- JULY FNCL 4.0: +15 at 101-09 (101.281) AUGUST FNCL 4.0: +0-16 at 100-30 (100.938)

- Secondary Market Current Coupon: -8.1 bps at 3.83%

- CC Yield Spreads:+80.9bps/10yTSY. +75.4bps/10yIRS. (I adjusted CPRs on 4.0s higher today)

- UST10YR: -8.7bps at 3.023%. 2s/10s: 6bps FLATTER at 239bps. 2YR NOTE=LEAST BEST PERFORMER

- S&P CLOSE: -0.20% at 1074.57 HIGH: 1082.57 LOW: 1071.73 WORST SECTOR: Energy -1.28%

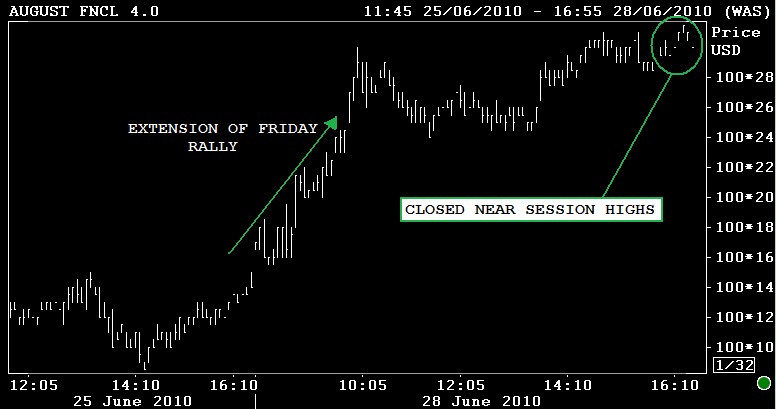

Production mortgage-backed security prices hit new record highs today...AGAIN!!!

The July FNCL 4.5 went out +0-11 at 103-23. The secondary market current coupon has fallen to 3.83%. WHY LENDERS WILL BE SLOW TO PRICE PAR BELOW 4.25%

While new record prices are being set in front month MBS coupons(July)...these are not the indications used to produce loan pricing, secondary has already moved onto August delivery. The August FNCL 4.0 coupon ended the day +0-16 and the August delivery FNCL 4.5 went out +0-13 at 103-12.

A few lenders repriced for the better before lunch but most were priced aggressively early on and did not republish. If mortgages extend their rally another day...you are due about 15 basis points. If mortgages sell tomorrow morning, loan pricing will still be aggressive but the majors probably won't pass along the gains they didn't share today.

On the surface, mortgages were led higher today thanks to a rally in the "rate sheet influential" portion of the benchmark yield curve, which also closed near the best levels of the day. The 2s/10s curve was 6bps flatter and the 10yr note rallied 8.7bps lower to 3.023%. 10s weren't the strongest coupon though, the just auctioned 7yr note fell 9.1bps to 2.483%. THIS HAD SOMETHING TO DO WITH THAT

In the chart below I called attention to a bullish breakout in 10yr note yields. In the short term my target is 3.00%...after that we'll have to re-evaluate sentiment. This means your lock/float strategies are due a re-evaluation in the near term future.

This graph below is the updated version of the long term 10yr note yield chart I posted on Friday. You can see that 10s made an aggressive move toward a test of the 3.00% pivot today. A break of 3.00% would lead traders toward 2.93%...then 2.85%.

S&Ps chopped around a range before closing 2pts below the open. After seeing a modest uptick in participation last Friday, volume was terrible today.

1070 support is still holding. Although bond yields are telling us to expect further weakness in stocks, until the 1070 support level is broken and confirmed, there is a chance S&Ps rebound higher.

The 10 year note is all set for a test of 3.00% and S&Ps are ready to see how strong 1070 support really is....if this trade plays out overnight into the morning session, you should see a few more bps on rate sheets in the AM. Be careful though, in the short term there isn't much room to work with as 10s are only 2.3bps away from long standing resistance. If 10s weaken overnight and MBS start the day lower tomorrow, loan pricing will be worse than you would expect.

Does anyone else think the market is pricing in a weak Employment Situation Report?

ps...barring a miracle it looks like the homebuyer tax credit closing deadline will not be extended. Plan accordingly...