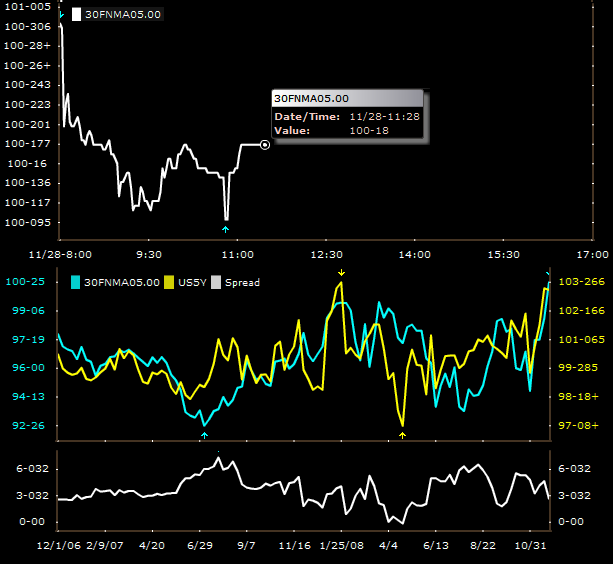

As expected, prices of the 5.0 FN MBS have been jumpy in this holiday hungover trading session.

Currently the benchmark 5.0 is bid at 100-18. 6/32 ticks above the morning post price level. Word on the street is a few investors have some aggressive rate sheets but in general pricing strategies could be described as apathetic.

Top graph is intraday 5.0. Bottom graph is FN 5.0 price vs. the 5 year US Treasury price. If you are wondering why I have posted the spread graph it is because when determining relative values of MBS it helps to compare the current coupon to the risk free security of similar maturity. In this case because the prepay speed of the current coupoin is about 6 years we compare to the UST5Y.