Good Morning.

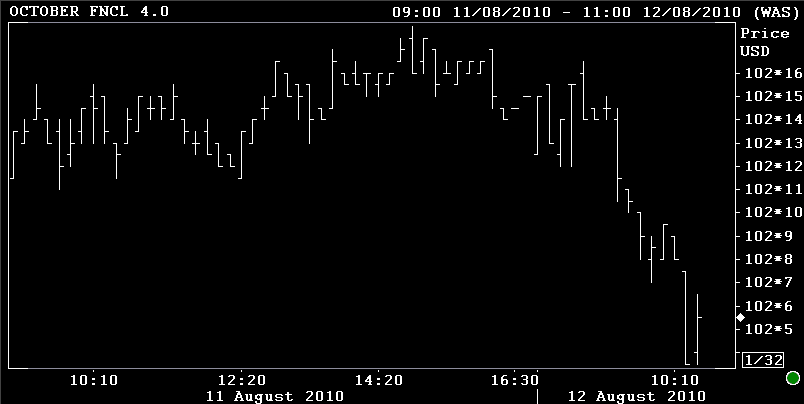

The long bond is outperforming outright and vs. the curve, the newly issued 2.625% coupon bearing 10yr note yield is 2.3bps higher and a little early session loan supply is on trading screens. Mortgages are getting beat up in a "bid wanted" environment. Rebate should be worse to start the day.

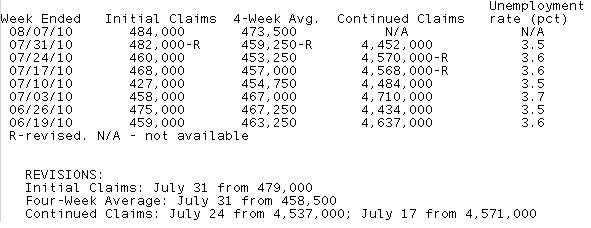

Weekly Jobless Claims have been released.

INITIAL CLAIMS: In the week ending Aug. 7, the advance figure for seasonally adjusted initial claims was 484,000, an increase of 2,000 from the previous week's revised figure of 482,000. The 4-week moving average was 473,500, an increase of 14,250 from the previous week's revised average of 459,250. (WORSE THAN EXPECTED)

CONTINUED CLAIMS: The advance number for seasonally adjusted insured unemployment during the week ending July 31 was 4,452,000, a decrease of 118,000 from the preceding week's revised level of 4,570,000. The 4-week moving average was 4,518,500, a decrease of 64,500 from the preceding week's revised average of 4,583,000. The advance seasonally adjusted insured unemployment rate was 3.5 percent for the week ending July 31, a decrease of 0.1 percentage point from the prior week's unrevised rate of 3.6 percent. (BETTER THAN EXPECTED)

The advance number of actual initial claims under state programs, unadjusted, totaled 420,997 in the week ending Aug. 7, an increase of 18,862 from the previous week. There were 482,590 initial claims in the comparable week in 2009.

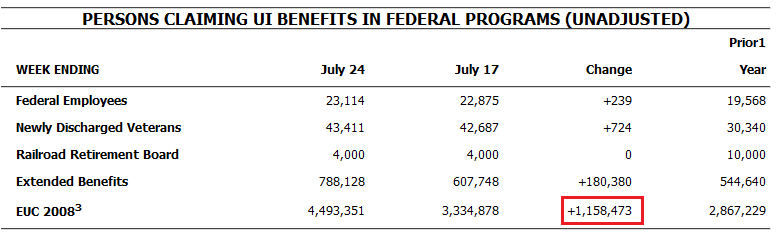

Is that uptick in Emergency Benefits bogus? Nope. Its the extension of Emergency Benefits kicking in...

Anyone think the S&P is worth a bid at 1075? Stocks are searching for a floor...