The April S&P/Case-Shiller Home Price Index has been released. Data was better than expected...

- APRIL 20-METRO AREA HOME PRICES +0.8 PCT UNADJ (CONSENSUS +0.2) VS -0.5 PCT MARCH -

- S&P/CASE-SHILLERAPRIL HOME PRICES IN 20 METRO AREAS +0.4 PCT SEASONALLY ADJ (CONSENSUS -0.1) VS REV -0.2 IN MARCH

- APRIL 20-METRO AREA HOME PRICES +3.8 PCT (CONSENSUS +3.4 PCT) VS APRIL 2009 --CASE-SHILLER

- APRIL HOME PRICES IN 10 METRO AREAS +0.3 PCT SEASONALLY ADJUSTED VS REV +0.1 PCT IN MARCH - CASE-SHILLER

- APRIL HOME PRICES IN 10 METRO AREAS +0.7 PCT UNADJUSTED VS -0.4 PCT IN MARCH - S&P/CASE-SHILLER

- US HOME PRICES IN 10 METROPOLITAN AREAS +4.6 PCT IN APRIL VS APRIL 2009 - S&P/CASE-SHILLER

Remember: S&P says we should be looking at UNADJUSTED home prices

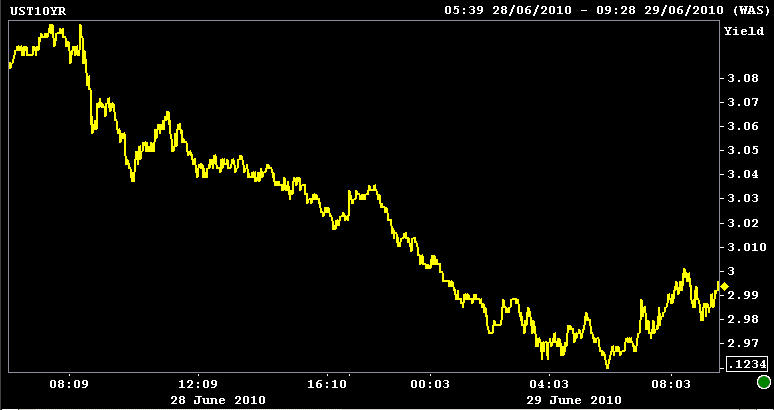

Stock futures and interest rates really didn't react to the headlines. S&Ps are currently -14.75 at 1056.25...

The 10yr note is +0-10 at 104-12 yielding 2.985%...

The August FNCL 4.0 is +0-04 at 101-02.The secondary market current coupon is 1.8bps lower at 3.812%. Yield spreads are wider into the TSY rally.