Equity futures are marginally weaker and interest rates are smidge lower this morning ahead of key data on inflation, weekly jobless claims, foreign appetite for U.S. securities, and regional manufacturing data.

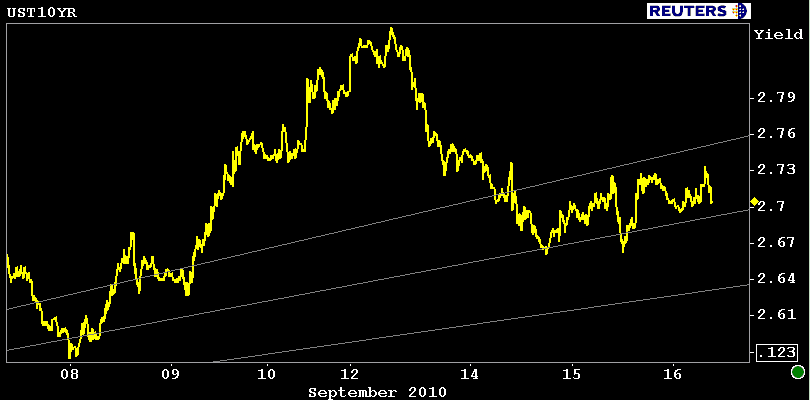

Ninety minutes before the opening bell, S&P 500 futures are down 3.50 points to 1,117.25 and the benchmark 10 year Treasury note is +0-04 at 99-09 yielding 2.71% (-1.3bps). The November delivery FNCL 4.0 is +0-02 at 102-08 and the October coupon is +0-02 at 102-17.

In addition to new economic data this morning, Treasury Secretary Tim Geithner will testify at 10:00 to the Senate Banking Committee on the Treasury’s foreign exchange report. At 2:00 he will then address the House on China’s exchange rate policy.

“It’s already been reported that he’ll have a stronger tone on the Chinese yuan, saying that ‘the pace of appreciation has been too slow and the extent of appreciation too limited,’ ” said economists at BMO.

Also, Fed Governor Elizabeth Duke will be speaking in Chicago at a public hearing on potential revisions to the Home Mortgage Disclosure Act, which according to Reuters “requires mortgage lenders to provide detailed information about their mortgage lending activity to federal agencies and the public.”

Key Events Today:

8:30 ― The Producer Price Index should continue to give the green light for the Federal Reserve to continue its accommodative monetary policy. Headlines prices are anticipated to rise 0.3% in August after a 0.2% gain in July and a 0.5% decline in June. Core prices, which exclude energy and food costs, are anticipated to inch up 0.1% in the month after gains of 0.3% and 0.1% in July and June, respectively.

Economists at IHS Global Insight expect headline prices to jump 1% because of a surge in energy prices.

“Gasoline prices will lead the way higher, because they rose in early August instead of declining as seasonally normal,” they wrote. “But that price surge has since been reversed. Core producer prices are expected to climb by a token 0.2%, but do not be surprised by any sharp movements in motor vehicle prices, as August through October are often volatile because of the model-year changeover.”

8:30 ― Initial Jobless Claims averaged 487k per week in August, way up from 459k in July. But last week new claims fell beyond expectations from 478k to 451k, a level that’s arguably consistent with labor growth in the economy, if sustained. The consensus looks for 460k claims in the week ending Sept. 11.

Economists at Nomura said last week’s decline suggests the rise in previous weeks was “likely temporary.” They said, however, that last week’s data may have been distorted, so they predict a bounce-back to 460-470k this week.

9:00 ― The Treasury International Capital (or TIC Flows) report has been displaying strength recently as a global flight to quality has boosted demand for safe haven assets. Economists at Nomura suggest a limited issuance of private-sector assets will drive foreign investors towards the supply of Treasuries and US agency debt.

10:00 ― Like its counterpart in New York, the Philadelphia Fed Index is expected to produce meagre growth in September. Unlike the New York index, however, any amount of growth in Philly will be an improvement after the index posted a -7.7 score in August. Economists look for a +3.8 level in September.

“After a sharp decline in the previous month, we look for an improvement to 4.0,” said economists at Nomura. “The negative reading of -7.7 in August seemed too low relative to the current economic condition, although we believe that the growth pace in the manufacturing sector in the region was slowing. Therefore, some payback of the decline is likely in September.”

ISSUANCE

- 11:00 Treasury announces 3- and 6-month and 52-week bills

- Asciano Fin Ltd, $750m 2-part 250m 5s, 500m 10s [guidance T+170-180(5s);+190-200(10s)]; JPM/MS/RBS

- Blackstone, $400m 10.5-year [guidance T+325]; BAML/JPM/MS

- Suzano, benchmark 10-year [guidance 6.25%]; Bradesco/Itau/JPM

- CBA, potential benchmark deal; JPM

OTHER EVENTS

- 10:15 Fed Treasury coupon purchase (03/15/2012 - 02/28/2013)