered rates enough to spur a week over week refi boom . The refinance index skyrocketed 203% to 3802.8. The purchase index hopped 38% to 361.1 (I feel like hop is an appropriate verb relative to the refi index's skyrocket).

On top of that the 4.5 FN MBS was trading awfully close to par at 5 pm today. If this down in coupon sentiment continues into tomorrow's session we could darn well see a 4.50% 30 year fixed rate near par on rate sheets.But allow me to pose this question to all the frustrated originators who read our commentaries...Do you think low rates will be enough to get borrowers qualified or are guidelines just too tight for this plan to be effective?

Mortgages again experienced early session selling as originators and money managers poured supply of 5.5's and 6.0's into the market. Later in the morning servicers and banks came to the rescue with a strong bid for the 4.5 coupons. The ready to be crowned benchmark FN 4.5 MBS was bid +18/32 to 99-29, the current benchmark current coupon title belt holder, the FN 5.0 ended the day +4/32 at 101-01. The 5.5 was down 3/32 to 101-17 and the 6.0 was sold off 4/32 to 102-00.

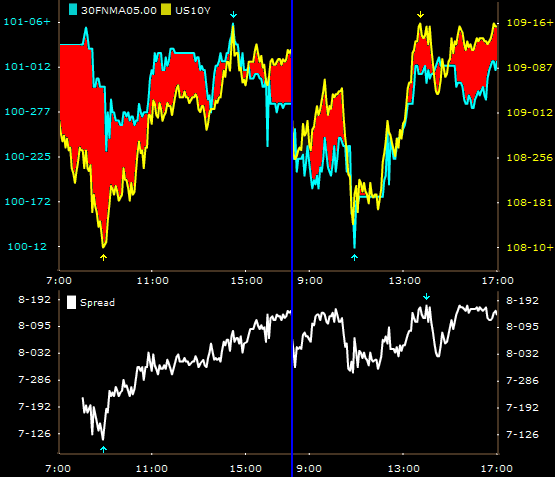

Remember that range I talked about last night...we will re-evaluate in the AM but if Paulson's plan gets formaly validated by a NAMED source who is "familiar with the matter", we might just see a tighter trading range in the current MBS coupon ....especially with the Treasury already participating in MBS purchases. Here is the two day chart with yesterday's mid term support and intraday support/resistance levels. Remember the "take the money and run level" was set at 101-16 yesterday. If we open down in coupon in the morning and the 4.5 gets officially crowned the new benchmark we will re-evaluate our technical levels. Stay tuned lock strategy may again be changing.

For the day the MBS stack marginally tightened the spread to Treasuries and Swaps, we can thank the 4.5's for the gap tightening. Stupidly low Treasury yields combined with the chatter about Paulson's plan forces us to set the float boat out for a winter sail...in lieu of the Treasury price trading range narrowing we expected to see a round of Treasury profit taking and MBS tightening in the near term.

And just for fun because I like to make sure everyone understands that the 10YR US Treasury Note should not be used as a lock/float indicator...here is the FN 5.0 MBS /10 yr Treasury spread...

Quick Economic Notes

ADP estimated that the U.S. economy lost 250,000 private-sector jobs between October and November. Due to the fact that the ADP report has underestimated job losses this year, analyst guesstimates for Friday's Non-Farm Payrolls data release will range from 300,000 and 350,000 job losses for the month of November

US productivity rose at 1.3% annual rate in 3Q '08. That's is above expectations of +1.0%. Hours worked in the 3Q dropped 3.1%... that's the fastest decline since the 1Q '02. Output fell 1.9%...that's the fastest decline since 3Q '01

The BEA estimated that Q3 GDP fell by 0.5%....down from the 0.3% that was reported in the advance report.

ISM's non-manufacturing index (NMI) fell more than seven points to 37.3 in November. Consensus was for a number close to 42. Yikes!

The Federal Reserve's release of the Beige Book didn't offer any surprises as business contacts in all twelve Federal Reserve Districts reported overall economic weakening in November....mostly due to declines in consumer spending.

Tomorrow's Calendar

ECB Rate announcement at 7:45AM

Jobless Claims at 8:30 AM

October Factory Orders at 10AM.

Fed Chairman Ben Bernanke will speak on Housing and Housing Finance at 11:15AM...WE WILL BE LISTENING TO THIS

Fed Governor Kroszner, who gets to vote at FOMC meetings, and a discussion panel will have a friendly chat on MORTGAGE BACKED SECURITIES at 4:15.