Last week had no shortage of headline news. Paulson, Bernanke, and Bair were again sitting before lawmakers on Capitol Hill to explain past decisions and discuss future plans to expedite the restoration of American capitalism. Fears of a deflation induced depression filtered their way through the financial system after headline Consumer Price Inflation fell 1.00% in October due to record declines in energy prices. The fate of the American automakers and consequentially the US job market is now up in the air as Ford, GM, and Chrysler are patiently awaiting government funds to protect them from bankruptcy. Housing Starts and Building permits fell to record lows. Anxieties regarding commercial mortgage loan defaults added fuel to the pessimism party. And after announcing 52,000 more job cuts, Citigroup, once the world's largest bank, closed this week at a price of $3.77.

Not all the news was bad though.

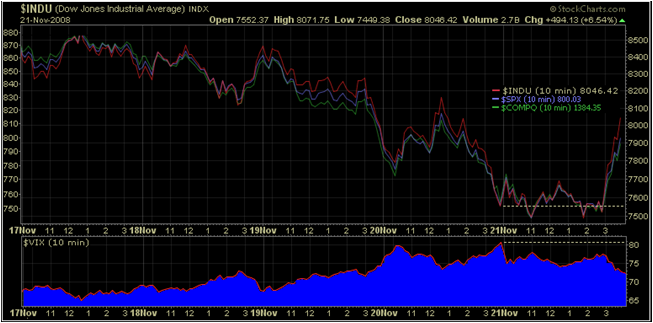

On Friday, a report surfaced that President Elect Barack Obama will choose Tim Geithner, the current President of the NY Fed, to succeed Hank Paulson as the Secretary of the Treasury Department. Tim Geithner has been intricately involved in the financial management of this ongoing crisis and is generally viewed by the Street as being a levelheaded pragmatic leader. After 5 years at the NY Fed, 2 years at the IMF, and 13 years working under financial leaders at the US Treasury Department....Geithner is adequately prepared to step into Hank Paulson's shoes. I for one am happy about this nomination and stock market investors must be too. After major equity indexes reached levels not seen since early this decade, averages quickly turned optimistic when the reported Geithner nomination hit news wires. Check out the action this week.

chart courtesy of StockCharts.com

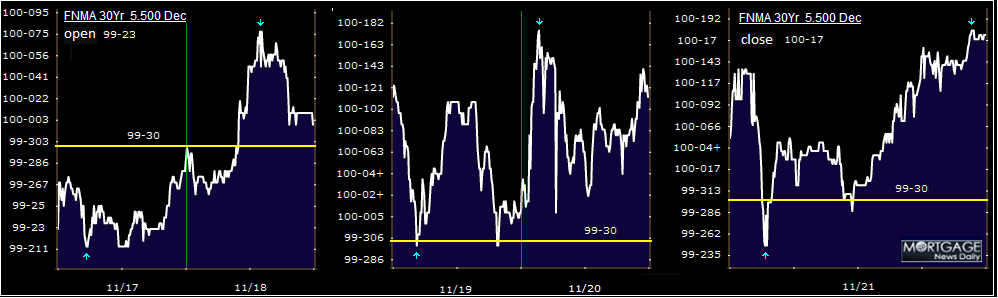

In Mortgage land...Fannie and Freddie announced they would suspend foreclosure sales and evictions from November 26 to January 9 to allow some time for new loan modification programs to take effect. The Mortgage Bankers Association reported that the refinance index rose 2.6% in the week before last, the purchase index fell by 12.6%.The benchmark 5.5 FN MBS closed up 26/32 for the week ending November 21, 2008.

Early in the week mortgage trading volume was light as market participants listened for housing market specific forward looking comments made by politicians and financial leaders at congressional hearings. Mid-week, trading volume increased after two key inflation reports showed intense reductions in domestic price levels. This month over month decline put the fear of deflation into markets. Fixed income traders reacted by quickly erasing a portion of the inflation premium that had been previously tied to the valuation of all types of bonds. Unfortunately the US Treasury market benefited from this bid much more than mortgages due to a general MBS pessimism. This negativity stemmed from worries in the commercial mortgage backed securities market and a strong flight to safety into shorter maturity, more risk averse Treasury bills. The MBS market will continue to be a day trading/profit taking environment as we approach the end of the fiscal year and banks look to bolster balance sheets.

Check back in the AM for a feeling of market sentiment going into this holiday shortened trading week.