A general feeling of insecurity has settled over the broad financial system as traders of all types prepare for the worst....the possible bankruptcy of a major automaker and the subsequent ripple that would be sent through the economy in the form of job losses and perhaps deflation. Yes I said deflation... it wasn't long ago that we were agonizing over burning inflation rates. Remember July?

The wave of unknown consequential economic events that-may or may not- flow through our financial system is clouding analyst's abilities to place an accurate present value on a prospective company's future revenues...stock valuation has become a guessing game. As a result of this lack of transparency, equity markets sold off in grand fashion today. The Dow Jones closed below 8,000 for the first time since 2003. The S&P 500-stock index was 6.1 percent lower, and the NASDAQ composite index was down 6.5 percent.

Chart courtesy of StockCharts.com

This effect has not only affected stock markets, it has created a day trading environment in fixed income markets. Panicked investors flee to more risk averse assets in the short end of the yield curve when the financial road ahead looks bumpy. Headline CPI fell 1.0% between September and October which provided a nice duration bid to intermediate maturity notes...the yield on the 10-year US Treasury fell 14.4bps to 3.391% (which is now overbought) . To put that in perspective, the headline number has NEVER fallen that much in the 51 years that the BLS has kept records. Bets for lower interest rates in general were made after market participants perceived the FOMC minutes as dovish. The minutes indicated that the FOMC was prepared to take "whatever steps were needed for economy" and some FOMC members even "saw a risk that over time inflation could fall below levels consistent with the Federal Reserve's dual objectives of price stability and maximum employment". Fears of deflation and the media's focus on the economic atrocities that might occur in the event of a major automaker's failure will create a steady flight to safety bid until anxiety abates...could we see a decabox on CNBC?

In other data releases....housing starts and building permits dropped to record lows in October indicating that the housing market has yet to bottom out. That is probably of no surprise to many mortgage bankers and brokers who are becoming more and more discouraged by continually tightening underwriting guidelines and a two-faced TARP plan.

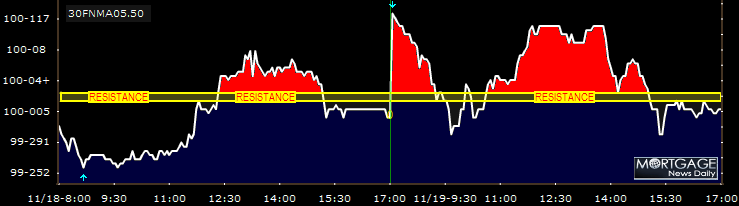

Speaking of Mortgages....the reason you come to this site.....Mortgage Backed Securities joined in the jumpy spirit and traded in a wide range today.Here is a 2 day chart.

The 5.5 FN MBS briefly traded over our continually re-tested 100-02 firm resistance level. Positive re-prices were given early in the session, only to be taken away closer to going out levels. Even though the 10-year Treasury note gained over a point, the benchmark 5.5 FN coupon was unchanged at 100-01 as originator selling and investor profit taking outweighed reported hedge fund buying. Volume was about 90% of the norm.

Going into the end of the fiscal year, the current day trading environment makes it impossible to buy MBS with any conviction.The Option Adjusted Spread on the current coupon widened to 144.77 today, indicating quantitative models are not as precise as portfolio managers would prefer when making longer term investment decisions. Although a short term breakout to the upside is possible...we are sticking to the current downward trend until we see proof of a reversal. If you have been consistently reading our updates this strategy should have been very profitable if you locked on our "top of the trend channel" lock/float advisories. One trend is expected to remain present in the MBS market though...volatility. Whether or not this sentiment continues into Q1 '09 will depend on headline news and the prospects of real money actively re-entering the marketplace.

Tomorrow's economic releases:

Jobless Claims at 830AM

Leading Indicators (Oct) at 10AM

Philly Fed (Nov) at 10AM

Treasury Secretary Paulson will speak on the Economy at 1:00 at the Annual Reagan Lecture at the Ronald Reagan Presidential Library.

Non-voting St. Louis Fed president Bullard will offer his "Personal Views on the Current Economic Environment" tomorrow night