Fearing systematic shocks, the US Government was again forced to hurriedly design a weekend bank rescue package. After losing almost 60% of its value last week, Citigroup needed assistance to prevent the continuance of its stock liquidation....and here comes Uncle Sam to the rescue!!! In a joint statement issued by the Treasury, the Federal Reserve, and the FDIC it was announced that Citigroup would be provided a "package of guarantees, liquidity access and capital". As part of the agreement the US government will guarantee a $306 billion loan portfolio and invest 20 billion TARP dollars in Citi. In exchange for these life preserving handouts, Citi will fork over $27 billion in preferred shares paying a rate of 8% to the Treasury Department and must comply with "enhanced executive compensation restrictions and implement the FDIC's mortgage modification program." FYI this $20 billion is on top of the $25 billion that was invested just a few weeks ago.

Equity markets reacted by carrying Friday's late session exuberance all the way to today's closing bell. Stocks haven't rallied this much in a 2 day period since 1987...back then stone wash jeans were cool and you were probably jamming out to"Livin on a Prayer". Yeah that long ago...

At Mid day, market participants paused for a moment to listen to President Elect Barack Obama unveil the major nominations of his economic team. Here's who will be helping Barack make important financial decisions...

Treasury Secretary: Tim Geithner

Director of National Economic Council: Lawrence Summers

Chair of Council of Economic Advisers: Christina Romer

Director of White House Domestic Policy Council: Melody Barnes

Obama also tiptoed around plans for another economic stimulus package. He didn't give us an exact dollar amount but urged Congress to act quickly in order to stave off further job losses. The chatter on the street is a stimulus package in the range of $700,000,000,000. I know... $700 billion looks a lot bigger when you write out all the zeros right?

The Citigroup bailout and Obama's focus on another stimulus package was a big positive for stock markets, but not for US Treasuries. The liquidation of flight to safety positions coupled with the expectations of another substantial influx of bond supply (that's how we pay for the proposed stimulus package) wreaked havoc on the Treasury market. The yield on the 2 yr note rose 8 bps, the 5 yr yield rose 18 bps, +12 bps on the 10 yr, and the long bond jumped 10bps. The spread between the 2 yr and 10 yr Treasury notes widened to 215 bps. The Treasury auctioned a record $36 billion in 2 yr notes at 1 pm, although foreign bidders demanded almost 35% of the auction, the overall demand was weak. Bid-to-cover ratio was 2.08%.

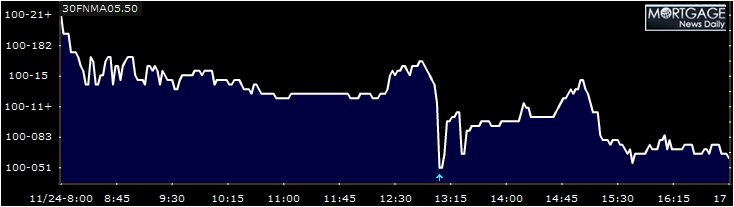

Trading activity was light in mortgages, the benchmark FN 5.5 closed down 9/32 at 100-07, however on a relative basis the 5.5 FN MBS outperformed Treasuries so you can take away some positives from today session.

(BTW I wanted to use the FN 5.5 vs. 5yr Treasury chart here but could not get into my system late night to redraw...frustrating!!! So you're stuck with this one for now)

It should be noted that the higher cost of funding combined with a holiday shortened week may weigh on trader's willingness to take on additional risk (like MBS). Earlier today we advised that taking the "not passed through" late Friday session gains was good policy as this trading environment is expected to remain illiquid (lightly traded) throughout the week. If you are a near term floater....these trading conditions tend to distort the visions we see in our crystal balls so this is one of those times when it's better to be out of the market than in...

Tomorrow:

Q3 GDP at 8:30 AM: expected to fall at 0.5% rate

Core PCE at 830AM: 2.9% is consensus

Case-Shiller at 9AM

Consumer Confidence at 10AM: expected in the area of 37.5 after a reading of 38 in October

The FHFA publishes is house price index at 10AM, the Treasury auctions $26 billion in 5 year notes at 1PM, and at 2PM the Fed will release the minutes from its recent discount rate meetings.