The current coupon we have become so accustomed to watching has been retired (for now at least). The NEW current coupon title belt has been awarded to the 5.0% FN coupon. Congrats to all....it has been a fine day in mortgage world so far.

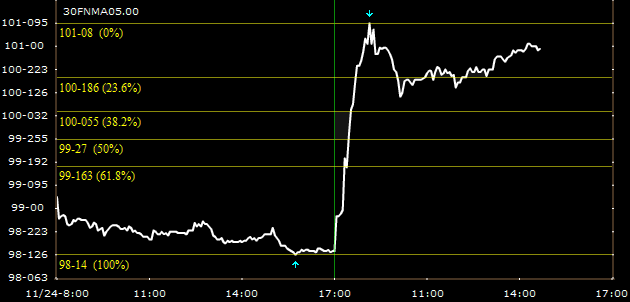

Last night the FN 5.0 traded at 98-15 into the close. At 9:08 this morning the 5.0 reached a price of 101-08....a price jump of 89/32 or 278 bps. Since that intraday high was reached, the 5.0 sold off to 100-11 and then begun a slow upward tick to the current price level of 100-30. We are now only 10/32 off the intraday high of 101-08. Here is a 5.0 intraday chart with retraces...

We have seen re-prices for the worse and more recently re-prices for the better. If the slow mid-day upward trend continues expect some lenders to give back a portion of the cushion they baked into mid morning rates. If you feel some lenders have been holding out on you these gains may be bigger than others.

We have received many inquiries as to whether or not we expect this rally to continue. Our response has been this:

If the government is serious about paying some focused attention to the root of all evil....the housing crisis....then yes we expect mortgage rates to continue to fall. Based on the verbiage used in recent speeches and the publicity/media attention surrounding this plan it appears the Fed and the Treasury are devoted to addressing home foreclosures and falling home prices. Plus....do you really think Hank will be an Indian giver AGAIN?

In terms of time frame here is the schedule given to us in the Fed press release regarding the timing of MBS purchases:

"Purchases of up to $100 billion in GSE direct obligations under the program will be conducted with the Federal Reserve's primary dealers through a series of competitive auctions and will begin next week. Purchases of up to $500 billion in MBS will be conducted by asset managers selected via a competitive process with a goal of beginning these purchases before year-end. Purchases of both direct obligations and MBS are expected to take place over several quarters. Further information regarding the operational details of this program will be provided after consultation with market participants."

FYI the 5.5 is +1-23 at 101-31. Will report back if anything changes...