Equity futures are soaring and interest rates are inching higher this morning as investors react to fairly light regulations instituted by the Basel Committee.

Equity markets ‘round the globe are up more than 1%. These broad gains add to the 4.2% climb in the S&P 500 seen over the past two weeks, which economists at BMO Capital Markets note is the biggest jump since June.

“Global banking regulators on Sunday agreed on new capital rules that are somewhat less demanding than feared,” said economists at BMO. “The key change is to increase the common equity requirement to 7% of risk-weighted assets from the current 2%. . . As well, banks will have up to eight years to comply with the new capital requirements, a little longer than expected.”

The Basel III plans are to be ratified by the G20 this November in South Korea.

One hour before the opening bell, S&P 500 futures are up 9.00 points to 1,118.75 and Dow futures are trading 78 points higher to 10,537. The 10 year Treasury note is -0-05 at 98-12 yielding 2.814% (1.8bps) and the October delivery FNCL 4.0 is +0-01 at 102-03.

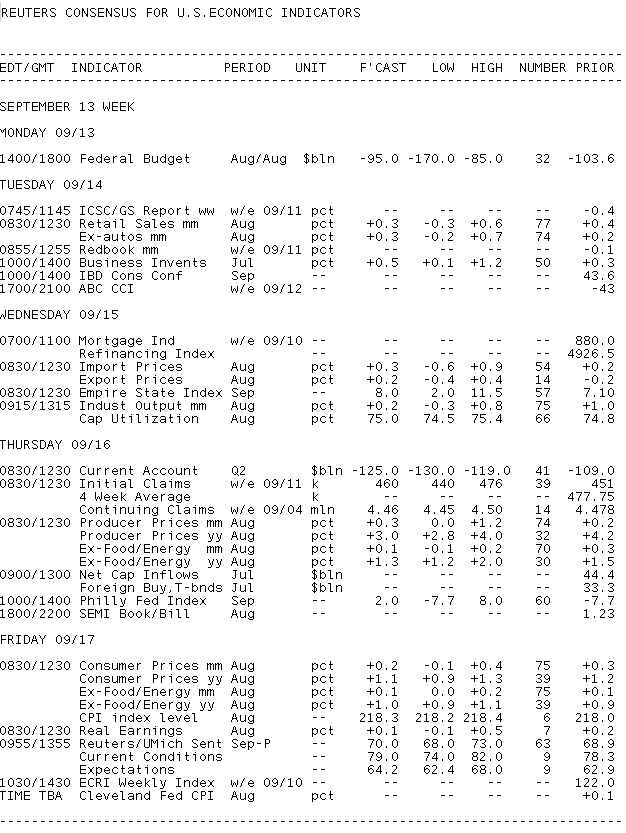

The week ahead is pretty busy as far as new data goes. Retail sales, industrial production, and inflation data will be highlights.

“If this week’s economic releases support a weaker than expected economic recovery along with a decrease in price indices, the market would become more worried about the sustainability of the recovery and intensify discussions on double-dip recession and deflation,” said economists at BBVA.

Key Events This Week:

Monday:

2:00 ― The Treasury’s Budget Statement for August is expected to be in deficit of $95 billion, according to economists polled by Reuters. The gap compares with an average August deficit of nearly $90 billion for the past five years, including a $104 billion deficit in August 2009.

“Receipts rose slightly from 2009, helped by the growing economy as well as larger remittances from the Federal Reserve (due to its substantial asset portfolio),” said economists at Nomura. “We estimate that outlays grew modestly, but not enough to offset the sizable gains in revenues.”

Treasury Auctions:

- 11:30 ― 3-Month Bills

- 11:30 ― 6-Month Bills

Tuesday:

8:30 ― Retail Sales, the key economic index this week, is expected to increase 0.3% in August. The anticipated rise, which follows a 0.4% gain in July and a 0.3% decline in June, is due to broad-based spending, as indicated by the +0.4% prediction for sales excluding autos. Also, consumer confidence increased in August.

“The GAFO (general merchandise, apparel and accessories, furniture and other sales) sales category is the main driver behind the projected August gains,” said forecasters at IHS Global Insight. “In addition, sales at gasoline stations will be pushed up by higher seasonally-adjusted gasoline prices.”

Economists at Deutsche Bank point out that the household savings rate is currently at 5.9%, up from 0.8% in mid-2005, indicating consumers have some ability to consume.

10:00 ― Business Inventories are expected to advance 0.6% in July following climbs of 0.3% and 0.2% in June and May. The consecutive advances could mean businesses are building inventories in anticipation of demand. Economists at Nomura say their prediction for a 0.5% increase is based on the already-reported 1% gain in manufacturing inventories.

Treasury Auctions:

- 11:30 ―4-Week Bills

Wednesday:

7:00 ― MBA Mortgage Applications decreased 1.5% in the week ending Sept. 3, but the decline was driven by fewer refinancings; purchases actually rose.

“Mortgage purchase applications picked up slightly last week, but remain well-below levels seen in the spring,” noted economists at Nomura. “The stabilization suggests that the post-tax credit but in sales is probably over, but that sales are likely to remain low for the time being.”

8:30 ― The Empire State Manufacturing Survey, the first regional index to be released each month, is expected to slow down in August from 7.1 to 5.0, according to economists polled by Reuters. The index has been quickly heading toward zero for the last several months ― in April, the index peaked at +32. New orders, a key component in the index which best projects future headlines, declined to a contracting score last month. Production weakened too.

9:15 ― Industrial Production, another key index this week, is expected to inch up 0.2% in August following a much larger 1% gain in July. Production has generally been rising since June 2009 but recent indexes from the around the country have been soft. The ISM manufacturing index suggests estimates might be a bit low, however; it

climbed to 56.3 in August, indicating fairly robust growth (anything above 50 indicates growth.)

Economists at IHS Global Insight said industrial production should be weak following July’s spike in motor vehicle production. “Utility output is likely to decline also, from an unusually high level, but ex-autos manufacturing should continue to advance,” they wrote.

Thursday:

8:30 ― The Producer Price Index should continue to give the green light for the Federal Reserve to continue its accommodative monetary policy. Headlines prices are anticipated to rise 0.3% in August after a 0.2% gain in July and a 0.5% decline in June. Core prices, which exclude energy and food costs, are anticipated to inch up 0.1% in the month after gains of 0.3% and 0.1% in July and June, respectively.

Economists at IHS Global Insight expect headline prices to jump 1% because of a surge in energy prices.

“Gasoline prices will lead the way higher, because they rose in early August instead of declining as seasonally normal,” they wrote. “But that price surge has since been reversed. Core producer prices are expected to climb by a token 0.2%, but do not be surprised by any sharp movements in motor vehicle prices, as August through October are often volatile because of the model-year changeover.”

8:30 ― Initial Jobless Claims averaged 487k per week in August, way up from 459k in July. But last week new claims fell beyond expectations from 478k to 451k, a level that’s arguably consistent with labor growth in the economy, if sustained. The consensus looks for 455k claims in the week ending Sept. 11.

Economists at Nomura said last week’s decline suggests the rise in previous weeks was “likely temporary.” They said, however, that last week’s data may have been distorted, so they predict a bounce-back to 460-470k this week.

9:00 ― The Treasury International Capital (or TIC Flows) report has been displaying strength recently as a global flight to quality has boosted demand for safe haven assets. Economists at Nomura suggest a limited issuance of private-sector assets will drive foreign investors towards the supply of Treasuries and US agency debt.

10:00 ― Like its counterpart in New York, the Philadelphia Fed Index is expected to produce meagre growth in September. Unlike the New York index, however, any amount of growth in Philly will be an improvement after the index posted a -7.7 score in August. Economists look for a +3.8 level in September.

“After a sharp decline in the previous month, we look for an improvement to 4.0,” said economists at Nomura. “The negative reading of -7.7 in August seemed too low relative to the current economic condition, although we believe that the growth pace in the manufacturing sector in the region was slowing. Therefore, some payback of the decline is likely in September.”

Friday:

Quadruple Witching Day! When stock index options and futures, stock options and futures expire all together, causing higher volatility than normal expiration days.

8:30 ― The Consumer Price Index is expected to rise 0.3% for the second straight month in August, while core prices are set to tick up once again by 0.1%. Markets have been watching consumer prices more closely recently because of an increased risk of deflation, according to economists at BBVA.

“We expect both core and headline inflation would continue to increase moderately in August,” BBVA analysts said. “The minutes combined with Bernanke’s recent speeches in August imply that the Fed will remain in its wait-and-see mode in the near term before shifting its policy orientation and stands ready to act aggressively if conditions warrant. Therefore, we expect both inflation rates to remain stable and positive but low in the near term.”

10:00 ― Economists believe Consumer Sentiment will rise moderately to 70.0 in September from 68.9 a month before. Such a gain wouldn’t add much insight to economic growth, but a surprise in either direction could.

Economists at Nomura noted that sentiment is historically low and will likely be held back from “a tepid recovery in the labor market and the volatile stock market.”

Analysts at IHS Global Insight, however, believe the recent stabilization in the stock market should cement a slight improvement.

“The plunge in sentiment in July was followed by a modest bounce in August, and we expect the consumer psyche to show another slight improvement this month.”