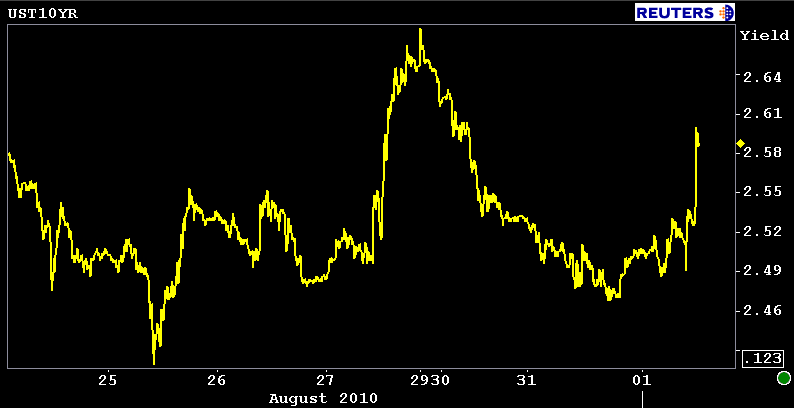

Stocks are rallying and the bond market is taking a beating after a much better than expected read on the manufacturing sector.

The August ISM Manufacturing Index came in at 56.3 vs. economist estimates for a read of 53.0. The "Prices" index rose 4 points to 61.5 from 57.5, quelling deflationary fears and giving bond traders a reason to fade the rally.

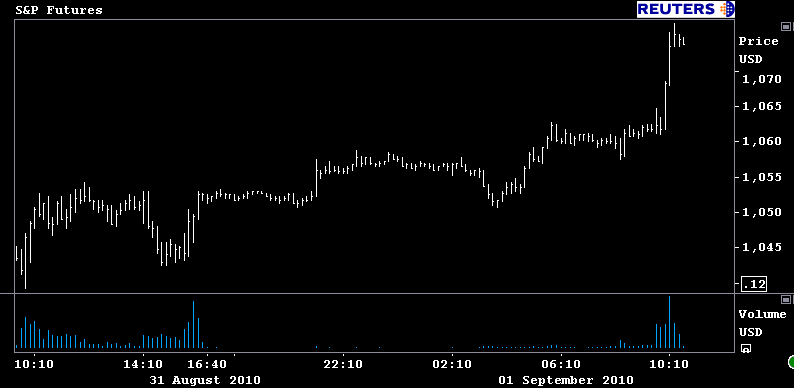

Stocks were up before 10am data but didn't take flight until after ISM flashed. S&P futures are currently up 27 handles at 1075.25.

The bull flattener is unwinding again. The 2s/10s curve is 9bps steeper at 209bps. The long bond is 14.7bps higher at 3.668%. The 7-year note is +12.5bps at 2.046%. The 10yr note is +12.3bps at 2.593%. Volume was heavy into the downtrade.

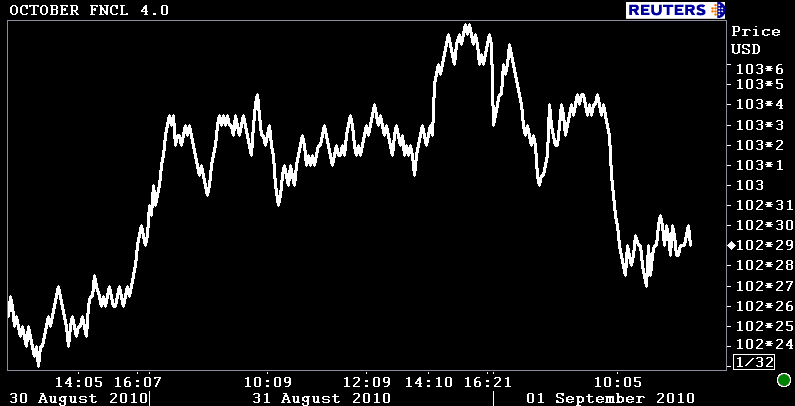

Although production MBS coupons are performing much better than their benchmark guidance givers, price declines are still steep. The October FNCL 4.0 is -0-09 at 102-30 and the October FNCL 4.5 is -0-06 at 104-16. Yield spreads are tighter on a nominal basis.

Rebate will be worse today...

This Friday the Bureau of Labor Statistics will release the EMPLOYMENT SITUATION REPORT, also known to many as Non-Farm Payrolls (that is only half the report). Jobs are clearly in focus as the main source of economic weakness in the US. Economic outlooks are highly correlated to the health of the labor market. This report will be a major market mover...

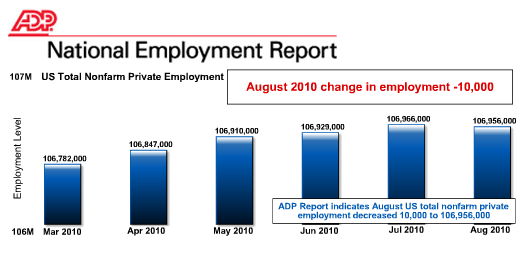

Because the Employment Situation Report is so influential in the marketplace, it is also a source of great speculation. One data release that provides a hint of what to expect from NFP is the ADP Employment Report. This data was released at 830 this morning.

Private sector employment decreased by 10,000 from July to August on a seasonally adjusted basis, according to the latest ADP National Employment Report® released today. The estimated change of employment from June to July was revised down slightly, from the previously reported increase of 42,000 to an increase of 37,000.

The decline in private employment in August confirms a pause in the recovery already evident in other economic data. The deceleration in employment was evident in the major sectors and by size of business. This month’s decline in employment followed six monthly increases from February through July. Over those six months the average monthly gain in employment was 37,000 with no evidence of acceleration.

Unlike the estimate of total establishment employment to be released on Friday by the Bureau of Labor Statistics (BLS), today’s figure does not include the effects of federal hiring — and now firing — for the 2010 Census. Hiring for the census peaked in May. For this reason, Friday’s figure for the change in nonfarm total employment reported by the BLS might be weaker than today’s estimate for nonfarm private employment in the ADP National Employment Report.

------------------------------

The market was expecting a read of +19,000 jobs. This data was much worse than expected. Another one of my preferred previews of the Employment Situation Report: INITIAL JOBLESS CLAIMS IN THE NFP SURVEY WEEK. Guess what...that data was much worse than expected too!

08:30 19Aug10 RTRS-US JOBLESS CLAIMS ROSE TO 500,000 AUG 14 WEEK (CONSENSUS 476,000) FROM 488,000 PRIOR WEEK (PREVIOUS 484,000)

Plain and Simple: both the ADP Report and Initial Jobless Claims in the NFP survey week were worse than expected. This paves the way for a weaker than anticipated Employment Situation Report on Friday.

With that in mind...the stock market rally/bond market sell off seems like a reallocation trade as opposed to a reaction to economic fundamentals. Bonds were overbought and stocks were oversold. Portfolio managers are doing a little rearranging....