Recap of Yesterday

Lost rate sheet rebate was restored yesterday as the bond market benefited from a reversal of demand for risky assets (stocks sold) and an onslaught of swapable corporate debt supply. Loan pricing was aggressive out the gate so not all lenders repriced for the better, but several of the mid-majors did recall and re-issue. While rebate did improve, less than $1.5 billion in new loan supply was offered by originators in the TBA market with the majority of hedges seen in 4.0 30-year paper, indicating the refi market has slowed since last week (or secondary is over hedged).

The benchmark 10-year Treasury note went out +1-00 (32/32) at a price of 100-08 yielding 2.598% (-11.5bps) and the October FNCL 4.0 ended the session +0-17 at 102-31 yielding 3.566%. Swap spreads tightened vs. the curve thanks to a flood of swapable corporate debt issuance/rate locking (+$15bn). More debt supply is on the block today so I will be keeping an eye of swap rates and spreads.

The August prepayment report was released in after hours trading yesterday. As MND expected, prepay speeds on recent vintage MBS coupons increased significantly as borrowers who refinanced in the last 20 months (homeowners who actually qualify) re-refinanced to take advantage of new record low mortgage rates. READ MORE

Overnight Events

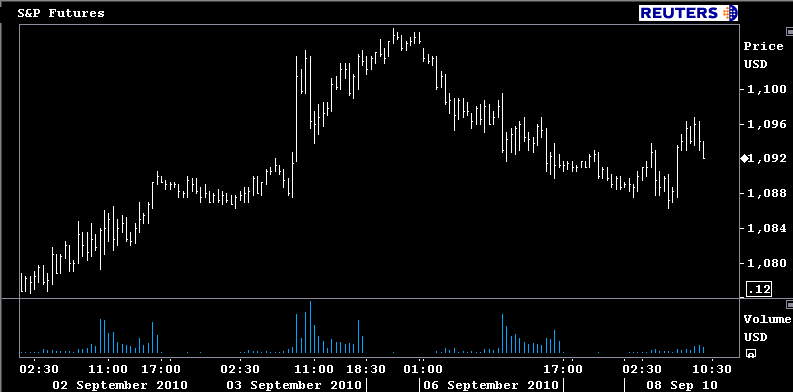

Asian stocks followed the lead of U.S. markets and traded lower in the overnight session but European equities are faring better with the major indices up 0.25 to 0.60%. Minor gains point toward day trading tactics and profiteering strategies as opposed to a fundamental shift in perspective (e.g. the market forgetting about sovereign debt issues). U.S equity markets are modestly higher this morning, pointing to some recovery after yesterday’s late-hour sell-off in the afternoon which left S&Ps down by more than 1%. About one hour before the opening bell, S&P 500 futures are up 2 points to 1,093.25.

Treasuries traded well in Asia as the NIKKEI shed another 2.18%. However as London started sipping breakfast tea, profit taking was noted and selling led to more selling. The 10-year note -0-09 at 99-31 yielding 2.63% (+3.2bps). tHE 2S/10S curve is 3bps steeper at 214bps.

Traders are taking advantage of an opportunity to price in a pre-auction concession...

The October FNCL 4.0 -0-06 at 102-25...

(Reuters) - Gold rose for a third day on Wednesday to within reach of another record high and silver hit a 2-1/2 year peak as the waves of nervousness over the global economy steered investors into perceived safe-haven assets.

(Reuters) - Japan's finance minister acknowledged currency intervention is an option for the first time since the yen's 14 percent rise since May, and a candidate to become prime minister sanctioned solo intervention as the yen jumped to a 15-year high versus the dollar.

Key Events Today:

7:00 ― MBA Mortgage Applications, just released, decreased 1.5% in the week ending Sept. 3. Refinancings declined 3.1% after a recent boom, but purchases gained 6.3%. Also, the average contract interest rate on a 30-year fixed-rate mortgages rose seven basis points to 4.50% (after falling 12 basis points in the prior week.)

2:00 ― The Federal Reserve’s Beige Book, an report on the economy based on anecdotal data from each of the 12 regional Fed banks,

Economists at BBVA said the latest Beige Book “will be a good source to figure out whether the economic recovery is running out of steam.” Consumer spending is picking up only modestly and labor markets are improving gradually, according to BBVA. “It is also anticipated that the report would show that both residential and commercial real estate remain weak.”

Economists from Nomura said the report, sometimes ignored by markets, will be “critically important” given the state of uncertainty these days.

“We expect the report to note clear signs of slowing across the economy ― in contrast to the latest ISM report but in line with many other indicators,” they added. “We expect particularly downbeat comments on the construction sector and the labor market. If correct, our proprietary Beige Book index should fall more deeply into negative territory.”

3:00 ― Outstanding Consumer Credit is anticipated to fall $3.5 billion in July as banks build up cash reserves consumers retrench from taking on debt. The index has fallen for the past five consecutive months ― as well as 15 of the past 16 months ― including a $1.3 billion cutback in June, a $5.3 billion drop in May, and a $14.9 billion decline in April.

“Consumers continue to trim credit card debt, but levels of ‘non-revolving credit’ (auto loans, etc) have stabilized,” said economists at Nomura. “We expect similar patterns to continue in the current slow-growth environment.”

OTHER EVENTS

- 08:55 Redbook Same Store Sales Index (Sep 4 wk) (prev 3.0% y/y)

- 10:00 Job Openings and Labor Turnover Survey (JOLTS) (Jul)

- 2:30 FRB Minneapolis' Kocherlakota (alternate voter) on "Inside the FOMC"

ANOTHER DAY OF HEAVY DEBT ISSUANCE...

- 11:00 Treasury auctions 4-week bills

- 1:00 Treasury auctions $21 bln 10-year notes (reopening of the 2-5/8% Notes of August 15, 2020)

- Freddie Mac Reference note announcement

- Italy, benchmark 3-year [talk MS+115a]; DB/MS/GS

- Lithuania, benchmark 7-year [talk MS+325]; BC/HSBC/RBS

- Lloyds, $2 bln 10-year [lnch T+400]; Citi/DB/GS/JPM

- Societe Generale, benchmark 2-part 3s/5s; BAML/JPM/MS/SG

- Dell, $1.5 bln 3-part 3s/5s/30s [guidance T+75(3s);+95(5s);+175(30s)]; Barc/GS/MS

- Aon Corp, $1.5 bln 3-part 600m 5s, 600m 10s, 300m 30s [lnch T+220(5s);+245(10s);+265(30s)]; CS/MS/BAML

- Medco Health Solutions, $1 bln 2-part 5s/10s (both $500m) [lnch T+135(5s);+15(10s)]; DB/GS

- Eksportfinans, $1 bln 5-year [talk ms+low 40s]; GS/JPM/MS

- Ontario, 5-year Global [talk ms+ mid 20s]; BAML/CS/HSBC/Scotia

- CBA, potential benchmark deal; JPM

- Telemar, benchmark 10-year this week; BNP/BAML/BTGP/Itau

- Korea Hydro & Nuclear Pwr Corp, benchmark 5-year expected this week; BAML/Citi/DB/HSBC/UBS

Rate sheets will be worse.