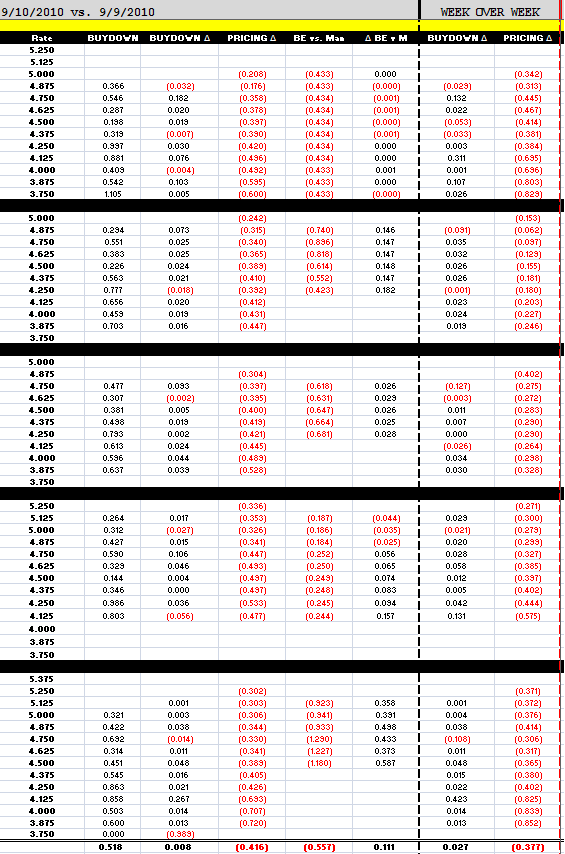

Pricing got whacked today! Rebate is 41.6bps worse in the last 48 hours. Week over week isn't any better. Reductions are robust across the coupon stack. Note rates below 4.25%, those used to fill 3.50 MBS coupon buckets, are the biggest losers. 4.25% is still on the board, but it'll cost almost 50bps more at closing. Check out how expensive the buydown is from 4.375 to 4.25%.

4.125% is out there as some desks are still looking to fill 3.50 buckets, but those offers are not widespread as 3.5s are no longer liquid. This is not pretty, even for a Friday....

Mortgages had a terrible week in general. Prepayment speeds were faster than forecast, especially in recent vintage production coupons, which sent investors running to shorten the duration of their portfolio. Falling price levels also pushed lock desks to sell forward a larger chunk of their pipeline (loan supply) to account for an expected increase in pull-through (more coverage/hedges). These two events did not bode well for MBS valuations.

The good news is the knife isn't falling anymore, at least not right now.

The October FNCL 4.0 has found some support at the low side of the recent range. I heard the price leader gave back 0.125 on this modest bounce. Considering how poor pricing is today, I wouldn't be surprised to see a few more desks try and lure in a few locks with a reprice for the better.

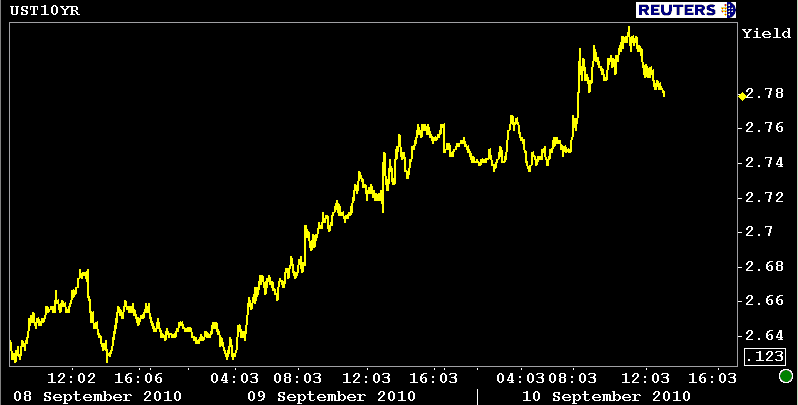

10s stopped out in the low 2.80s before turning back toward the high 2.70s. Real money accounts were buying overnight but fast money short sellers were quick to reiterate their desire to see yields go higher. The 10yr note is -0-08 at 98-20 yielding 2.786% (+2.7bps)

Not much going on out there today. It's hard to make much of this price action with so many folks M.I.A and robots (black boxes/models) at the helm. That applies to the entire week actually. Volume was low, flows were thin, and prices seemed to travel as far as stop losses would let them. Without any follow through to what we witnesses yesterday (a very poor long bond auction), I am not ready to sound the alarm bells on an all out rate lock alert just yet. READ THIS POST IF YOU HAVEN'T ALREADY