Equity futures are pointing higher this morning after the House and Senate agreed to a final version of what’s being called the the biggest regulatory overhaul since the Great Depression.

Ninety minutes before the opening bell, Dow futures are up 23 points to 10,122 and S&P futures are 3.25 points higher at 1,073.75.

The 2-year Treasury note is 1.2 basis points lower at 0.668% while the benchmark 10-year note yield is 0.2 basis points lower at 3.133%.

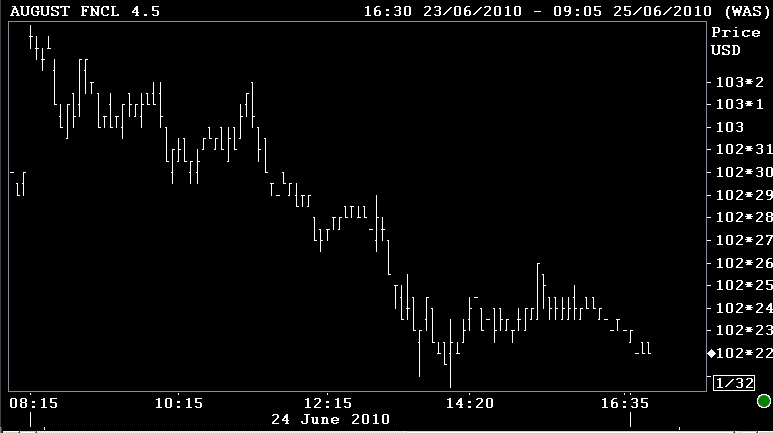

The August delivery (15 and 30 day locks) Fannie Mae 4.5 MBS coupon has opened 0-01 at 102-19.

The FinReg reform agreement could allow Congress to take a final vote for passage as early as next week. President Obama could sign it into law by Independence Day.

Some key aspects of the bill include a compromise to the Volcker rule (which, instead of banning proprietary trading, will limit how banks use funds to make risky investments); plus a compromise restricting what derivatives insured financial institutions can trade.

The bill also calls for a new consumer protection agency to be created within the Federal Reserve (auto dealers would be mostly exempt from its oversight); it gives the Securities and Exchange Commission powers to regulate financial institutions and hedge funds (but banks should still be able to keep some operations that are used for hedging such as interest-rate swaps.)

Lastly, banks and hedge funds will be forced to pony up $19 billion to pay costs associated with financial reform, according House financial services committee chairman Barney Frank.

Key Events Today:

8:30 ― Final revisions to Q1 GDP aren’t expected to be large. The previous revision downsized the indicator from +3.2% to +3.0%, and economists say no data has indicated any large revisions since then.

“We expect inventory accumulation to be revised up slightly, and net foreign trade and consumer spending on services to be revised down,” said economists at IHS Global Insight. “If we're right, that would tilt the distribution of first-quarter growth even further towards inventories and away from final sales, which would intensify concerns about the future strength of the recovery once the inventory boost to growth begins to fade.”

Economists at BBVA said if GDP were revised lower, it would “negatively affect the market’s mood and increase concerns over the sustainability of the recovery.”

10:00 ― Consumer Sentiment rose almost two points to 75.5 in June’s preliminary survey, marking the highest level in about a year-and-a-half. The gain was surprising given declines in the stock market, the ongoing Eurozone debt crisis, and high unemployment levels. But now, with gasoline prices falling, equity markets stabilizing, and support plans for the Euro crisis agreed upon, economists are expecting the Reuter's/University of Michigan's index to remain on an upward trend.

“Somewhat surprisingly, the preliminary estimate of consumer sentiment held up well in the face of declining stock prices. Even the report's assessment of current government policy improved despite the oil spill in the Gulf of Mexico. This encouraging outcome may be a sign that the consumer sentiment recovery is more durable than previously feared,” said economists at Nomura.