Lenders hooked it up today.

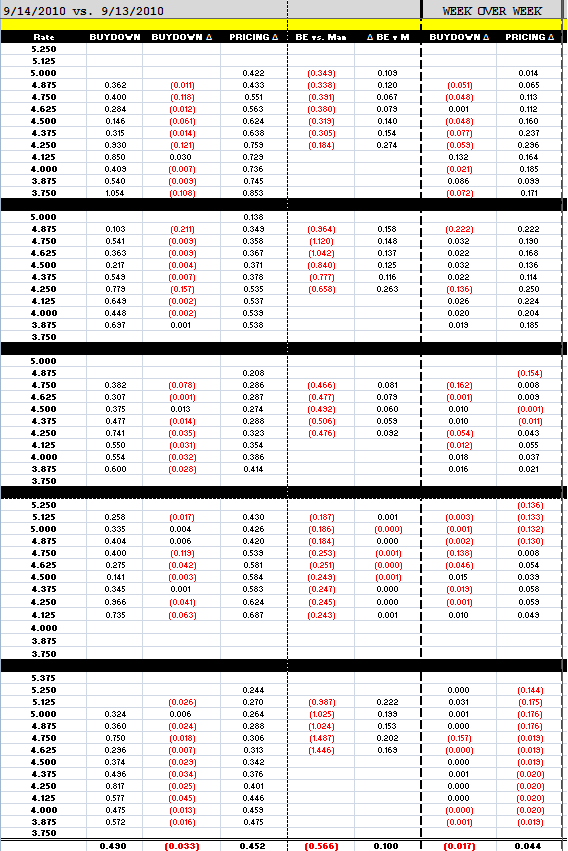

Short termers and day to day floaters should be foaming at the mouth after seeing how much loan pricing has improved this week. 45.2bps vs. yesterday morning!

I think we can safely say there was some extra margin baked into rate sheets on Friday. Blame it on the roll....

The November FNCL 4.0 went out +11/32 at 102-18. FNCL 30s are running up against price resistance at a high traffic inflection point, see chart below. I had the "current coupon" (my version is really the production coupon) marked at 3.665% when I shut down last night. As of 5pm today, I show it 4bps lower at 3.625%. MBS were outperformed on a nominal basis. From a flows perspective, the street says profit taking sent spreads wider in the afternoon hours. So we're in N'sync today (Vic's favorite band)

Trading volume in production MBS coupons was low overall with less than $1.5bn offered by originators (who paired off on Friday?).

Lots of random rumors were floating around the bond market today. One little tidbit was that the Fed was going to announce new plans that would expand their quantitative easing efforts a little deeper into the debt market. Rates are already stupid low, yet people are still saving instead of investing. I guess the Fed needs to reiterate their desire to force consumption via low rates?

Either way, rumor or not, the bond market seems to believe it needs to buy longer duration assets in the long end of the yield curve. There is little evidence to substantiate the news. Don't blame it on Barclays Index adjustments either, real money accounts have been behind the bid since 2.85% on Sunday night. Perhaps we are too quick to forget how slow our economic recovery will be?

The 2.625% coupon bearing 10 year TSY note rallied 19/32 to a price of 99-17. Yields fell 6.7bps to 2.679%. Check out how well our Fibonacci Fan predicted the consolidation. 10s bounced perfectly off of 2.661%. With trading volumes relatively low and rumors running around the market (presumably the remaining TSY longs grinding an ax), there is high potential for chopatility. Quadruple witching is this Friday.

At this point we are seeking to discover a new range or move back into the old one. Either way the market needs to define its parameters. Clearly 10s at 2.40% is worthy of the "way overbought" status, if you don't agree, just look back at how aggressively the market rejected 2.40%, then never tested it again. This implies we should be expecting to settle between 2.50% and 2.75% in 10s. From that perspective, we have some room to improve further, data permitting. But at some point I would expect a retest of higher yields to ensure the recent move lower is acceptable.

I know lock desks are patiently watching for prices to top again so they can sell forward their pipelines at the perceived price highs. The next time they offer supply to the street, in size, I think you should lock up a few more deals along with them.

4.25% seems like a firm floor for now....