This week, the Federal Reserve Bank of New York Open Market Trading Desk began conducting a limited amount of agency mortgage-backed security (MBS) "coupon swap operations" in order to facilitate the timely settlement of agency MBS trades.

A coupon swap is a transaction conducted at market prices that involves the sale of one agency MBS with the simultaneous agreement to purchase a different agency MBS. Coupon swaps allow the Federal Reserve to sell agency MBS coupons that are not readily available for settlement in the market and simultaneously purchase a different agency MBS coupon that is more readily available for settlement.

The Federal Reserve uses coupon swaps as a tool to address temporary imbalances in market supply and demand. The New York Fed transacts agency coupon swaps only with primary dealers who are eligible to transact directly with it. Agency MBS coupon swaps WILL NOT reduce or increase the Fed's MBS inventory. FRBNY MBS FAQ

Plain and Simple: coupon swaps give the Fed the ability to sell primary dealers MBS coupons that are experiencing a shortage of deliverable loan supply. In exchange, primary dealers sell the Fed the same amount of MBS, but different coupon rates, specifically those being actively produced by loan originators (4.0s and 4.5s right now).

------------------------------------------------------------------------------

HERE IS AN OVERVIEW OF THE TBA MBS SETTLEMENT PROCESS

The MBS coupons that determine rate sheet pricing are traded in the TBA MBS market.

TBA = To be Announced

In the TBA MBS market, at the time a trade is made, buyers and sellers

agree to a few specific terms like what coupon, the issuing agency

(Fannie, Freddie, Ginnie), size of trade, and a buy/sell price....the

actual pools of loans are NOT exchanged at the time of this commitment.

Instead, the MBS buyer and the seller make an agreement to complete

the transaction at a later date.

Agency MBS trading settles

once a month. In the TBA MBS market this date is pre-determined; it's

called SETTLEMENT DAY (clever name right?).

Two days before the pre-scheduled settlement date, the MBS seller

"notifies" the MBS buyer of the specific pools that they will deliver to

satisfy the previously agreed upon terms of the trade.

This is Fannie Mae's guidance:

Forty-eight hours prior to settlement, pool information must be

communicated to the Capital Markets Sales Desk's back office by phone

(202-752-5384), facsimile (202-752-3439), or via EPN transmission.

Delivery of pool information must take place by 3:00 p.m. eastern time.

It is advisable that pool information is communicated early as phone

lines, fax machines, and the EPN queues are extremely taxed as the 3:00

p.m. deadline approaches. If the transmission does not occur by 3:00

p.m., one day's fail will be incurred, despite the fact the information

is residing in queue.

Then the MBS buyer reviews the pool information to ensure the seller has delivered loans that meet the agreed upon terms. 48 hours later, after being deemed to within "Good Delivery" guidelines, pool purchase funds are wired and the trade is complete (it goes deeper...this is the outline).

------------------------------------------------------------------------------

From the Operating Policy:

Statement Regarding Timely Settlement of Federal Reserve's Agency Mortgage-Backed Security Purchases: The Desk plans to swap unsettled Fannie Mae 30-year 5.5 percent coupon securities (Fannie Mae 5.5) for other agency MBS that are more readily available for settlement.

WHY IS THE FED BEING FORCED TO INTERVENE IN THE TBA MBS MARKET?

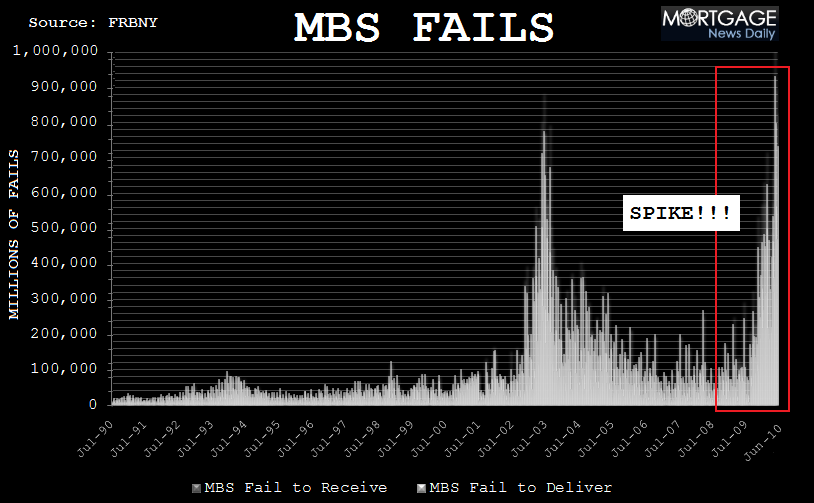

A huge spike in failed trades over the past year, specifically in 5.0 and 5.5 MBS coupons.

From the FRBNY's Primer on Settlement Fails: A settlement fail occurs when MBS securities (MBS) are not delivered and therefore are not paid for on the scheduled settlement date. The transaction can be an outright sale or the starting or closing leg of a repurchase agreement. Fails are important because they expose market participants to the risk of loss in the event of counterparty insolvency. The prospect of such loss leads participants to devote resources to monitoring and controlling counterparty exposure and could, in an extreme case, lead them to limit their secondary market trading.

Anyone care to take a shot at explaining why the majority of fails have occured in the fuller, credit-impaired side of MBS coupon stack?

HINT: Slow Prepayment Speeds