The main topic of discussion over the last few days has been the upcoming refinements to the HARP program. As detailed Monday morning by the FHFA, the changes are designed to allow more borrowers with negative equity in their homes to refinance into lower-rate loans. As with many recent programs, the ultimate success of the program will depend on details which will be announced by November 15th.

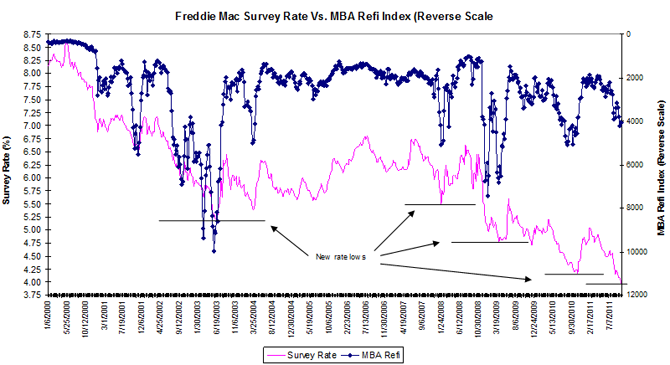

Aside from the continued torpor of the real estate markets, the revised program was broadly intended to widen the number of homeowners that can take advantage of the current low levels of consumer mortgage rates. Using the MBA’s refi index as a proxy, the chart below indicates that refinancing activity has become unresponsive to the recent declines in rates. The people able to refinance appear to be the same borrowers that took advantage of earlier declines in rates; broad swaths of the population are unable to take advantage of the declines in rates, most likely for equity-related reasons.

Looking at the FHFA’s announcement, the most interesting aspect of the proposal was to eliminate “certain risk-based fees for borrowers who refinance into shorter-term mortgages and lowering fees for other borrowers…” For one thing, the Administration is clearly trying to encourage borrowers to refinance into shorter-term mortgages. The initial paragraphs state that “(A)n important element of these changes is the encouragement…for borrowers to utilize HARP to refinance into shorter-term mortgages.” They clearly view this as a way for borrowers to build equity in their homes in an environment of stagnant home prices. Encouraging refinancing into shorter-term products is also a way for the FHFA to reduce its credit exposure over time.

Aside from a general statement that “certain risk-based fees” will be lowered, the FHFA gives no guidance on how much the fees for refinancing into new 30-year loans will be reduced. In my mind, the overall effectiveness of the program will depend strongly on how much LLPAs for underwater borrowers will be reduced, particularly for borrowers that have accompanying credit-related problems.

The announcement triggered the expected down-in-coupon trade. Fannie 4.5s and 5s lagged the 5-year Treasury by 1 and 3 ticks, respectively; Fannie 5.5s underperformed 5s by more than 3/8 of a point, and 6s lagged by about 5/8 of a point. (These results are calculated on a duration-neutral basis; this means that their prices increased less, or declined more, than what would be expected given their duration.) Given the stratospheric dollar prices at which these coupons are trading, however, a tweaking of coupon swap levels for big premiums was probably overdue.

Current coupons widened on the initial announcement, but as a testament to how aggressively markets had been pricing-in HARP 2.0's effects or perhaps as a testament to the increasingly lackluster response to what at first seemed to be a robust package, spreads recovered as early as Monday afternoon.