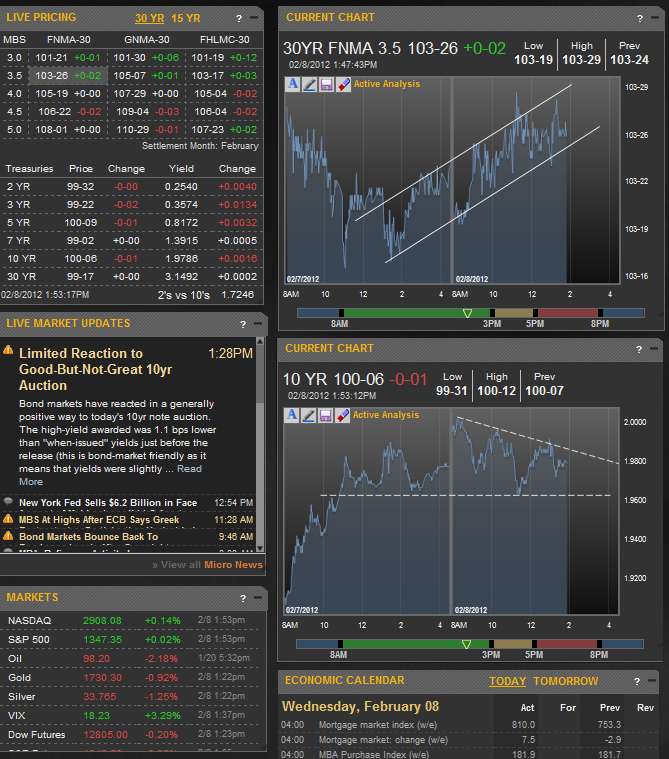

After the 10yr auction, production MBS and the long end of the yield curve didn't move much at first. But it now seems that some additional bid for the 10yr was on hold until after the Fed's Scheduled selling that ended at 2pm. As that was wrapping up, 10's made another move lower in yield to test the the pivot point just over 1.96% that can be seen in the chart below. First, here's the full text of the MBS Live alert that went out after the auction:

Limited Reaction to Good-But-Not-Great 10yr Auction (1:28PM)

Bond markets have reacted in a generally positive way to today's 10yr note auction. The high-yield awarded was 1.1 bps lower than "when-issued" yields just before the release (this is bond-market friendly as it means that yields were slightly lower than the street was expecting) and the bid-to-cover of 3.05 was very close to its historical average of 3.02.

This is good to see considering the headwinds facing bond markets today, including the seemingly endless uncertainty as to the eventual outcome of Greece's bailout negotiations. Earlier today, markets began pricing in news that the ECB would conspire with the EFSF to effectively reduce Greece's debt load without the ECB technically being the one to pull the trigger. 10yr yields rose above 1.99% several times after that news initially hit, but pulled back later in the morning after the ECB said it was as yet, undecided on its participation in the Greek bailout.

Following the auction, 10yr yields moved down from 1.99 to 1.975m and MBS held onto a supportive trend of higher low's from yesterday afternoon to move from 103-24 before the auction to 103-26 currently.

All told, these moves are fairly limited in magnitude, but we wouldn't expect traders to want to overcommit in either direction at the moment considering the multiple possible outcomes of the Greece situation, not to mention one more significant auction to go (tomorrow's 30yr bond). In fact, given those headwinds, we're pleased that things have held up as well. The current positivity may not be enough for additional likelihood of positive reprices, but it remains a possibility for some.

In the bigger picture, hitting resistance in the 1.96's is a bit troublesome for 10yr yields considering this was a recently broken on the latest round of optimism over Greece's bailout negotiations. It's not the be all, end all technical level, but as long as yields continue to hold above it, a sideways trend is reinforced, as opposed to the bullish (descending yield) trend that was just broken. "Sideways around 2%?" That sounds fine to us, but the risk is that confirming this sideways trend could be the first step in a shift to an uptrend. But for now, that discussion is premature. We'd need to see higher pivots (2.04 and 2.09) broken before considering a broader shift, and like many market participants, would greatly appreciate the opportunity to hear just what the heck the real outcome will be for the Greece negotiations as well as tomorrow's 30yr bond auction. At least in the case of the latter, we know that it will happen tomorrow, whereas a more significant resolution for Greece is anyone's guess.